All weekend long was the chatter about how this would be THE MOST ANTICIPATED OPENING OF ALL TIME, and how the Reddit “revolution” had changed everything forever. Errr, listen, folks, I suspect in about three weeks hardly anyone will be talking about this revolution anymore.

The WHOOSH sound you are hearing is the options premium rushing out of GameStop (NYSE:GME) calls and puts, and you can expect to hear that sound all week long. All this talk about GME going to $1,000 is hysterically stupid.

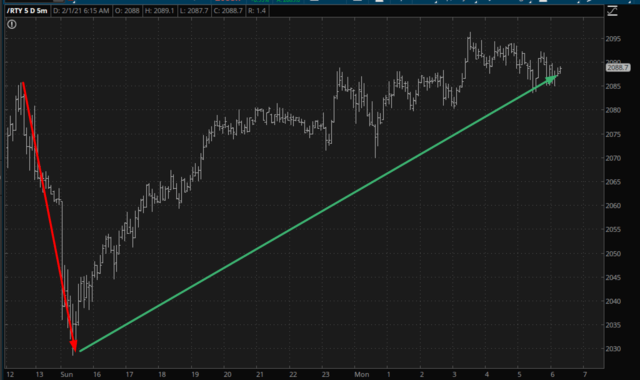

Still, I’m kinda pissed off that the plunge lower on Sunday was, surprise, surprise, utterly underline. The Russell is representative of this:

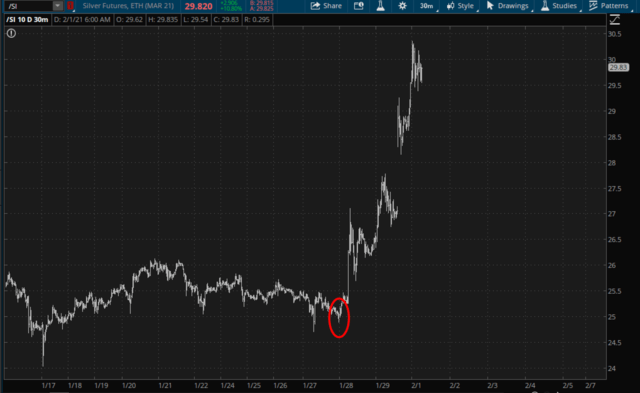

I am pleased, however, that Silver is rocking the free world. This is a nice, sustained launch:

More importantly, from my perspective as a chartist, we are reaching escape velocity from this range we’ve been in since last summer. This could be a game-changer for the iShares Silver Trust (NYSE:SLV) too, as the kids say.

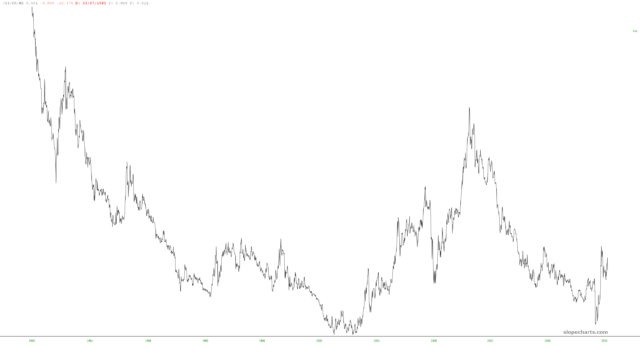

Long-term what I find most compelling is the value of silver (and gold for that matter) relative to the money supply. We could be in for a multi-year bull market, my friends.