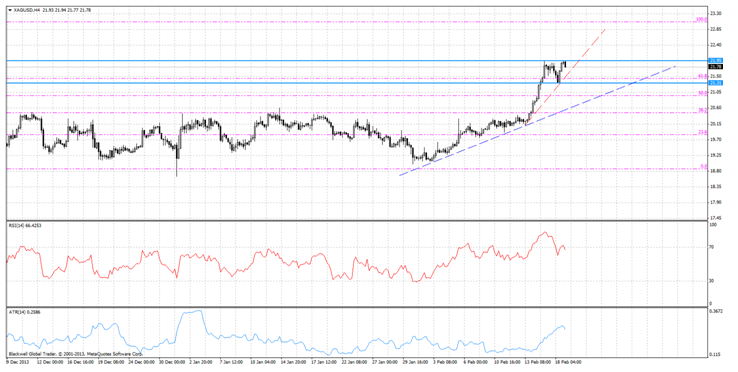

Silver markets have been explosive over the last few days as the market has gone from trending upwards to literally jumping upwards on the charts, as momentum and volatility kicked in with rampant speculation for the precious metal.

Currently, Silver is just shy of the 22 dollar mark, can it break through and push higher? I certainly think so.

The reason behind this has been the bullish nature of precious metals over the past few weeks. Gold, Silver and Platinum have all seen a breakdown of the bearish trend lines they were stuck in, and we are now seeing a push higher from metals on the back of Dollar weakness.

Silver is certainly trending in line with Gold, with brief episodes of moves outside the correlation between the two. But what’s most apparent is, investors who still worried about massive gold drops of the past and the lows it has hit of late, are seeing Silver as a more attractive speculative investment.

Current market sentiment has seen Silver pushed up to the 22.00 mark before pulling back. This resistance level was not surprising given past data, but the next level is at 22.30 and we should expect a fair degree more resistance. Support can be found at 21.31, and the 50.0 fib level and 38.2 fib level.

The current steep trend line is expected to also act as strong support for the time being, but I would expect to see a massive movement tomorrow, 20th Feb,with the FOMC minutes, which I would expect to be relatively weaker talking given the recent data.

Either way, with the recent uptrend in Silver coupled with the breakout from its ranging, I can’t see Silver stopping its bullish run until it breaks through both trend lines. And with the FOMC minutes out 20th Feb, we could well see Silver pushing new highs.