For the second time this week, gold found strong support after a retest at the 20 DMA. The first test took the metal down to $1589 before retracing higher. We witnessed a copy and paste scenario yesterday. This may suggest that short sellers are short covering their positions as we approach the end of the Q1, and ahead of the long weekend in Europe. It also indicates that short sellers are under pressure to offload their positions for a good profit. The recent trade of blows between bulls and bears may soon come to a conclusion that prices could head higher.

Technically, gold managed to stay above the 20 DMA at $ 1592.22 and reversed higher. Moving forward, it will need more buying momentum to sustain well above $ 1600.00 before tackling the pivotal resistance level of $ 1620.00. Gold will be very sensitive to the next economic data from the U.S. and this data could prove to either stop the good rebound it has put in, or potentially act as a catalyst for gold to push higher before we enter the Q2 trading period.

Long gold at $ 1620.00 target $ 1630 with a stop loss at $ 1611.50.

Long gold at $ 1592.50 target $ 1618 with a stop loss at $ 1575.00 – In Progress

Resistance: $ 1615, $ 1625, $ 1634 (50 DMA), $ 1650, $ 1686, $ 1697 (previous high)

Support: $ 1592, $ 1584.86, $ 1580.39, $ 1522 (2012 low)

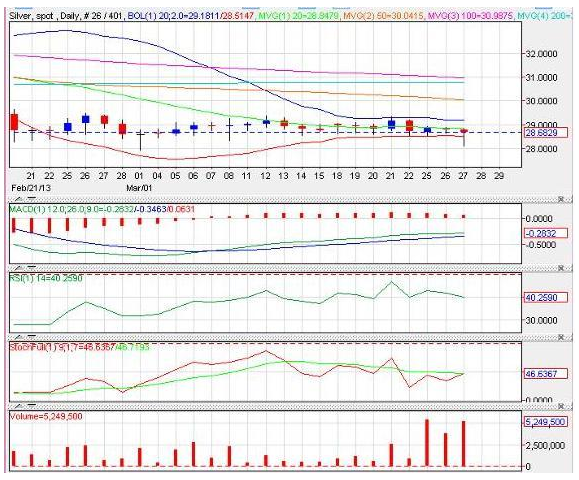

The Daily Chart shows some encouraging buying interest on silver. Prices moved lower on March 22 with a low volume, and it reversed higher on March 25 with a strong high volume. Once again, silver prices made a reversal day with a higher volume, indicating strong buying interest as there are more buyers than sellers. The Bollinger band remains tight and there is no outbreak to the downside, suggesting that a market bottom is in place and we could be witnessing higher silver prices.

Despite such encouragement, a dominant US dollar continues to cap any rallies and we repeat caution for any silver trade. Unless silver can trade above $ 29.50, we will remain bearish. There is too much volatility (and non-volatility) to take a position.

Long silver at $ 29.40 target $ 29.80 with a stop loss at $ 29.15

Short silver at $ 28.20 target $ 27.60 with a stop loss at $ 28.40 – Stop Loss Triggered.

Resistance: $ 29.50, $ 29.74 (38.2%), $ 30.19 (50%)

Support: $ 28.33, $ 27.93, $ 27.50

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Silver Prices Made A Reversal Day Again

Published 03/28/2013, 07:19 AM

Updated 05/14/2017, 06:45 AM

Silver Prices Made A Reversal Day Again

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.