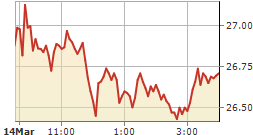

In morning trading Friday, the price of silver rose $0.62, or 2.44%, at $21.89 an ounce. While the white metal slipped $0.148 Thursday to finish the session at $21.25 an ounce, the dip came on mild profit taking. Silver had a stellar showing Wednesday, ending up 2.66%, or $0.55, at $21.33.

Escalating concerns regarding the Russian occupation of parts of the Ukraine, and the ensuing global threats flying back and forth, have been an important catalyst for higher silver prices over the week.

Additionally, a recent spate of soft U.S. economic data has caused investors to seek refuge in silver.

“The premium for gold and silver has increased as people are nervous about U.S. growth,” David Meger, director of metal trading at Vision Financial Markets, told Bloomberg. “The turmoil in the currency market has also pushed people toward precious metals.”

Also stoking silver demand are concerns over a bond default in China (the world’s second-largest economy), plus mounting anxieties the Asian nation’s recovery will be more difficult than first thought. Thursday, Bank of America Corp’s Hong Kong-based economists cut their first quarter growth forecast for China to 7.3% from 8%, and their full-year estimate to 7.2% from 7.6%.

Silver is again playing the alternative currency card and is also taking up its familiar stance as a safe-haven asset amid growing global uncertainties. With market participants unsure of what to expect, there has been a notable flight from risk-on to risk-off trades.

Indeed, precious metal traders have accumulated long positions ahead of this weekend’s crucial vote in Ukraine.

Sunday, Ukraine’s citizens will cast ballots for or against Crimea uniting with Russia. Russia has said it will recognize the outcome. The rest of the world has said it won’t.

Whatever the results, tensions will definitely flare up.

It’s exactly those kinds of situations that experts cite for why they always hold some physical silver in their portfolios.

“I have physical silver,” said Money Morning Defense & Tech Special Michael A. Robinson earlier this year. “I might have bought some at the top, but I don’t care what the price goes to; I will not sell that physical silver. It’s there for a reason – just like I have insurance on my car. I have insurance in case of a disaster.”

Rising Silver Prices Offer Profits and Protection

Safe-haven seekers, savvy investors, and bargain hunters have helped push the white metal up 10.3% year to date. That’s a welcome respite from a painful 2013, which left silver down 36.3%, its poorest annual performance since 1984.

In fact, silver’s 2014 gains have handily bested year-to-date returns of all three benchmarks. Since the start of the year, the Dow Jones Industrial Average is off some 3%, the S&P 500 is nearly flat, and the Nasdaq is up a tepid 2%.

But it’s not just doom and gloom that’s luring investors to silver, although the white metal can widely outperform other assets during times of financial and geopolitical stresses.

Growing demand from India, which has been importing large quantities of silver and is expected to continue to do so, has provided a cushion for silver. Shipments to India, the world’s No. 1 buyer, hit a record 5,400 tons last year according to Thomson Reuters. That was more than India’s record high purchase of 5,048 tons in 2008.

Silver imports by India during the first half of 2014 are also forecast to be strong, boosted by high rural demand as incomes rise after a good harvest.

And then there’s robust consumer demand.

Silver is a more affordable alternative to gold. Last year’s near 37% slide in silver, steeper than gold’s 28% decline, has brought out bargain hunters.

As Money Morning Global Resource Specialist Peter Krauth explained, weak silver prices haven’t prompted investors to sell, nor has it driven consumers away. Instead, it has drawn them in.

Indeed, sales of silver coins by the U.S. Mint almost quadrupled in January to 4.78 million ounces from December.

That’s why Krauth sees silver prices reaching the $30 range in 2014. Investors can play the rally with Silver Wheaton Corp. (NYSE: SLW).

“The company invented the streaming business and is the largest precious metals streaming/royalty company by market cap at $7.9 billion. With more than 1.6 billion ounces to their name, SLW has more silver reserves than any other silver company in the world,” Krauth said in January.

“Their suite of assets is very well-diversified geographically, with mostly geopolitically low-risk projects. Most of their ounces have a total cash cost around $4 (extremely cheap), and production is expected to grow about 45% between 2012 and 2017. What’s more, as a streaming/royalty company, SLW bears none of the exploration, permitting, and development risks that miners do.”

SLW is up about 32% in 2014.