Silver is poised for a massive recovery upleg in 2014, a mean reversion from last year’s dismal action. The main driver of silver’s initial strength will be American futures speculators covering shorts. These bearish bets on silver soared to a bull-record high last month, which will require exceptional buying to unwind. Futures speculators as a herd always bet wrong at major lows, they are a fantastic contrarian indicator.

Because futures trading is such a hyper-leveraged zero-sum game, futures traders have a reputation of being smart and sophisticated. And they are to a great extent, futures are so unforgiving that survival of the fittest rules. Capital naturally flows from the poor traders to the good ones. Nevertheless, within their chests thump the same hopelessly emotional human hearts that are such a liability in the markets.

Even good futures traders succumb to groupthink, getting too greedy or too scared with the rest of the herd. They flood into silver futures after the metal has already surged in strong uplegs, buying into the popular euphoria. Then they flee silver after it has plunged, waxing bearish with everyone else. This leads to buying high and selling low, the same emotional affliction that torments nearly every trader.

Futures trading is one of the purest forms of speculation, making leveraged up-or-down directional bets on underlying prices. When these traders buy silver futures, they expect its price to rise imminently so they are effectively bullish on the metal. When they sell, they expect silver to fall in the near future so they are bearish. Thus looking at their aggregate bets on silver reveals their collective sentiment on it.

Thankfully this useful data is readily available. All silver futures buying and selling gets distilled into the famous Commitments of Traders reports from the US Commodity Futures Trading Commission. These weekly reports show how futures speculators as a group are betting on silver. They’ve always been the most bearish, as evidenced by the most selling, right when silver happens to be carving major bottoms.

Futures are a zero-sum game, every contract has a trader on the long side betting a price will rise and an opposing trader on the short side betting that same price will fall. Every dollar won by one trader is a direct dollar lost by the trader on the other side of that contract. The total number of longs and shorts in silver futures always nets to zero. But the classic CoT reports divide traders into three separate groups.

They are commonly known as commercial hedgers, large speculators, and small speculators. Of course the first group actually produces or consumes physical silver for business purposes. They are simply trying to lock in future prices to better manage their cashflows. The latter two groups of speculators take the opposing side of those hedging trades, and it is their bets that are a powerful contrarian indicator.

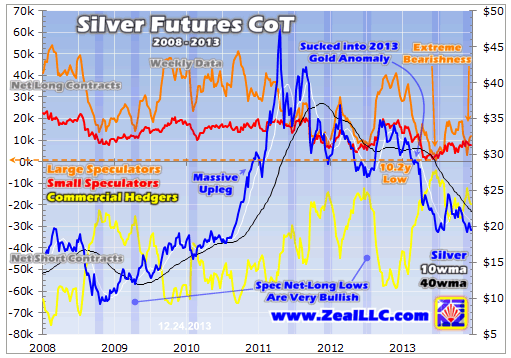

This first chart looks at the net-long and net-short positions among these broad categories of traders. The more net-long silver-futures speculators get, the more bullish they are on silver’s price. But the opposite extreme is far more interesting today. The less net-long or even net-short speculators become on silver, the more bearish they are on it. And in recent weeks that bearishness has approached record extremes.

Recently in early December as silver slumped back towards its brutal June lows, futures speculators’ net-long positions plunged. The large specs’ net-long futures contracts held fell to just 2.9k. How low is that? Between 2009 and 2012 before last year’s epic precious-metals selling anomaly, large specs averaged net-long positions of 28.1k contracts. A month ago they were merely 1/10th normal levels.

Silver’s secular bull was born way back in November 2001 just above $4 per ounce. Since then there have been 631 weekly CoT reports. Large specs’ net-long positions have fallen under 3.0k contracts on just 10 of those, or 1.6% of the time. 2 of those weeks were last year, the first in late June. When futures speculators as a herd get that bearish on silver, the white metal is always on the verge of a major surge.

Right after that late-June episode of exceptionally-low speculators’ net-long positions, silver soared by nearly a third in the next couple months. Right when futures speculators were the most bearish on this metal as evidenced by their low net-long positions, it was bottoming. They were betting against silver at exactly the wrong time, selling low. And this certainly wasn’t the first time, specs have always done this.

Late June’s large-spec net-long contracts happened to fall to their lowest level in just over a decade, truly anomalous. But in general spec net-long lows are very bullish silver indicators even when they aren’t as extreme. A basic rule of thumb is that if spec net longs are near their lowest levels in at least 6 months, they reveal excessive bearishness. And that has always been a universal contrarian indicator.

I highlighted some of these episodes above in blue. Pretty much without exception, when large futures speculators’ net-bullish bets on silver reach a major low, this metal is also at a major low. Note above how the large-spec net-long lows coincide with bottomings in silver. Immediately after these speculators wax the most bearish, silver starts powering higher in either a sharp rally or a much longer major upleg.

While there are some very smart silver-futures traders out there, as a herd they succumb to popular greed and fear just like the rest of traders. They get too bullish after silver has already run too high too fast, and too bearish after silver has already fallen too low too fast. They trade like momentum players, betting that whatever mature trend is in place will continue indefinitely. But that really isn’t prudent.

Universally in the financial markets, greed and fear dominate short-term price action. Once greed crests after a long upleg, everyone who is interested in buying in anytime soon has already bought. That leaves only sellers, so the price soon corrects. And once fear peaks after a deep correction, everyone who is susceptible to being scared into selling has already sold. That leaves only buyers, so the price rallies.

Excessive greed and fear naturally burn themselves out, spawning all the major trend changes. These are exceedingly profitable to trade if you can get in fairly early near the inflection points. Contrarian traders attempt to do this, buying low when everyone else wants to sell then later selling high when everyone else wants to buy. Being brave when others are afraid is the only way to consistently buy low.

But fighting the crowd is never easy, because your own heart will desperately try to convince you to wrongly be excited or scared exactly when everyone else is. You can short-circuit that desire with context data like silver-futures specs’ net positions that reveals when everyone else is too bullish or bearish. And with net longs not far above decade-plus lows in recent weeks, specs’ bearishness remains extreme.

And provocatively this very bearishness in futures is what drives the initial silver rallies out of net-long lows. Futures enable traders to easily sell silver short, to effectively borrow silver they don’t own and sell it in the open market. If the silver price soon falls as these short sellers expect, they can then buy back the silver they originally borrowed at a lower price to pay it back. Then they pocket the difference as profit.

When a price is falling particularly sharply, and fear is exceptionally high, short sellers are often the only buyers around. Their buying to cover slows the price decline, reverses it, and then accelerates it back to the upside. The higher the short positions, the larger the necessary buying and the bigger these short-covering rallies become. And last month total spec silver shorts surged to a record, a super-bullish omen.

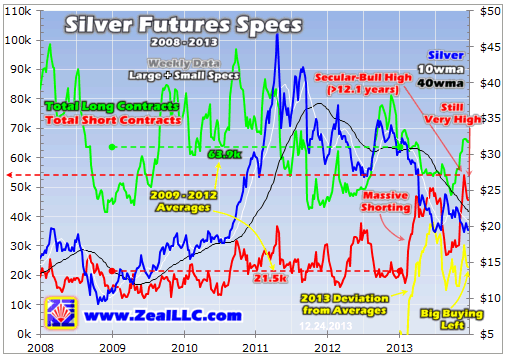

This next chart slices up the weekly CoT data a bit differently, adding the total long-side and short-side silver contracts that both large and small speculators hold. Every silver contract sold short has to be bought back before it expires, creating futures buying demand. And when silver starts rallying in the face of large short positions, the traders have to scramble to cover before their leverage slaughters them.

Just a month ago in early December, the total silver-futures short positions held by both large and small speculators surged to 54.3k contracts. This is astoundingly high, actually the highest levels ever seen in silver’s entire dozen-plus-year secular bull! It is also over 2.5x the 2009-to-2012 average levels seen before 2013’s wildly anomalous selling. And these shorts haven’t come down much in recent weeks.

The speculators holding these massive shorts have no choice, they have to buy long-side contracts to offset their shorts and cover them. And this has to happen before expiration, which is in the next couple months for most of the outstanding contracts. But if silver starts rallying sharply, these speculators will have to buy very quickly to limit their leveraged losses. This should ignite a major short-covering rally.

Each silver futures contract controls 5000 ounces of silver. At $20 per ounce, that is worth $100k. Yet futures speculators are only required to put down an initial margin of $11k to buy a single contract, and the maintenance margin to keep that position is only $10k. So silver-futures speculators can effectively run 10-to-1 leverage today. That dwarfs the 2-to-1 legal limit for stock trading that’s been in place since 1974.

While futures speculators don’t typically run maximum leverage, they like to get close since that is the main allure of futures trading. They can win huge gains on their capital risked with relatively small moves in the underlying commodity’s price. But when that moves against them, the losses snowball just as fast. And at or near 10x leverage, there is very little room for error in the enormous silver shorts.

As all silver investors know, silver has always been an exceptionally-volatile metal. 3%+ price moves in a single trading day aren’t uncommon at all. For silver speculators shorting at minimum margin (maximum leverage), silver merely rallying 10% wipes out 100% of the capital they risked! And if silver keeps rallying, which is very likely once momentum shifts in its favor, they can lose far more than they initially bet.

And the greater speculators’ total short positions, the greater the risk they all face of a really big and fast rally erupting to wipe them out. Once again the only way to close these shorts is to buy futures to offset them. So as soon as a small fraction of speculators start buying to cover, silver’s price starts rising. That convinces increasingly bigger fractions of the remaining traders to buy to cover, sparking a self-feeding cycle.

The more shorts who buy futures to cover, the faster silver’s price rises. And the faster silver’s price rallies, the more pressure it puts on the remaining short speculators to close their positions. That is why it is so exceedingly dangerous to be short when everyone else is. Short covering can quickly become a stampede for the exits, with very few speculators getting out unscathed. Their frantic buying creates a short squeeze.

While some minor short covering happened in December after that secular-bull-record short position of the futures traders, their shorts remain very high. As of the latest CoT report (Christmas Eve), they still had 45.5k contracts short! In the 631-CoT-week history of silver’s secular bull, only 16 weeks saw spec shorts over 45k contracts. Fully 15 of those happened during 2013’s wildly-anomalous silver selloff.

After shorting extremes, positions quickly mean revert back to averages. Between 2009 and 2012 in normal years for silver futures trading before 2013’s anomaly, speculator short positions averaged 21.5k contracts. That means traders are going to soon have to buy to cover 24.0k merely to mean revert, not even to overshoot as usually happens after extremes. And that is a lot of silver buying likely to happen quickly!

At 5000 ounces per contract, this mean-reversion silver buying from short-side silver-futures speculators alone is 120.2m ounces! Both the US Geological Survey and the Silver Institute estimate total global mine production in 2012 around 780m ounces. So the short covering necessary by American futures traders merely to return to recent years’ average levels of shorts is nearly 1/6th of total worldwide production!

And because of the risks rapidly-rising prices pose to short sellers’ capital, short covering happens fast. So once this mean reversion starts, all this silver is very likely to be purchased in the US futures markets alone within a couple months. You can see how fast speculators’ short positions dropped after past extremes in this chart. Once short covering starts, it rarely stops until positions fully mean revert or overshoot.

Today’s near-record futures shorts are extremely bullish for silver as we dive into 2014. It is guaranteed near-future buying that feeds on itself. The early gains in major new silver uplegs are nearly always sparked by short covering, and the bigger the shorts the greater the initial boost. But futures speculators short silver are certainly not its only buyers. Their early buying will start enticing investors back into silver.

As I explained in an essay a couple weeks ago, silver has many exceptionally-bullish factors going for it in addition to the extreme futures shorting. It has converged on multiple major secular support zones, a technical launchpad from which past major uplegs were born. Silver also remains very cheap relative to its primary driver, the price of gold. Once silver starts rallying decisively, investors will start flocking back.

A silver short squeeze will spread like a wildfire in a bone-dry forest. Despite silver’s miserable 2013, its ages-old allure certainly wasn’t stamped out. Great latent interest in silver remains among investors and speculators alike. Though silver plummeted 36% last year thanks to gold’s anomalous selloff dragging it down, the holdings of the flagship SLV silver ETF only fell 1%. And physical silver demand soared worldwide.

So as silver starts rallying again initially on short covering, it will ignite widespread buying from all quarters. This will feed on itself too. The more capital that returns to silver, the faster its price will rise. And the quicker it rallies, the more investors it will attract in. The gains in silver this year ought to be enormous, well over 50% as I explained a couple weeks ago. But the silver-stock gains will dwarf those.

The stocks of silver miners and explorers were thrashed to within an inch of their lives in last year’s precious-metals carnage. They’ve never been more undervalued relative to silver even near its recent lows, truly at fundamentally-absurd levels. So as silver recovers this year, silver stocks are overdue to see gigantic mean-reversion gains. Most should at least quadruple, with the best flying even higher.

At Zeal we’ve been intensely studying silver stocks for over a decade. Very fortuitously considering the epic silver-stock bargains out there, we recently finished our latest 3-month deep-research project looking into silver stocks. We started with a universe of nearly 120 of them trading in the US and Canada, and gradually whittled them down to our dozen fundamental favorites. These winners are awesome.

They have been able to thrive operationally even in 2013’s extreme carnage, and will enjoy vast upside leverage as silver recovers. All dozen are profiled in depth in our fascinating new 27-page silver-stock report recently published.

The bottom line is silver is on the verge of a massive short squeeze. Speculators’ silver-futures shorts surged to extreme bull-record levels less than a month ago. And they’ve barely started to mean revert, which means big buying to cover is still coming soon. While speculators’ silver-futures positions are always a great contrarian indicator at extremes, exceptional shorts are the most bullish portent of all.

Unlike new long-side buying, short covering isn’t optional. Silver futures’ hyper-leverage guarantees that speculators have to quickly buy to cover as silver’s price rises. This feeds on itself, igniting a buying frenzy as traders rush for the exits. The bigger their aggregate shorts, the greater the rally their covering sparks. So the recent bull-record shorts are a super-bullish harbinger for silver and its miners’ stocks.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Silver Poised For Massive Recovery Upleg In 2014

Published 01/05/2014, 02:34 AM

Updated 07/09/2023, 06:31 AM

Silver Poised For Massive Recovery Upleg In 2014

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.