As poorly as precious metals have done since Aug. 6, silver has remained relatively frisky. Compared to gold, it has been doing great lately. Here is the SLV/GLD ratio chart.

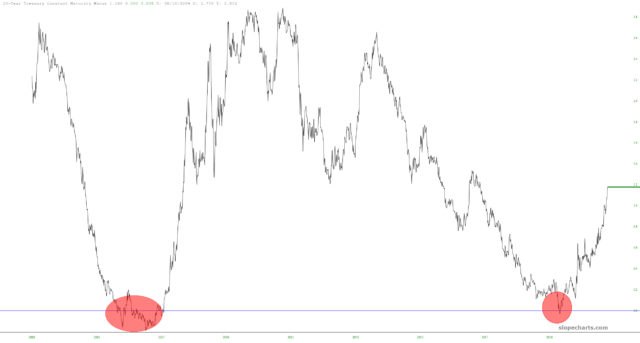

Long-term, silver still has every good chance to rocket higher, assuming its saucer pattern isn’t violated. And we’ve certainly seen through recently experience in crypto how potent saucer patterns can be (just take a look at $BNB this morning for proof). Here is the long-term silver continuous contract:

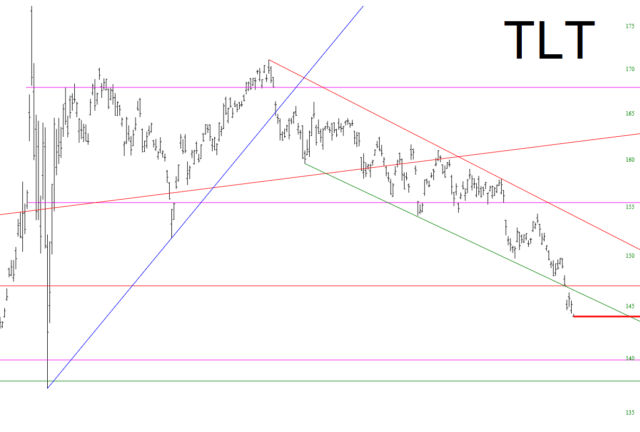

Part of what is driving this is that interest rates are surging, as witnessed by the potent bear market that has been driving bond prices lower for the past year.

iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT):

In turn, the recession-predicting yield curve inversion is way back in the rear view mirror.