By Brien Lundin, Money Metals Exchange

Gold steals most of the headlines, but silver has stealthily set itself up for a potential run to $40.

After nearly 40 years in this business, I’ve read, listened to, watched, and talked with countless thousands of very smart people.

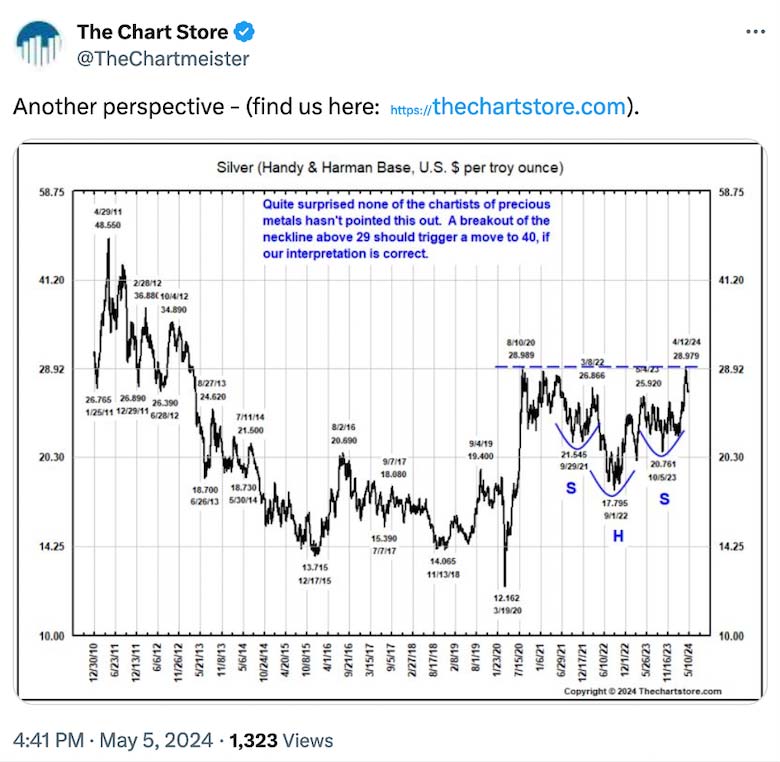

I was reminded of the value offered by the best analysts when I started noticing a number of people posting a chart of the silver price and how it’s setting up for a big breakout.

In fact, this chart and market observation was originally posted by Ron Griess of TheChartStore.com:

As you can see, silver has essentially completed a reverse head-and-shoulders pattern that projects to a price of over $40.

While many others are now talking about this, it’s important to give credit where credit is due, because that tells us who we need to listen to going forward.

Ron and his service are among those, which is why I’ve relied on his observations for over a quarter century.

This particular note on silver is important because the metal has been trading very strongly since Ron posted that chart:

As I write, gold is trading lower today, yet silver is up. You can see by this chart of the gold/silver ratio that silver has in fact been outperforming gold in recent days:

And silver’s outperformance hasn’t been limited to the last few days. Generally speaking, and counter to what most believe, silver has been leveraging gold’s gains since this rally began on March 1st.

Also note that over this period, the gold/silver ratio fell through both the 50-day and 200-day moving averages and that the 50-DMA is poised to fall through the 200-DMA. While the track record of so-called “death crosses” is mixed, this is yet another indication that silver could continue outperforming gold in the days ahead.

So “Hi ho silver, away!”

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Silver on the Launch Pad, Eyeing Run to $40

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.