It’s always interesting to compare related markets to provide a different perspective on our primary investment, and whilst silver does not correlate directly with gold, nevertheless, it does offer an alternative view for gold investors and provides some balance in forecasting future market direction for the precious metal.

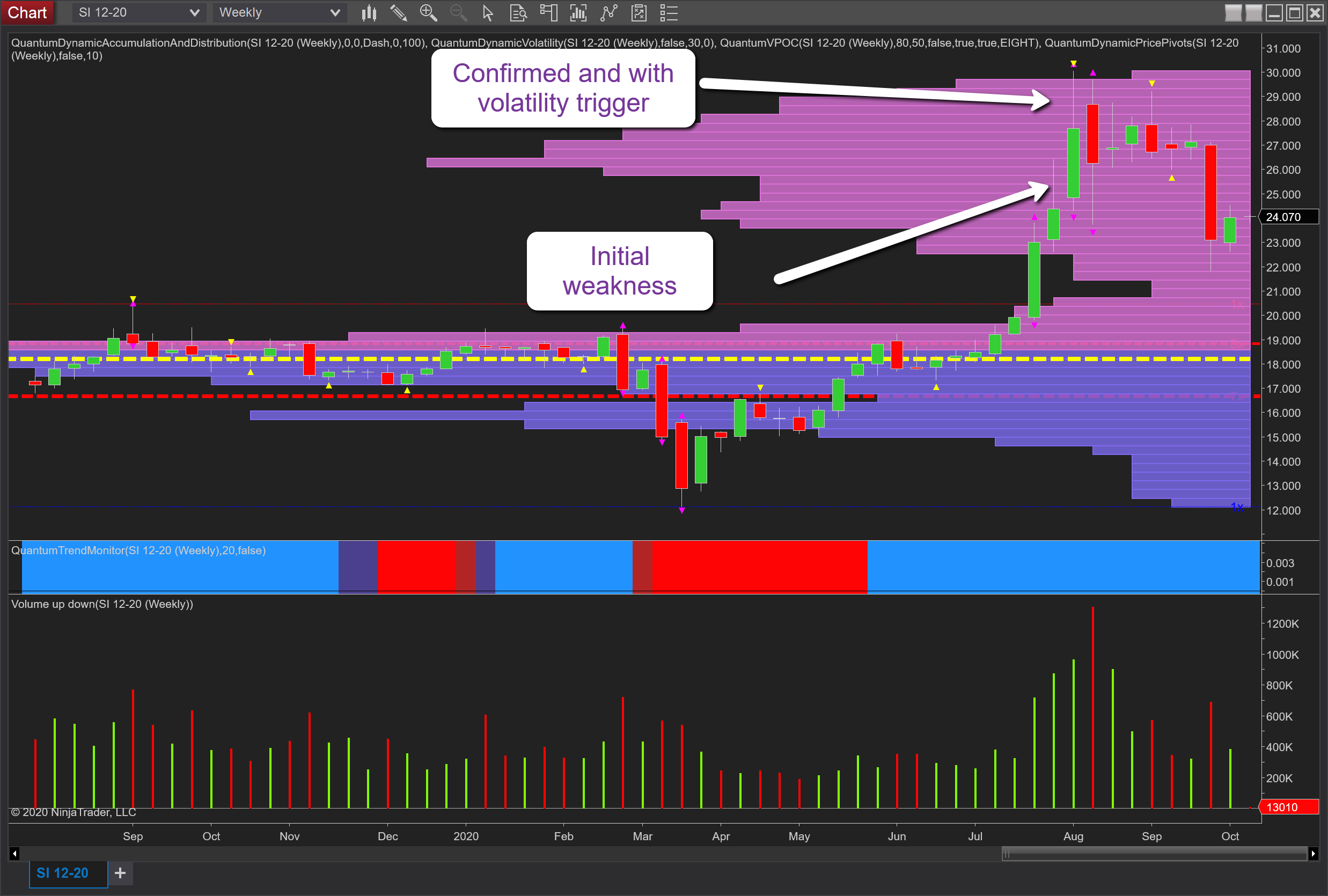

Once again I have moved to the weekly chart for the industrial metal to consider it from a technical perspective, starting with the move higher in July. Here the weakness in the metals was signaled the previous week, with the final week of July closing with a deep wick to the upper body on rising volume signaling weakness, before the first week in August confirms this signal, doubly so with the trigger of the volatility indicator.

This alone would have given us a heads up as to what to expect next which is either congestion or a reversal. Throughout the weeks which followed the $30 per ounce area was a level which held firm before the sharp sell-off in late September on the wide spread down candle on high volume, with last week’s rally on average volume mirroring that of gold.

As with gold, the longer-term outlook for silver remains positive, but in the short to medium term, it is the low volume node at $21 per ounce which looks vulnerable, and if this is breached we may see a possible return to the VPOC and strong price-based support in the $19 per ounce area. However, if we can hold above the $23 per ounce area in the medium term which is where we have well-developed volume to provide support on the VPOC histogram, then longer-term, like gold, we are likely to see bullish momentum develop and return provided it is supported with good volume.