The silver market has as previously mentioned in other articles, continued to slide down the charts in a bearish descending wedge. The question now is how much more sliding can we have in the market and what is driving it?

At present the market has been pounded lower by the rising strength of the US dollar, which should come as no surprise as the market buys up large positions in the USD, as Greek worries continue to be a problem for the market. Also QE from the ECB has caused many to devalue the currency heavily and a move to parity with the USD is looking more and more likely.

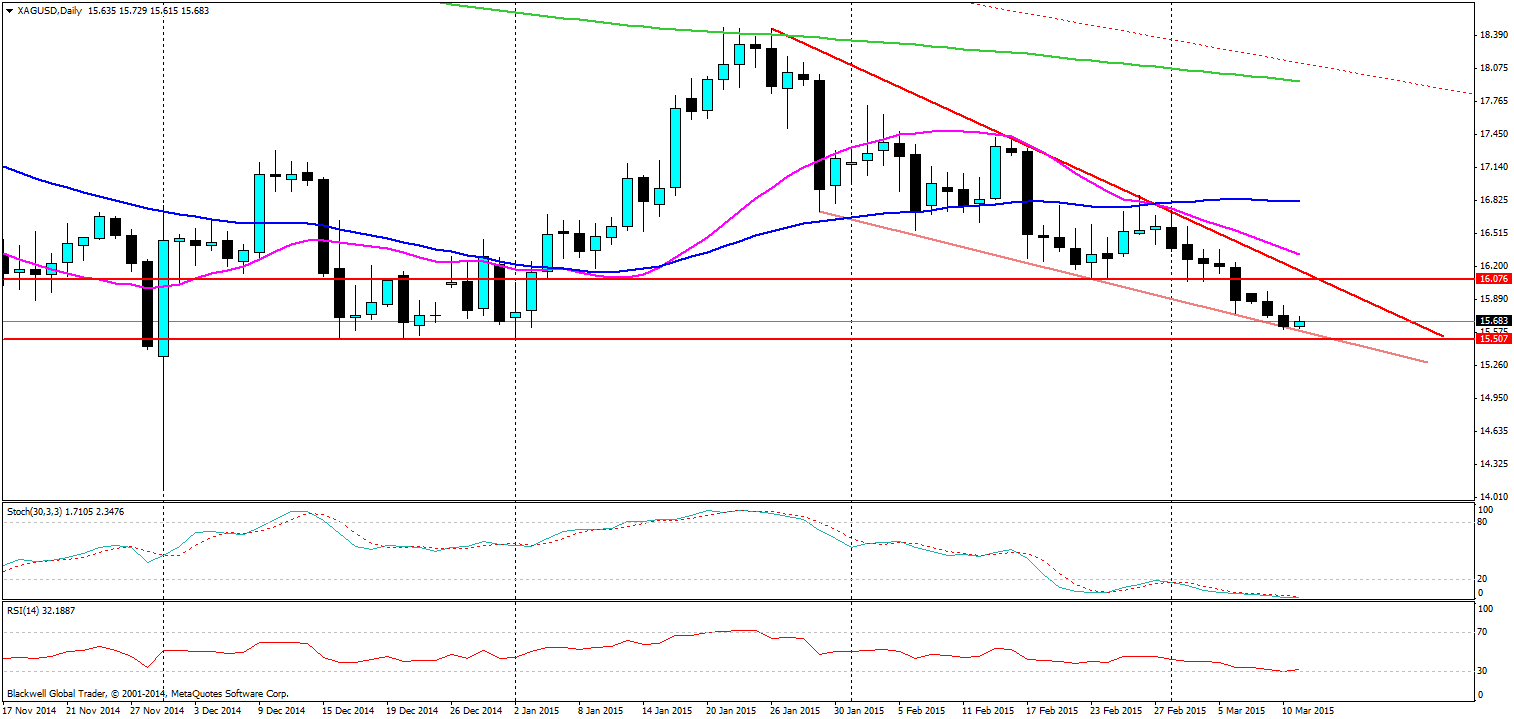

(Source: Blackwell Trader Silver, D1)

So with the wedge starting to tighten the market is looking to move which is unsurprising. Ideally, I am still looking for a bullish run after we find proper support and we are heading that way shortly as the market nears a very strong level at 15.507. From this level I am looking for a proper attempt on the wedge which has so far held out. As after a bearish wedge is a bullish pattern in the long run, and with Greece looking to make a move demand may pick up for precious metals again very quickly.

Overall this is one to watch in the next 48 hours as silver has been building up for some time and its likely the market will be looking to rush back in for a buy with the upcoming worries building up in Europe. So look alive at 15.507 because the market is looking for a point of play.