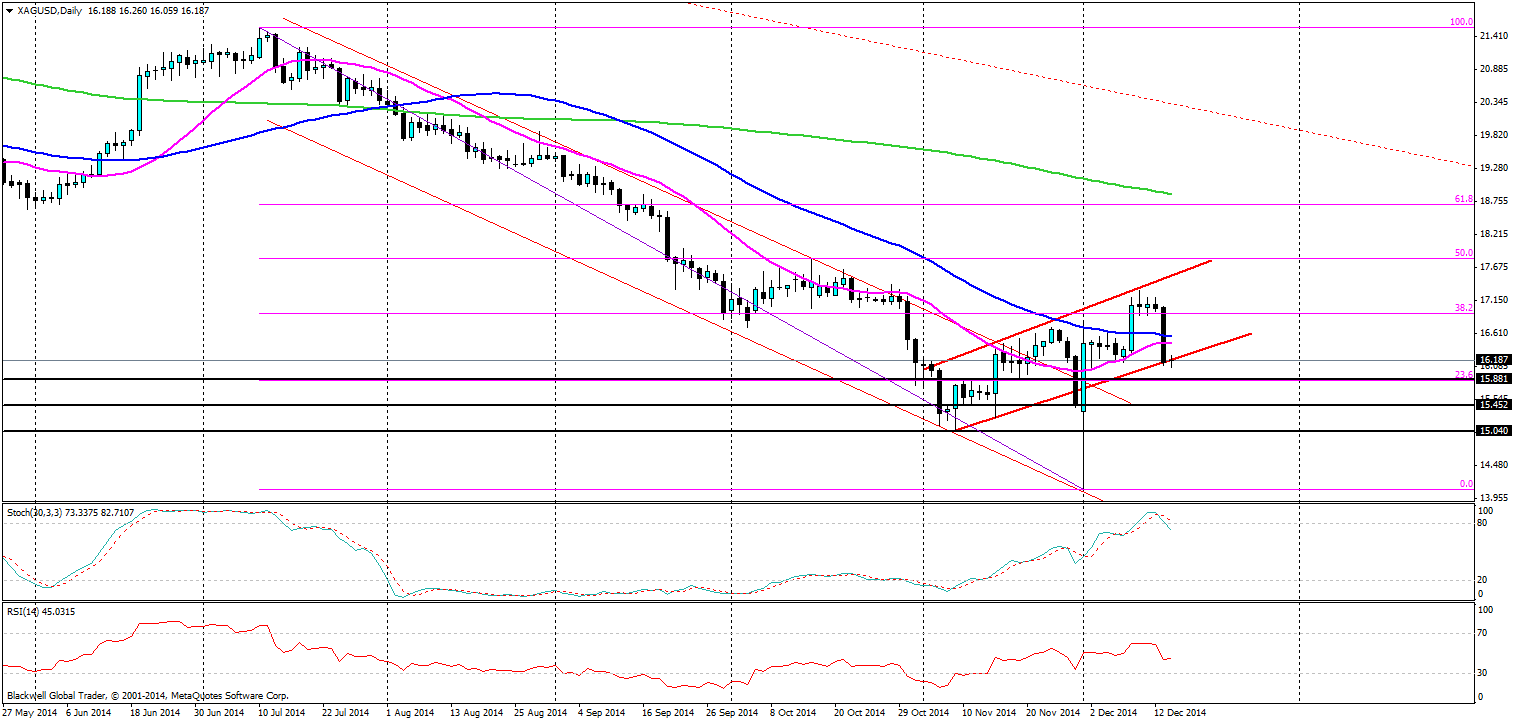

Silver charts are looking interesting after last week’s article on the possible movements that it was going through.We could be set for some more moves higher, as silver does not look likely to slow down in the current market.

Currently the market has been trending upwards, but last night we saw a strong pullback. No surprise there really as commodity markets have been very volatile as of late, and not just because of the recent crude oil drops. Either way strong US data has a negative effect for metals, and silver was not the opposite. It dropped sharply, before it managed to find support on the current bullish channel.

Going forward the market will be looking to play of this channel in the long run. The question is where to from here.

We have two options here, the first is the most obvious and that is we are going through a brief correction and that silver will play of this trend line and look to aim higher on the charts. Even looking to push up to the 50.0 fib level. This is possible and price action during the London/US hours will reinforce the possibility of this.

The second option is that we are seeing a potential correction in the market after a deep trend and we should expect further drops in the market. This would not surprise me either given metal markets movements over the past year. A move lower would look to find some support at 15.452 before running away lower towards the 15.00 level.

Overall, silver is poised for some big moves over the next few days, it will be interesting to see which way it moves with price action. But more importantly, it could be confirmation of the downward trend starting over, or the bulls driving silver higher.