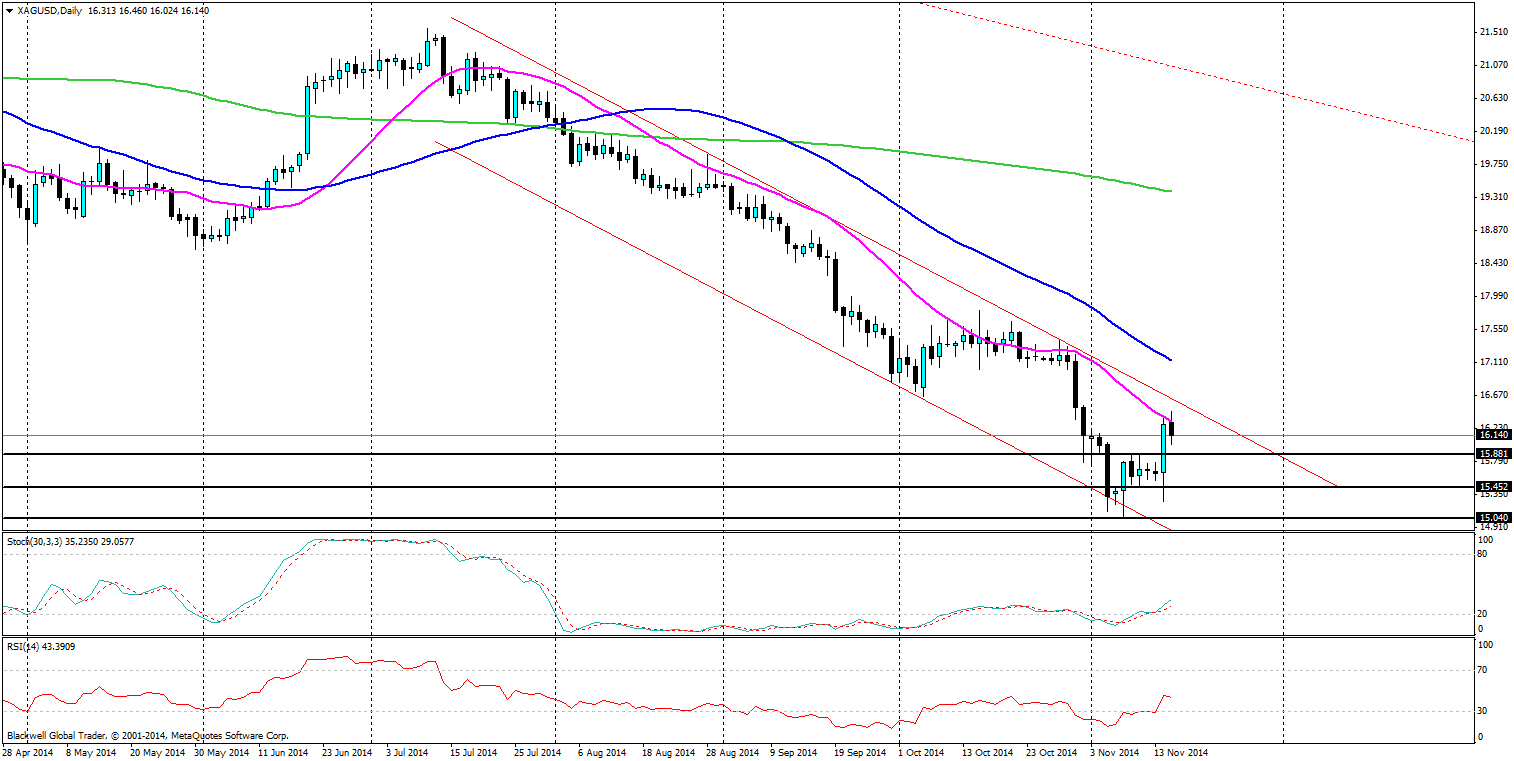

The silver market has been trending downwards for sometime on the charts, and almost looked like it was going to pull back a few days ago.

What we saw was a brief strong rally in metals for the market and from it we also saw some strong attempts by the markets to finally beat back the bears. This was thwarted in two areas: firstly Fridays strong rally pulled up sharply before it was stopped by the 20 day moving average which acted as dynamic resistance. Secondly, yesterdays brief rally came close the channel, however the market refused to budge and pulled it back down below the 20 day moving average.

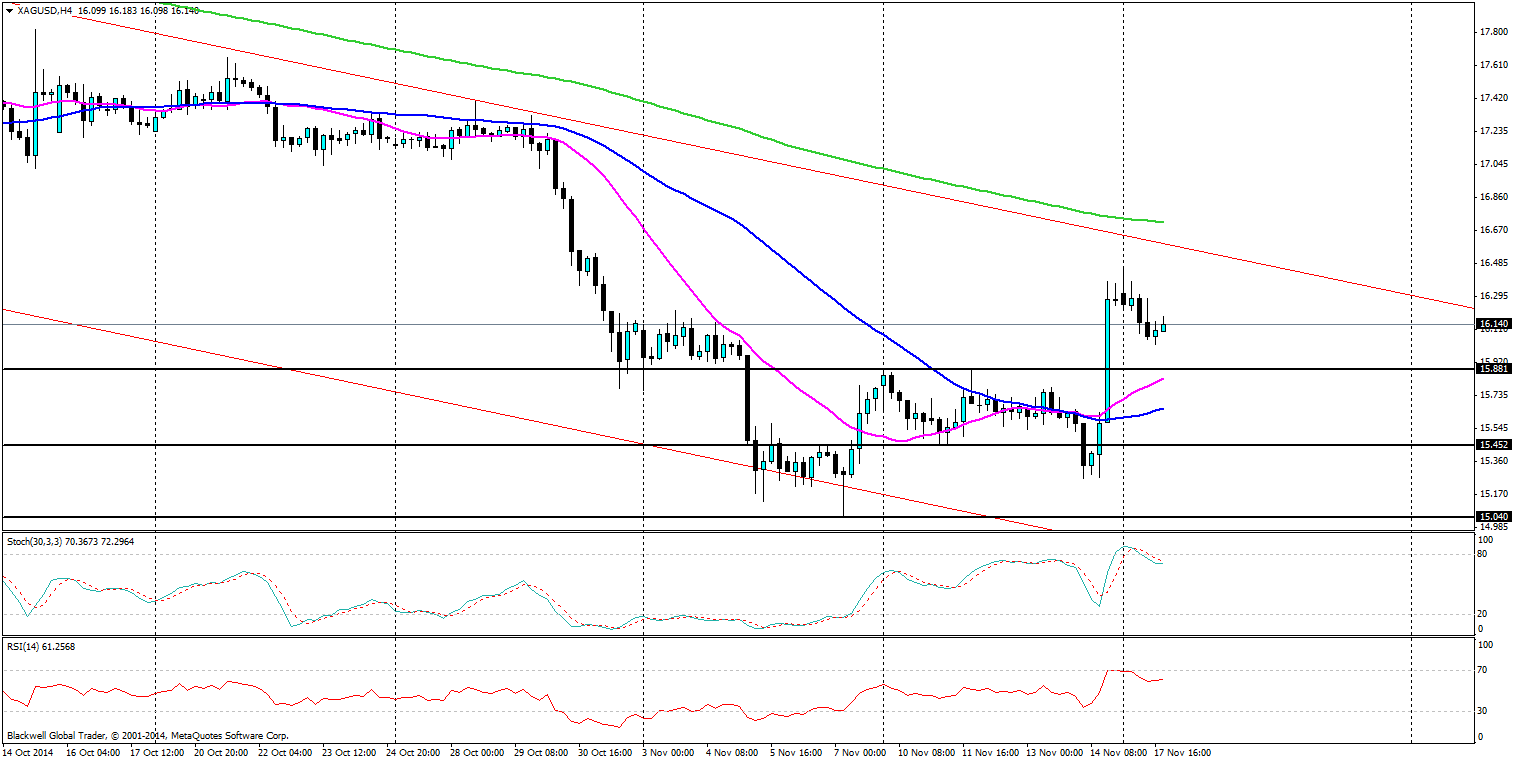

Source: Blackwell Trader (XAGUSD, H4)

The 4h chart really sums it up when it comes to market movements. We have seen a volatile pull back on the chart and the market shift upwards in an aggressive move. But what we are really looking for here is the trending long term market, which shows that after that rally we have continued to move lower with lower lows forming and lower highs. A sign that the bears are still very much in control when it comes to the key movements.

So why have the bulls failed to regain control? The key element in all of this is the US economy and the strength of the US dollar. The market still believes that the US economy is going from strength to strength, and US retail sales have shown us this coming in at 0.3% (exp 0.2%). At the same time consumer sentiment as also lifted to 89.4 as the US consumer look favourably on the future of the US economy – a bonus in the lead up to Christmas.

Targeting key levels now becomes to the next move in the market and there is strong support levels to come in Silver that markets will be looking to target. These levels can be found at 15.881, 15.452 and 15.040 and nearly all 3 levels will offer some sort of support and even resistance if there is a breakdown lower.

Overall, silver is a good trade at the moment and is still very much in a bearish market. This is clear with the current bearish trending channel, as well as the strong 20 day MA. The market will likely trend lower over the course of the coming year and this should provide traders with key opportunities to strike.