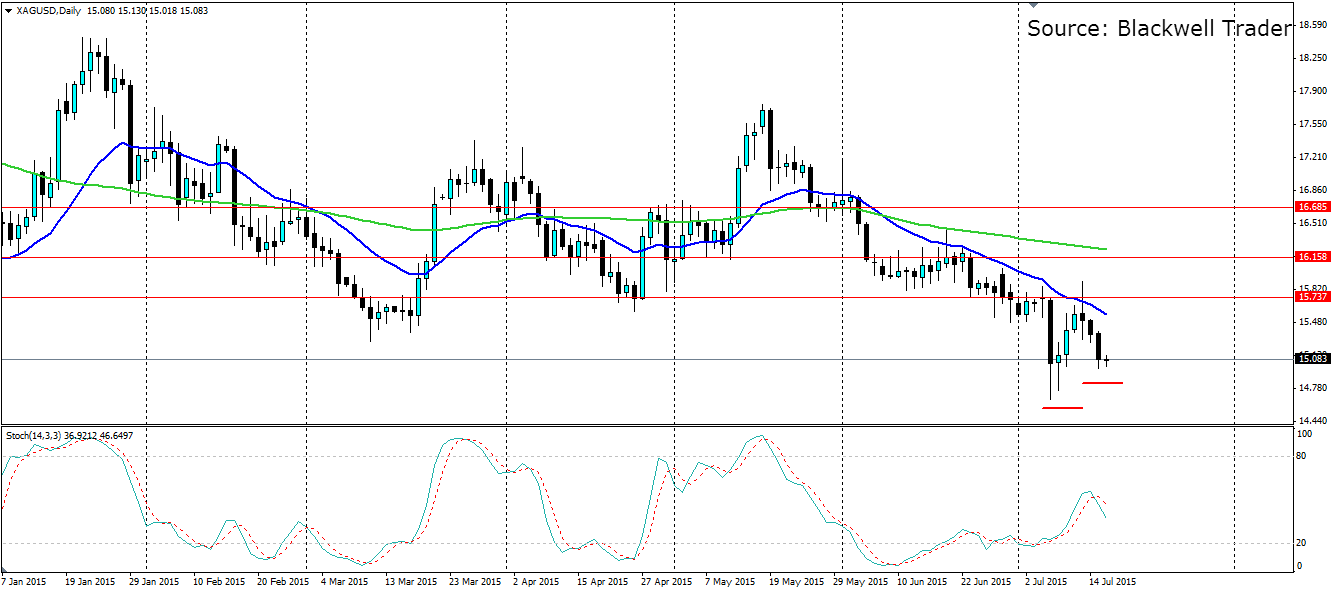

Silver has been in a bit of a downtrend recently and has turned volatile after it broke though the previous support level. Silver now looks to form a double bottom that could see the bulls push it back to the highs seen earlier this month.

The short term down trend in Silver looks to be under threat as a double bottom is forming on the above H4 chart. The long wicks indicate the bulls pushing back against the intense selling with the price being pushed back above the top if the large bearish engulfing candle. From there the bears took their cues and the selling began again.

The Stochastic oscillator is showing some bullish divergence that supports the formation of the double bottom. The Stoch hit a low in early June and the next two lower lows in the price actually created higher lows in the Stoch. The low at the current candle has a much higher Stoch reading indicating the momentum has shifted towards the bullish side.

In a push higher, watch for the neckline to act as heavy resistance around the 15.737 mark. If this is breached, we are likely to see an initial push up, and possibly a pull back to it where it will act as support. This will be a cue that the double bottom has formed and we can expect a solid rejection higher off the support. Further resistance on the way up will be found at 16.158 and 16.685 with the 100 H4 MA acting as dynamic resistance.