Key Points:

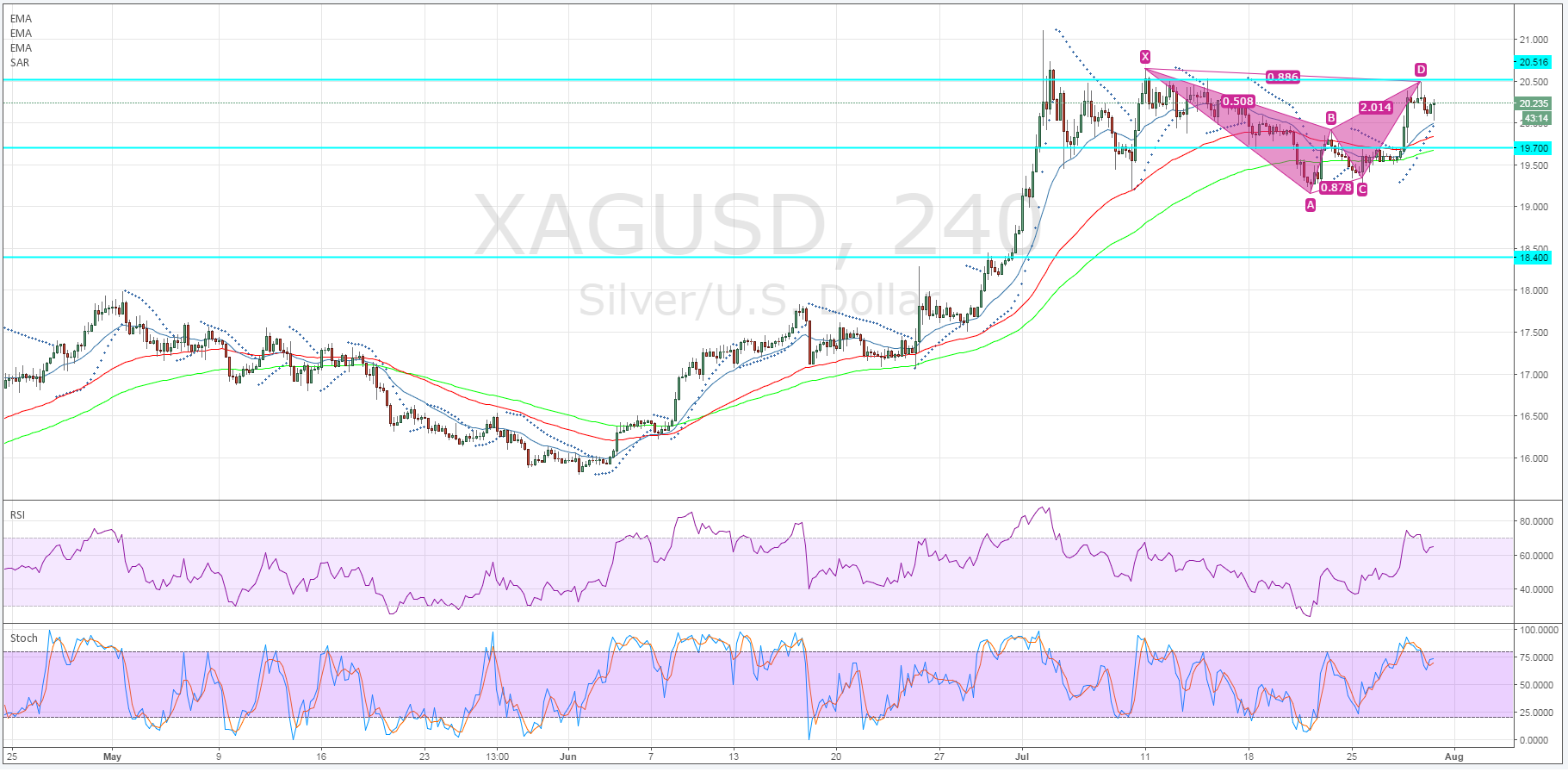

- Bearish bat pattern completed.

- RSI Oscillator nears overbought levels.

- Expect a challenge of the key $20.00 handle.

The precious metals markets have benefitted strongly over the past few weeks as uncertainty over both the impact of the Brexit, as well as the Fed’s prevarication over interest rates have continued.

Silver has subsequently remained relatively stable in a range above the key $20.00 handle. However, some cracks are starting to appear in silver’s façade as the completion of a bearish bat pattern currently dominates proceedings.

Subsequently, given the risk that the metal could tumble in the coming session, a review of the current technical indicators appears highly salient. In particular, the 4-hour timeframe provides some clear evidence of the recent completion of the bearish bat pattern which started to form early July.

In addition, price action is relatively close to what has been a fairly consistent zone of resistance around the $20.50 mark. Further adding to the argument for a short side move is the RSI Oscillators which has been trending steadily higher but is now relatively close to over-bought territory.

Subsequently, there are plenty of technical reasons to believe that the metal is now facing a reversal in the short term.

In fact, the last few hours has seen the metal commencing a small pullback with the lows becoming lower and drawing price action closer to the key $20.00 handle. Subsequently, any breach of this support level could see the metal plummet towards the next major support levels at $19.70, and $18.40 in extension.

Now, before I start to receive hate mail from my more gold and silver focused readers, it is true that physical demand for silver has recently been soaring but, as explained in some of my previous research notes, the physical price has little correlation with silver derivatives. The big banks are simply able to float paper at will to “manage” prices within the COMEX market.

Subsequently, as many of you have pointed out, silver must rally at some point given the excess pent up demand to satisfy those contracts. However, that is largely a long term proposition which allows us to focus on the short term technical indicators rather than the fundamental factors.

Ultimately, silver is likely to challenge the $20.00 handle in the coming session, especially with overbought RSI readings and the recent completion of the bearish bat. Subsequently, watch for a break towards the $19.70 mark with stops above the $20.00 handle.