Silver is turning bullish after unlimited QE and inflation fears. The USD is down heavily, interest rates are low so investors have hard time to find real investment, so they are looking at precious metals; demand increased which makes price higher.

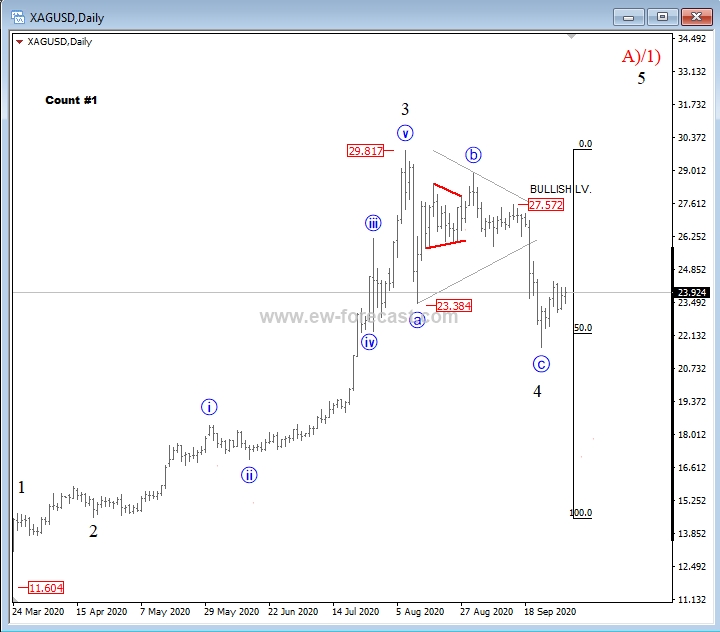

Technically speaking, we see nice turn up from March. It looks like an impulse, so more upside is expected within new bullish cycle. As such, current price activity from the 29.81 high can be part of a correction within an uptrend. We are tracking two counts: count #1 indicates price to be at the end of a corrective wave 4 of a bigger uptrend, which can look for support at the Fib. Ratio of 50.0 (around 22.0 level) and turn higher. Count #2 is also bullish, however here we see already a bigger correction underway labelled as wave B)/2), which can face same support around the 22.0 level. That said, a bullish impulsive move, and above the 27.57 level will be a sign for further upside.

Silver Daily Chart (count #1):

Silver Daily Chart (count #2):