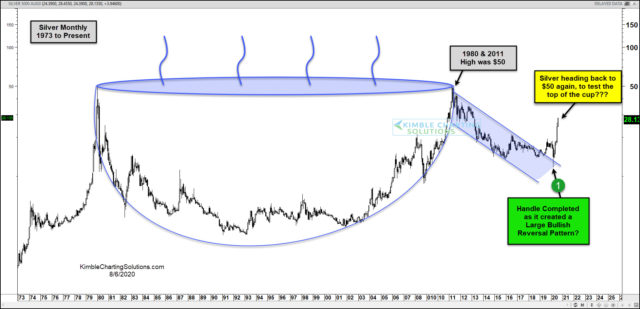

Could silver be creating a multi-decade bullish “cup-and-handle” pattern? Possible!

Did a retest of a handle breakout take place in March at (1), where silver created one of the largest bullish reversals in decades? Possible!

Could silver be creating a 40-year bullish pattern? Anything is possible! I humbly have to say share this; I’ve been in the business for 40 years and I haven’t seen anything like this.

Silver looks to have double topped back in 2011 at $50, which was the 1980 highs. After double topping, silver lost over two-thirds of its value, as it closed below $15 several times.

During this decline, it looks possible that it formed the “handle” over a nine-year period. A breakout and then a retest of old resistance as new support took place at (1) in March, where silver created one of the largest monthly bullish reversal patterns in decades at (1).

Following this large bullish reversal pattern at (1), silver has blasted off of late.

Where does the next long-term resistance test for silver come into play? The 1980 and 2011 highs at $50.

If silver is creating a multi-decade bullish pattern, the upside target for silver is way beyond the $50 level!