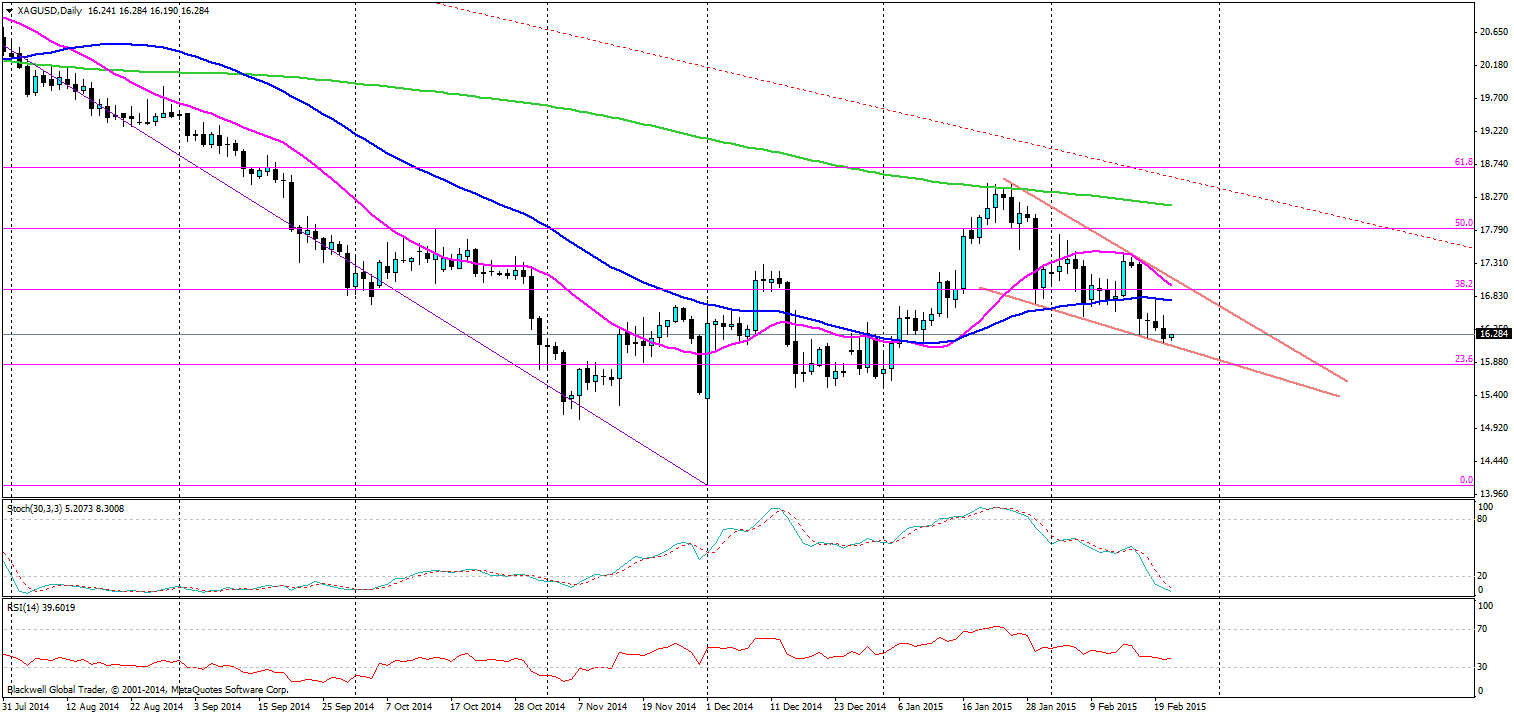

Silver markets are looking to get squeezed at present as the market converges into a tight descending wedge at present.

The last few months have seen a strong rally in silver, but it failed to bring through the 61.8 fib level on the charts, as a result, we have seen the precious metal slide back down the charts in a somewhat aggressive bearish move. Strong bearish candles followed by plays of the moving averages have been the main theme for the most part.

A descending wedge is generally indicative of a bullish move upwards, but I don’t believe it has the momentum possible at this stage for any bulls to come back into the market. After the fib failure and the lack of buying strength in the market lower lows are looking ever more likely in the current market and we may possibly see a breakout on the down side for silver.

Either way a breakout lower is a real possibility and a target of the support level at 15.600 is a real possibility. In the event of a bullish push upwards the 50 MA is likely to act as dynamic resistance before anything else and even then it would be crossing with the 20 MA which in turn would give us a golden cross signal which would be bearish.

So overall, a slight pullback may be on the horizon but it’s likely to get quickly defeated by the moving averages coming down on the pair and we may see a push through the descending wedge as the market is looking very bearish as of late.