Key Points:

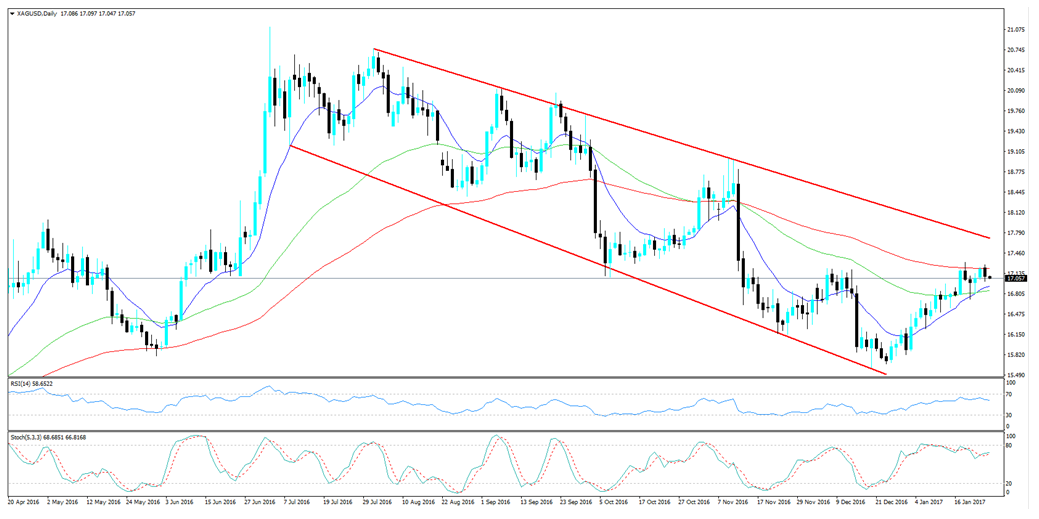

- Divergence evident on Stochastic Oscillator.

- Price action stalls at 100 Day MA.

- Watch for a breakdown in the coming days.

Silver has had a relatively positive run over the past month, as the metal has benefited from a range of uncertainty from President Trump’s inauguration and slipping dollar sentiment. Subsequently, silver has been steadily ticking higher, within a relatively wide bearish channel, but may now be facing an impending reversal as price action stalls.

The past 24 hours have seen the bulls start to diminish within the market and price action’s rise appears to have stalled right at the 100 Day MA around the $17.216 an ounce mark. This zone of resistance has subsequently caused the metal to take a decidedly sideways direction, which is reflected in the RSI Oscillator’s sideways trend right at the edge of overbought territory.

However, rather than a period of sideways moderation, we could actually be setting up for a fall and decline back towards the lower channel constraint. In particular, the Stochastic Oscillator is showing some signs of divergence as the indicator is evidently trending lower, after having reached overbought territory. Subsequently, we may be seeing the early stages of a reversal and start of the next bearish leg for the metal.

Further supporting the bearish contention is the recent rout of stock within the physical market, with supply having becoming significantly easier over the last four weeks. Although there is scant evidence of a direct correlation between the physical and derivative markets, prices still provide some base indications of demand for investment grade silver. Subsequently, there appears to be some tangential evidence of a slowdown in appetite for investment grade silver that may also be impacting the physical market.

Ultimately, the various technical factors are likely to be the primary drivers of the metal’s trend in the near term. In particular, the evident divergence within the Stochastic Oscillator would tend to support a bearish contention. Subsequently, the likely scenario is one that involves the breaching of support at $16.71 and then a rapid decline back towards the channel bottom at $16.11 and $15.65, in extension. However, watch out for the Trump effect over the coming weeks, as the newly elected President is likely to make his presence keenly felt on the markets.