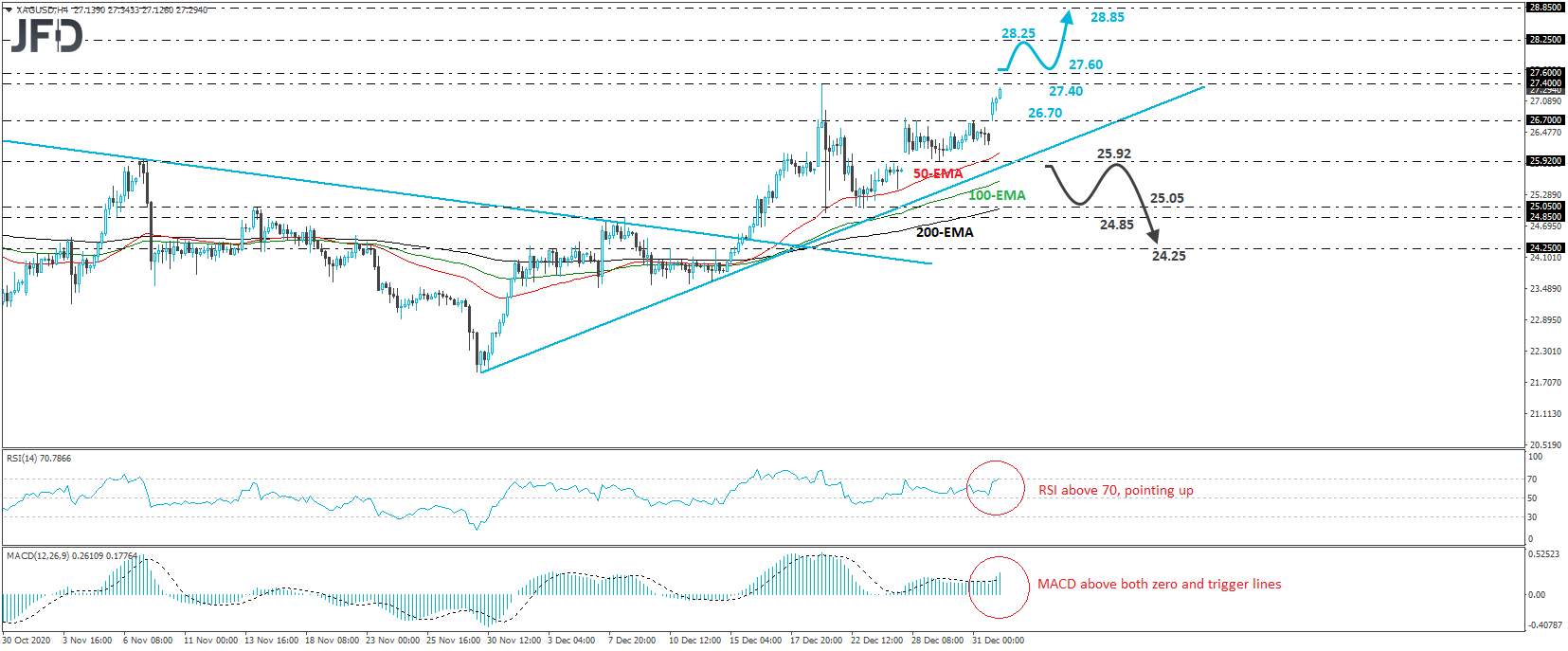

XAG/USD opened with a positive gap on Monday, breaking above the 26.70 barrier, which was marked as a resistance by the highs of Dec. 28 and 31. The metal continued drifting north during the Asian and European sessions, and currently, it is near the high of Dec. 21, at 27.40. Overall, silver is trading above the upside support line drawn from the low of Nov. 30, and thus, we would consider the short-term outlook to be positive for now.

That said, in order to get more comfortable with the upside, we would like to see a break, not only above the 27.40 barrier, but also above 27.60, which is the high of Sept. 15. This would confirm a forthcoming higher high on the daily chart and may initially target the 28.25 obstacle, which is defined as a resistance by the high of Sept. 2. Another break, above 28.25, could set the stage for extensions towards the high of the day before, at 28.85.

Taking a look at our short-term oscillators, we see that the RSI just poked its nose above 70 and continues to point north, while the MACD lies above both its zero and trigger lines, pointing up as well. Both indicators detect strong upside speed and corroborate our view for further advances in the white metal.

On the downside, we would like to see a dip below 25.92, marked by the low of Dec. 29, before we start examining the case of a bearish reversal. Such a move may confirm the break below the aforementioned upside line and open the path towards the 25.05 zone, marked by the lows of Dec. 22 and 23, or the 24.85 barrier, marked by the inside swing high of Dec. 8. If neither support is able to halt the slide, a break lower may extend the fall towards the 24.25 territory, defined as a support by the inside swing high of Dec. 14.