Silver

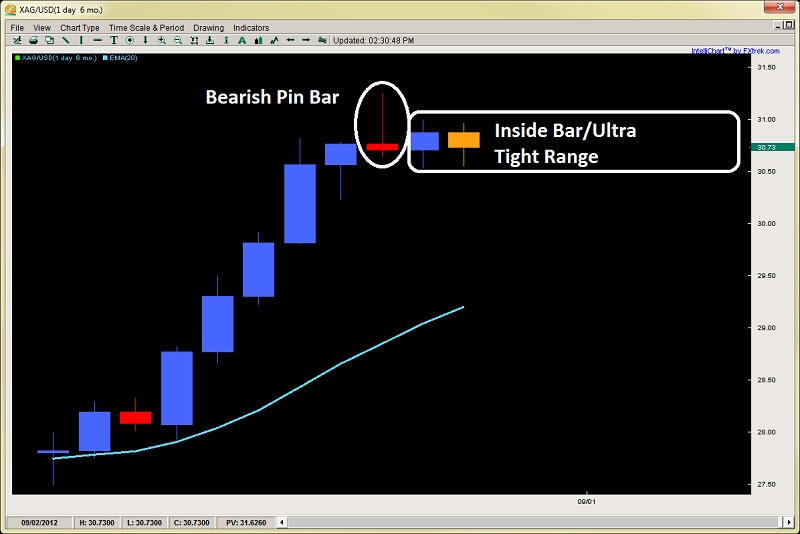

As the snoozefest continues with investors pulling out prior to the Jackson Hole meeting this Friday, breakouts are an endangered species till then while small ranges are dominating. 'Tis no surprise that an daily inside bar formed on almost everything, but the one that is more notable is the one on silver.

Why?

Well two days ago the pair formed a bearish pin bar after a 5-day climb. Since then, it has formed a non-descript bull bar with today’s being a bearish inside bar. Normally you do not have two bars back to back like this after a notable bearish pin bar. Either a test on the pin bars high manifests, or a breakdown, but not such a straight range.

I suspect this is part due to precious metals traders wanting to wait till the Bernanke speech, but the fact the metal is hovering there suggests some underpinning. If Bernanke does not announce any more easing, then expect a strong sell-off in silver and gold, but if he does, then expect the pin bar high to be taken out within hours after the speech. Aggressive intraday players can take longs just above $30.50 with ultra tight stops, while intraday bears can short just a few cents shy of $31 (tight stops as well).

XAG/USD" title="XAG/USD" width="662" height="323">

XAG/USD" title="XAG/USD" width="662" height="323">

Global Market Commentary

Volumes were ultra low today with markets mostly trotting in place with gold being one of the more active instruments shedding $11 dropping to $1658 to close the day.

There is some speculation the ECB will do some sort of easing since he has communicated he will not be at the Jackson Hole meeting, possibly to prepare for such easing to be announced on its September 6th meeting.

Euro German GDP came in around expectations as well as US GDP hitting the main predictions as well.

Original post

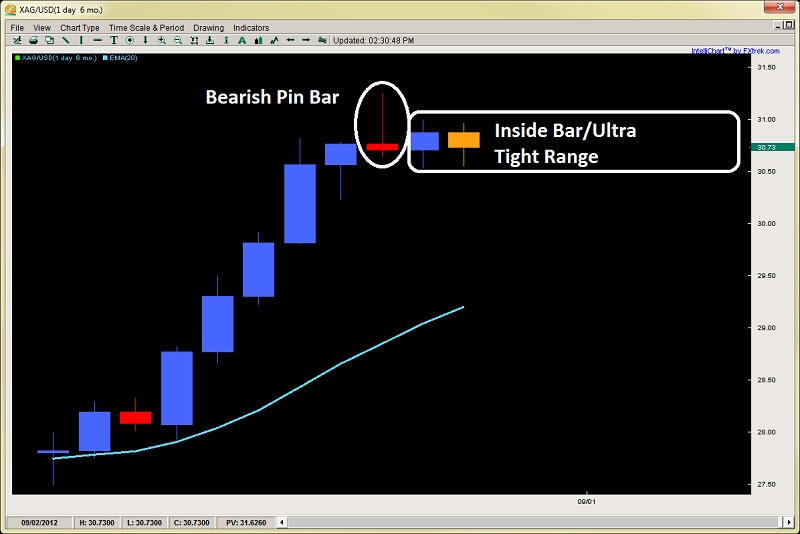

As the snoozefest continues with investors pulling out prior to the Jackson Hole meeting this Friday, breakouts are an endangered species till then while small ranges are dominating. 'Tis no surprise that an daily inside bar formed on almost everything, but the one that is more notable is the one on silver.

Why?

Well two days ago the pair formed a bearish pin bar after a 5-day climb. Since then, it has formed a non-descript bull bar with today’s being a bearish inside bar. Normally you do not have two bars back to back like this after a notable bearish pin bar. Either a test on the pin bars high manifests, or a breakdown, but not such a straight range.

I suspect this is part due to precious metals traders wanting to wait till the Bernanke speech, but the fact the metal is hovering there suggests some underpinning. If Bernanke does not announce any more easing, then expect a strong sell-off in silver and gold, but if he does, then expect the pin bar high to be taken out within hours after the speech. Aggressive intraday players can take longs just above $30.50 with ultra tight stops, while intraday bears can short just a few cents shy of $31 (tight stops as well).

XAG/USD" title="XAG/USD" width="662" height="323">

XAG/USD" title="XAG/USD" width="662" height="323">Global Market Commentary

Volumes were ultra low today with markets mostly trotting in place with gold being one of the more active instruments shedding $11 dropping to $1658 to close the day.

There is some speculation the ECB will do some sort of easing since he has communicated he will not be at the Jackson Hole meeting, possibly to prepare for such easing to be announced on its September 6th meeting.

Euro German GDP came in around expectations as well as US GDP hitting the main predictions as well.

Original post