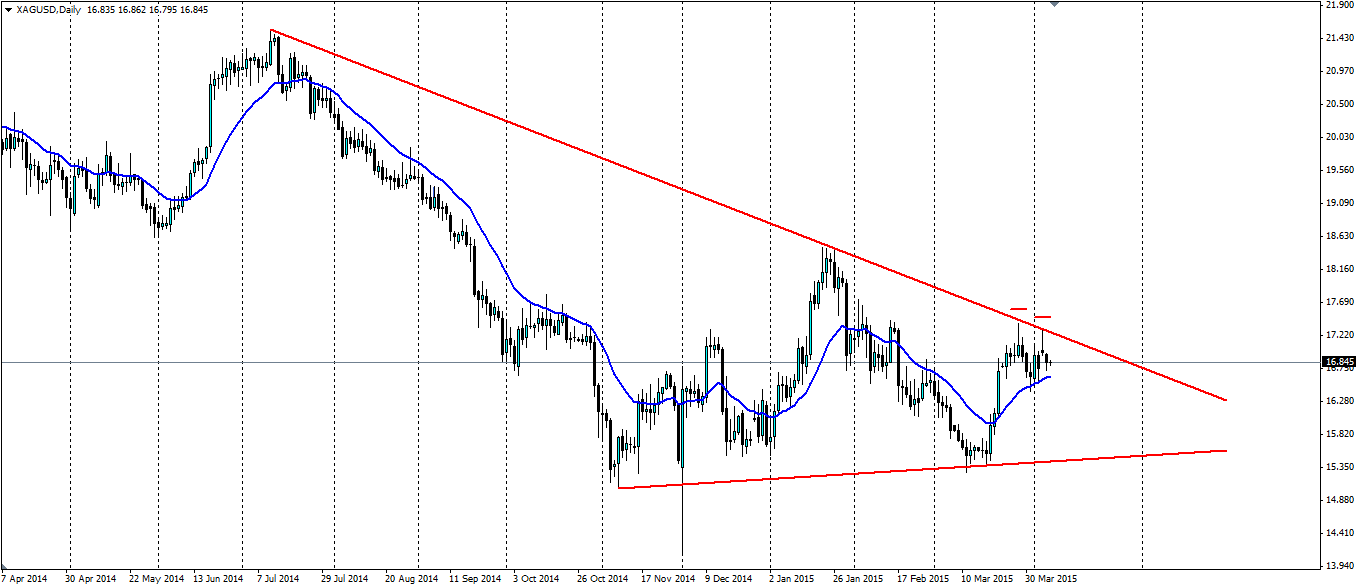

The silver markets have been active recently and found plenty of support thanks to the US Federal reserve and the disappointing Nonfarm report. A double top with a solid pin bar points to a reversal and a rejection off the trend line that could see the recent lows targeted.

Source: Blackwell Trader

Silver has been consolidating under a bearish trend line with the highs becoming lower and the lows becoming higher. The most recent leg-up was largely thanks to the Fed becoming coy about when they will look to raise interest rates. The disappointing result last week in the US Nonfarm Payrolls, which fell from 295k to 126k, likely added to the fear that an interest rate rise would be pushed back toward the end of the year.

Yesterday’s JOLTS job openings report lifted strongly from 5.0m to 5.13m and made last week’s nonfarm result look more like a blip rather than a serious fundamental change in the US economy. There is still a possibility we will see an interest rate rise in June, and silver will suffer as a result. If the majority of data out of the US remains positive, we will see silver trend lower, towards the bottom of the above pennant shape.

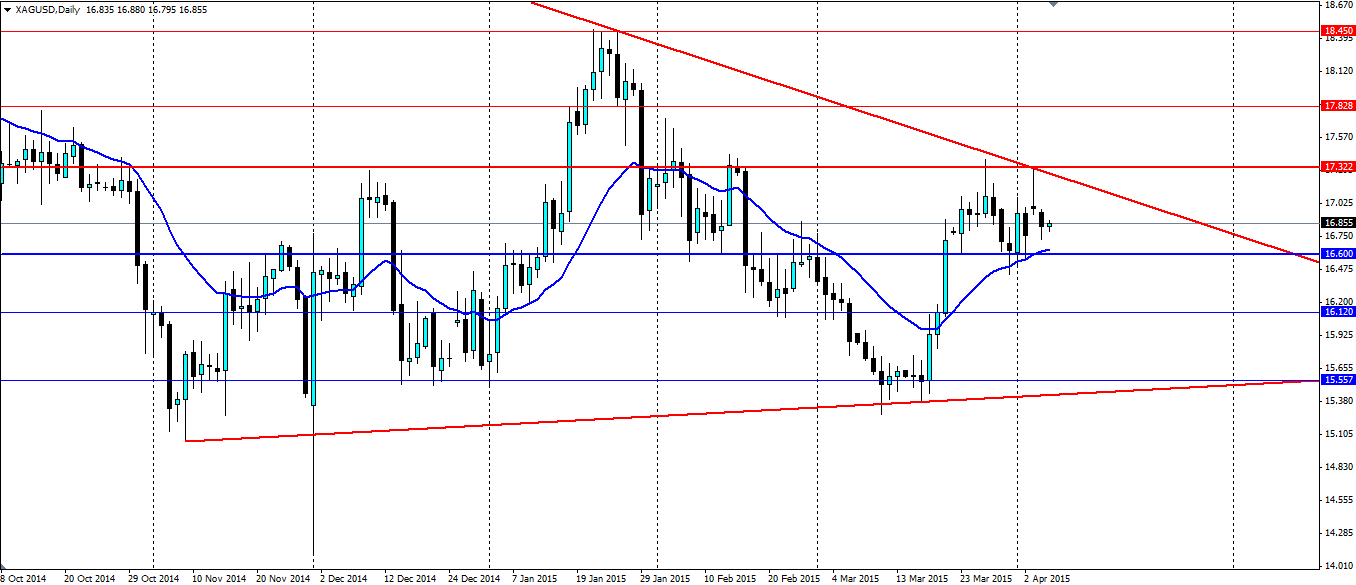

The double top seen over the last few days shows the validity the market has given to the trend line. This should be taken as a sign that a strong rejection is coming, if technicals play out. The FOMC meeting minutes are due out later today and could well put a spanner in the works, so it may pay to assess the impact of that on the market before looking to trade this set up.

A rejection off the trend line will look for support at 16.600 which is a strong liquidity area and could act to hold price up. Further support is found at 16.120 and 15.557. An upside breakout will look to find resistance at 17.322, 17.828 and 18.450.

Silver has seen a strong rejection form as the price comes into contact with a bearish trend line. If technicals hold, price should be led down toward the recent lows, but watch for the FOMC meeting minutes which could add volatility and trigger stops.