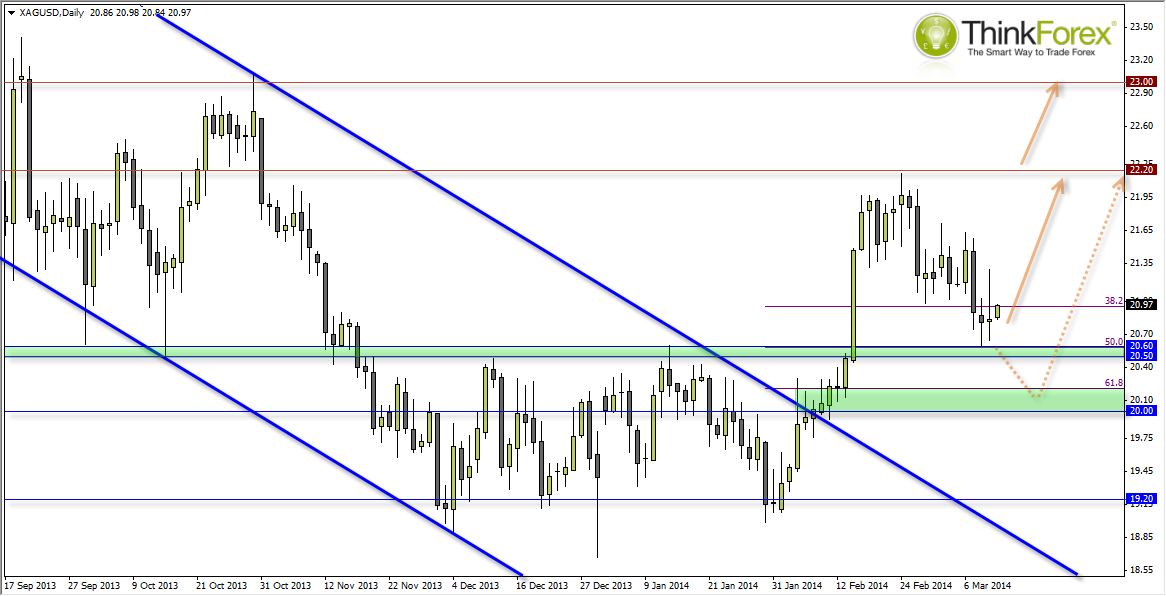

The decline from the $22.20 highs appears to be corrective, so as long as we remain above $20.50-60 zone then bullish targets remain $22.20 and $23.00.

Attempting to pick the bottom of a correction can become frustrating as it whips you into a profitable trade for a few ticks, and only to see it drop a little lower. This is why multiple confluences of support or resistance paramount in such circumstances to help define a more likely turning point before the anticipated trend resumes.

We are now holding above the $20.50-60 zone, and Monday’s low tested this area to produce a Doji (and hesitancy to go lower). This zone also coincides with a 50% retracement (my favoured ratio as generally more reliable), and yesterday produced a Rikshaw Man Doji with a higher upper wick to show the sentiment from the previous decline is waning and suggests there are buyers down around $20.50 and above.

Of course nothing in this game is guaranteed, but I do like the confluences of support highlighted to assume a trend continuation soon.

However, in the event we do break below this area then we have a 2nd zone of support between $20-$20.20. This really depends on your own trading style but I am not a fan of trading from the 61.8% as I prefer to see shallower pullbacks in line with an impulsive move. I find deeper pullbacks tend to entice choppier and more confusing corrections - my opinion only of course.

DISCLAIMER: Trading in the Foreign Exchange market involves a significant and substantial risk of loss and may not be suitable for everyone. You should carefully consider whether trading is suitable for you in light of your age, income, personal circumstances, trading knowledge, and financial resources. Only true discretionary income should be used for trading in the Foreign Exchange market. Any opinion, market analysis or other information of any kind contained in this email is subject to change at any time. Nothing in this email should be construed as a solicitation to trade in the Foreign Exchange market. If you are considering trading in the Foreign Exchange market before you trade make sure you understand how the spot market operates, how Think Forex is compensated, understand the Think Forex trading contract, rules and be thoroughly familiar with the operation of and the limitations of the platform on which you are going to trade.

A Financial Services Guide ( FSG) and Product Disclosure Statements (PDS) for these products is available from TF GLOBAL MARKETS (AUST) PTY LTD by emailing compliance@thinkforex.com.au .The FSG and PDS should be considered before deciding to enter into any Derivative transactions with TF GLOBAL MARKETS (AUST) PTY LTD. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. Also, see the section titled “Significant Risks” in our Product Disclosure Statement, which also includes risks associated with the use of third parties and software plugins. The information on the site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. 2013 TF GLOBAL MARKETS (AUST) PTY LTD. All rights reserved. AFSL 424700. ABN 69 158 361 561. Please note: We do not service US entities or residents.