PR, WHEN will this correction end and when will the decline pick up pace?

Silver Signals Weakness Despite Short-Term Strength

The above is probably something that you might be thinking. While I can’t tell with certainty (nobody can), there are a few signs suggesting that the top is in or at hand, depending on what part of the precious metals sector one focuses on.

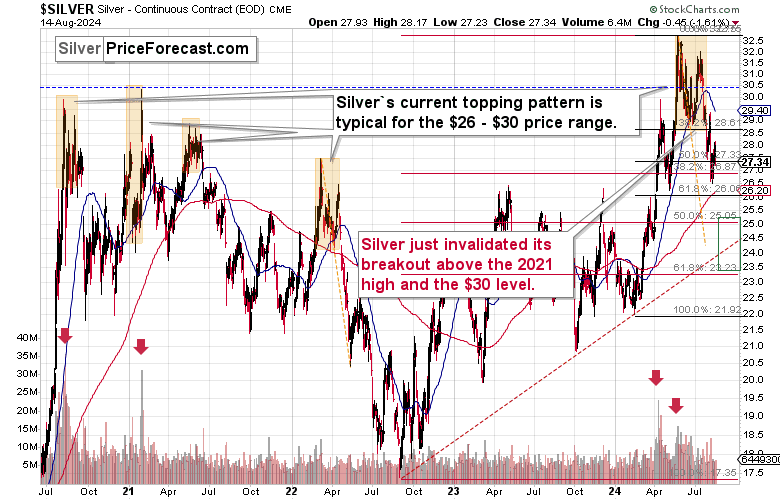

As it’s been some time since I last focused on it, let’s start with… Silver.

The white metal’s performance has been really poor since it failed to hold above the $30 level. I had warned about this failure, so it didn’t come as a surprise to you.

But even though silver has been in a rather short-term decline, there are still quite many voices that don’t agree that silver is indeed in the decline mode.

Well, that’s normal – that was also the case after the 2021 top (which I also warned about) – it takes some time and even lower prices for most to realize what’s going on.

Of course, when that happens, the opportunity coming from profiting on the decline in the prices is already gone.

Silver is on its way to its downside target close to the $24 level – at its rising support line.

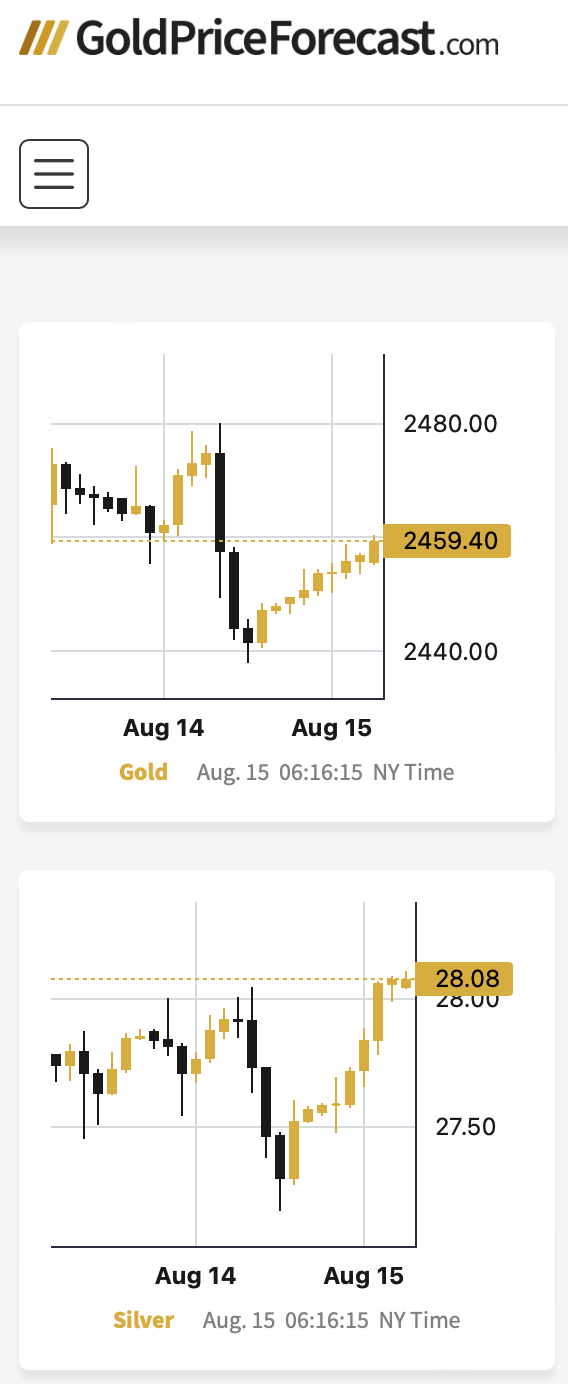

The interesting thing about silver’s performance is that despite being weak recently and being in a clear downtrend it just showed very short-term strength against gold.

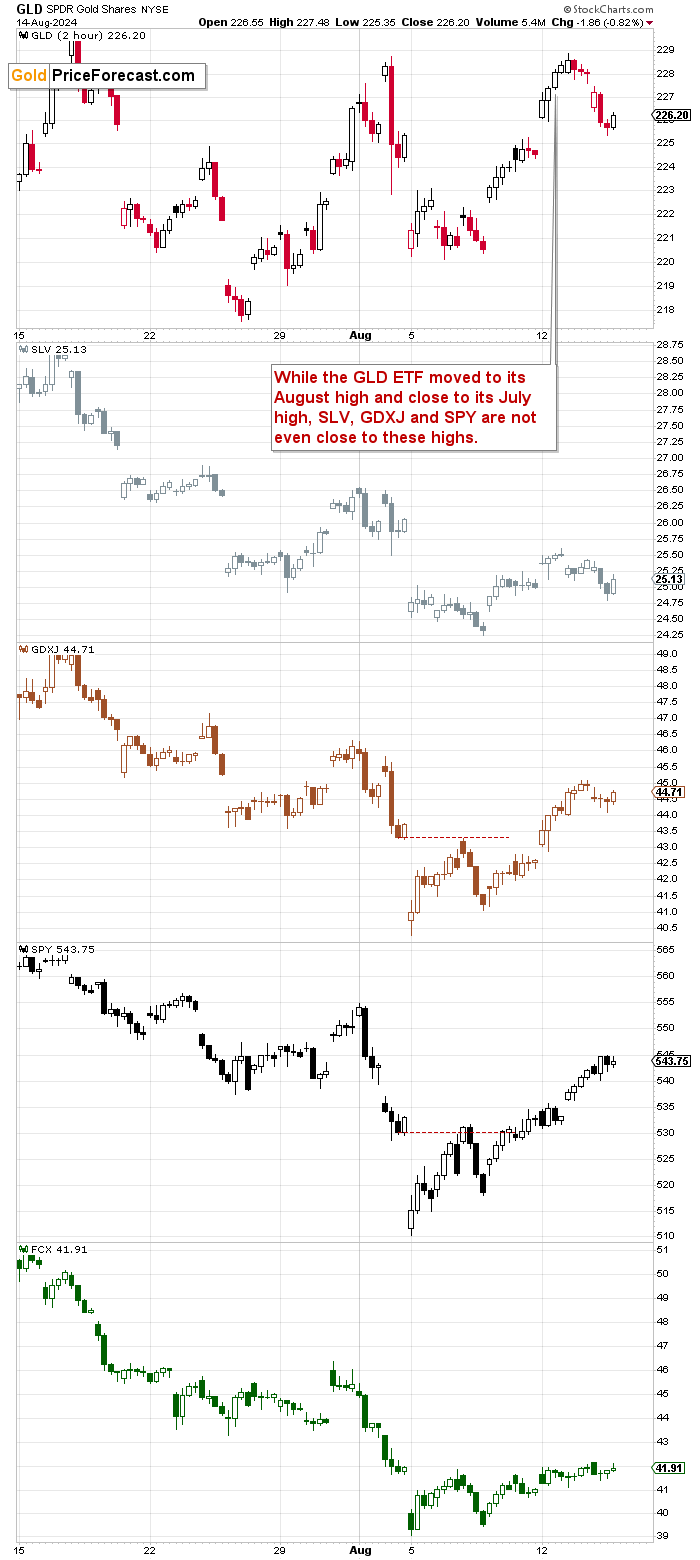

The times when silver outperforms gold on a short-term basis are usually the times when it’s great to be prepared for another sizable decline in both markets (and in mining stocks). And speaking of gold stocks, here’s what we saw yesterday:

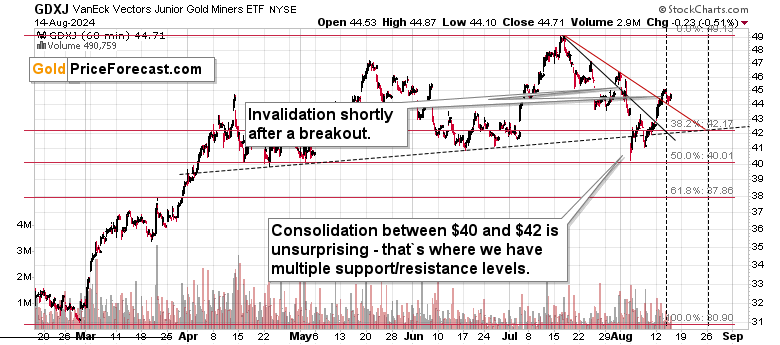

The GDXJ declined a bit, and it did so after reversing at its triangle-vertex-based turning point. As a reminder, when support and resistance lines cross, it indicates a good possibility of seeing a reversal. This technique doesn’t point to specific prices, but it points to specific times.

Since the GDXJ turned south at the reversal, the odds are that this was indeed the top or an early part thereof.

Besides, the previous breakout above the previous declining resistance line that we saw in early August was followed by significant short-term declines. This means that the current breakout should not be trusted.

Gold sold off a bit, failing to hold above the previous high, but given the move up in stocks, it had a limited impact on silver, miners, and FCX.

Those of you who have been shorting GDXJ and FCX in the recent weeks (about which I’ve been writing in my analyses) are likely happy with their performance despite the most recent run-up.

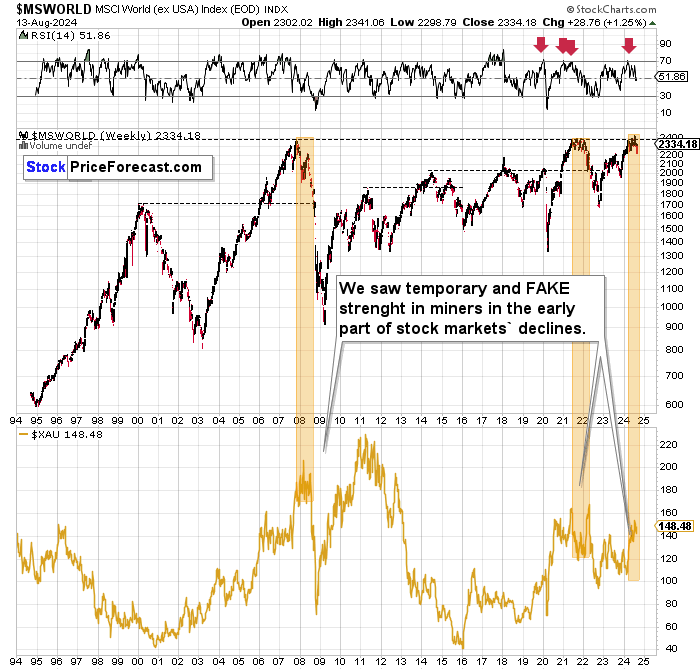

Are stocks really bullish here? Absolutely not. The world stocks chart suggests that the opposite is the case.

After failing to hold above their 2007 and 2021/2022 highs, world stocks declined. Right now, they rebounded, but the key thing remains intact – the breakout was invalidated.

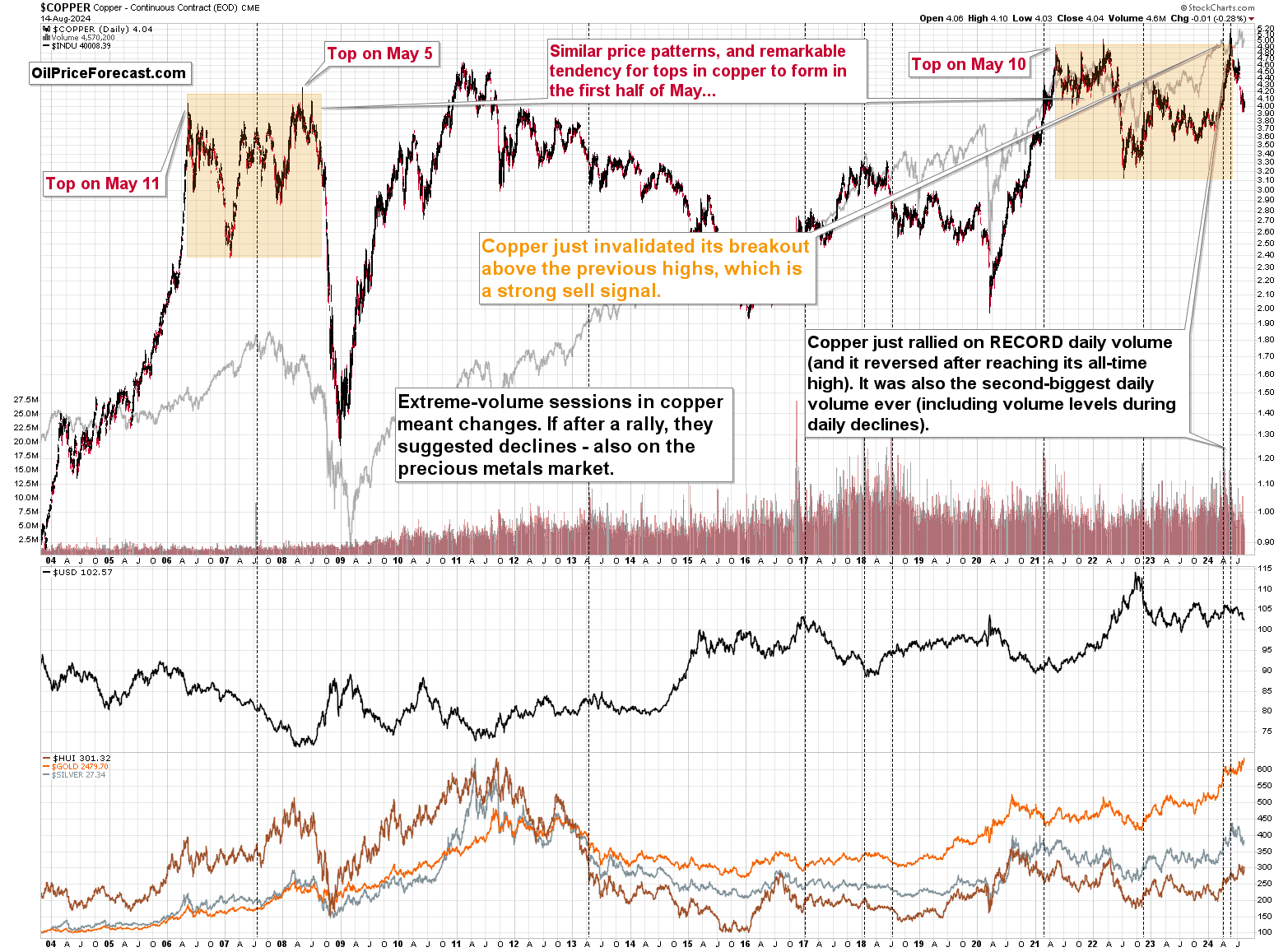

Remember when I emphasized how bearish it was in case of copper back in May?

Copper plunged in the following weeks, and it seems that the decline is far from being over.

USD Index Building a Strong Base for Potential Rally

The same fate most likely awaits world stocks (and also U.S. stocks).

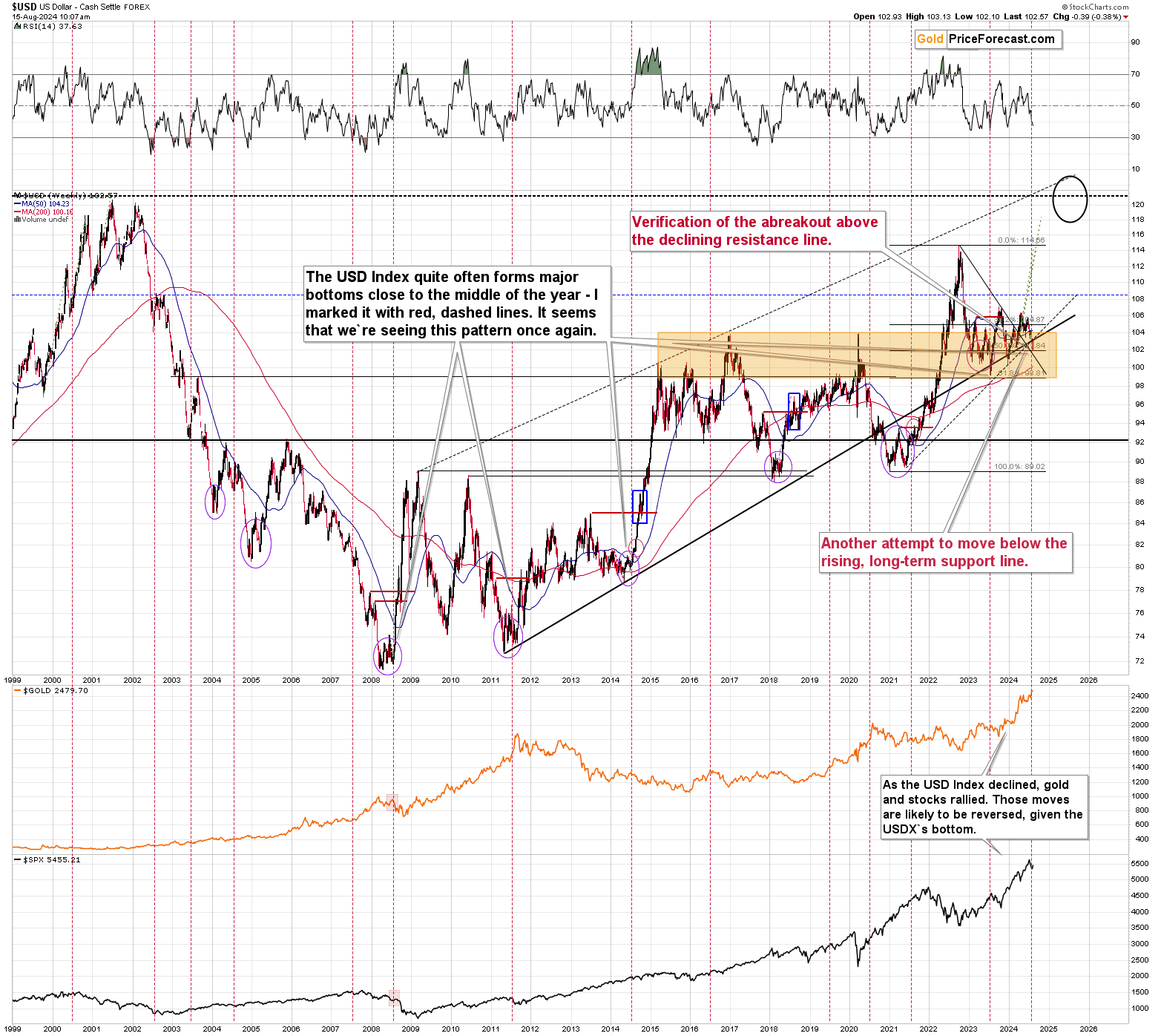

Also, the US Dollar Index is likely forming a major bottom here.

Why would I say so?

First of all, the USD Index is after a relatively small (compared to the length of the line) breakdown below the rising black support line. This might be viewed as bearish, but actually it’s bullish because the USD Index rallied back up strongly after each previous breakdown – they were all invalidated.

Second, the USD Index is after a breakout above the declining, medium-term resistance line. The recent move lower made the USD Index move back to this line, but not below it. This way, the breakout is likely to be verified.

Third, it’s about TIME for the USD Index to form a major bottom, as it tends to do so close to the middle of the year. Precisely, that’s when the USD Index tends to reverse in a meaningful way, but since the recent move was to the downside, the implications are bullish.

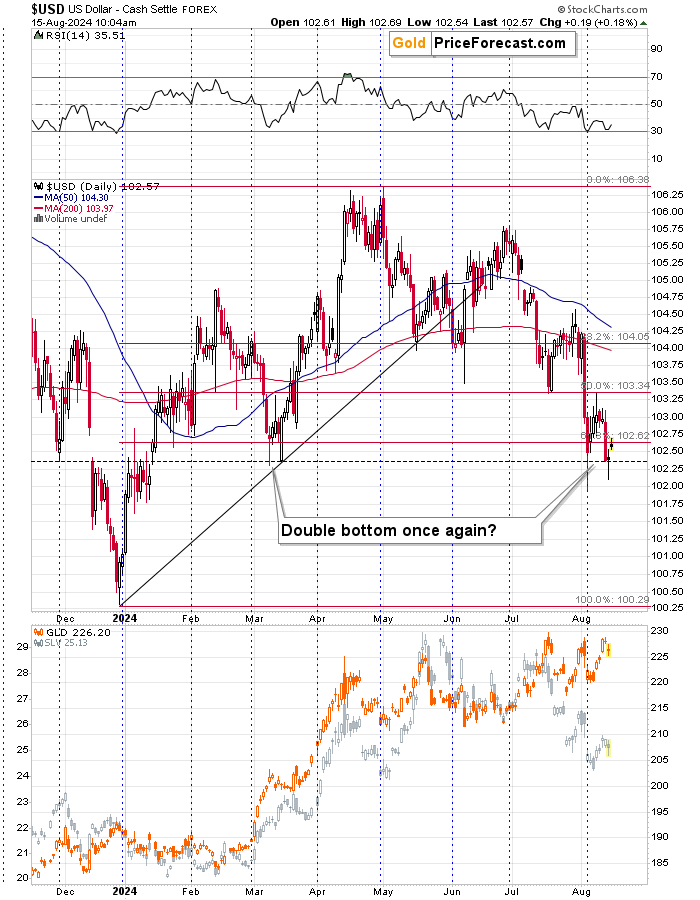

Let’s zoom in.

The USD Index just formed a bullish reversal candlestick and along with the early-August reversal, it creates a double-bottom pattern. The same kind of pattern triggered rallies from almost the same price levels in mid-March.

The previous attempt of the USD index to move below its 61.8% Fibonacci retracement based on this year’s rally was invalidated and (also given today’s move up) it seems that we’ll see this kind of invalidation once again.

Looking beyond charts – with the looming liquidity problems given the reversal of the yen carry trade, many asset prices (such as stocks and commodities) are likely to decline.

We saw something similar in 2008 when we had bankruptcy-driven liquidity problems – the USD Index soared sharply back then.

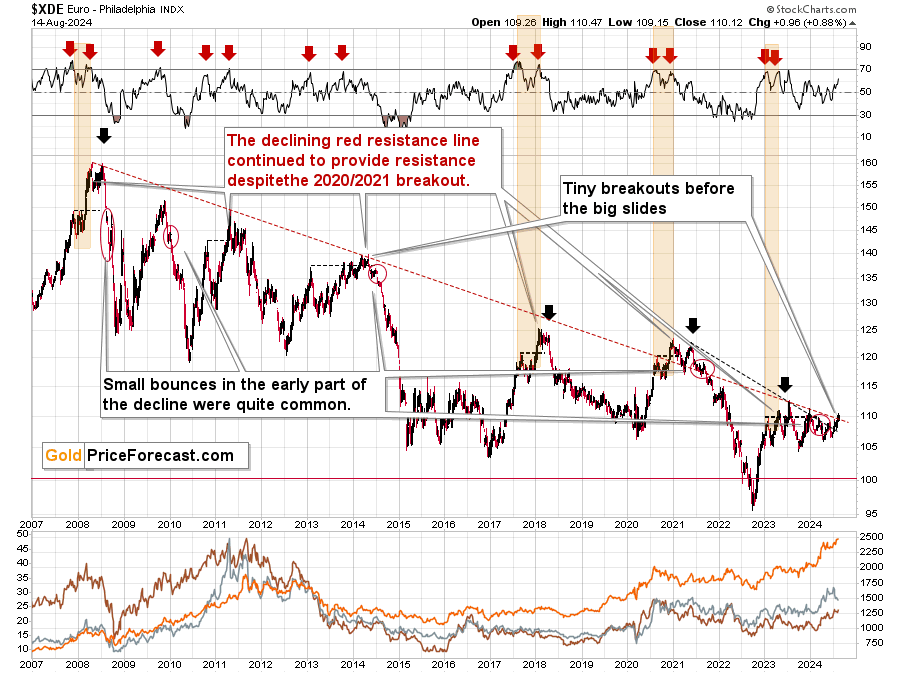

Moving back to charts, the key component of the USD Index – the euro – remains in a long-term downtrend, and it appears to be ready to move lower once again.

What may look like a bullish breakout on euro’s short-term chart, is just a tiny move above the declining, red resistance line. All previous breakouts (2014, 2020/2021) were invalidated and followed by declines.

Is this time any different, or is the history about to rhyme? The latter tends to happen much more frequently in the markets. Consequently, the odds are that the euro will decline and the USD Index will rally.

And since big moves up in the USD Index (unless triggered by serious geopolitical turmoil) lead to big moves down in the precious metals market, we have yet another reason to expect a bigger decline in the precious metals market in the following weeks.

This is regardless of any short-term price moves that we saw or may see this week.