Investing in precious metals such as gold and silver once again grabbed investors’ attention following the global stock market sell-off on Tuesday sparked off by political instability in Greece and the announcement of snap presidential elections along with renewed fears surrounding global economic growth (read: Greece ETF Crashes as Political Uncertainty Returns).

Additionally, a stronger U.S. economy and the recent cautious comments by U.S. Federal Reserve officials have bolstered the case for an earlier-than-expected interest rates hike, leading to a decline in dollar for the fourth consecutive session and support to gold prices.

Persistent decline in oil prices, slowdown in China, and continued weakness in Euro zone and Japan added to the global stock woes. While weak energy prices generally dull the metal’s appeal as a hedge against inflation, the rising risk environment is resulting in a flight to safety and increased demand for gold as a store of value. Moreover, most economies across the globe are seeking lose monetary policies compelling investors to turn their focus on gold.

The safe haven demand and short covering are the main reasons for the recovery in gold prices, which hit four-and-a-half-year lows last month. The trend is more pronounced given that the ultra-popular SPDR Gold Trust (ARCA:GLD) has seen inflows of over 37 million over the past two days, bringing its total asset base to $28.5 billion (read: Gold ETFs Dip on Swiss Vote, Will India Save the Yellow Metal?).

The risk off trade is also driving silver prices higher, as the white metal is regarded as a store of wealth and an alternative investment to risky assets during economic and political uncertainty. Additionally, silver has become extremely cheap after declining for three years and rising industrial applications bode well for the metal’s demand.

This is especially true as silver industrial demand is expected to grow 27%, adding 142 million ounces of silver demand through 2018 compared with the 2013 levels, as per U.S. Mint. Additionally, the report showed that American Eagle silver bullion coins sales have reached 42.37 million ounces year to date, slightly lower than the historical high 42.68 million ounces sold in 2013.

The bullish trend in the two precious metals are likely to continue at least in the near term especially if the combination of low oil prices and slumping stock markets promote investor risk aversion or new sovereign risk concerns flare up. Given this, both gold and silver ETFs have seen smooth trading over the past two days.

Silver Outshines Gold

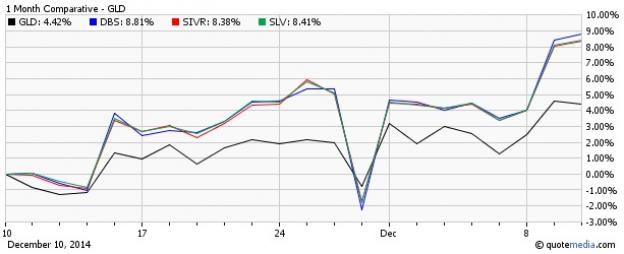

In fact, silver has an edge over the gold as the white metal is used in a number of key industrial applications, which are increasing with stepped-up domestic economic activity. Silver ETFs are clearly outperforming gold from both a five-day and a one-month look, adding over 4% and 8%, respectively, compared to gains of 1.4% and 4.4% for GLD. These products also have a Zacks ETF Rank of 2 or ‘Buy’ rating, suggesting their continued outperformance in the coming weeks.

iShares Silver Trust (ARCA:SLV)

The fund tracks the price of silver bullion measured in U.S. dollars, and kept in London under the custody of JPMorgan Chase Bank. It is the ultra-popular silver ETF with AUM of over $5.6 billion and heavy volume of nearly 7.5 million shares a day. It charges 50 bps in fees per year from investors.

ETFS Silver Trust US (NYSE:SIVR)

This fund has amassed $303.8 million in its asset base while trades in moderate volume of more than 100,000 shares per day on average. It tracks the performance of the price of silver less the Trust expenses and is backed by physical silver under the custody of HSBC Bank USA in London. Expense ratio came in at 0.30%.

PowerShares db Silver Fund (NYSE:DBS)

This product provides exposure to the silver futures market rather than spot market and tracks the DBIQ Optimum Yield Silver Index Excess Return index, before fees and expenses. It is unpopular and illiquid with AUM of $21 million and average daily volume of less than 8,000 shares, increasing the total cost for the fund in the form of wide bid/ask spread. DBS is the high cost choice in the silver bullion space, charging 79 bps in fees per year from investors.

Bottom Line

It is clear that buying pressure has been intense for silver compared to gold and that the most recent trend is extremely favorable for the commodity given the decline in dollar, global economic woes, and political uncertainty. Additional buying could be in the cards for the space should oil prices stabilize or tensions in Greece escalate.