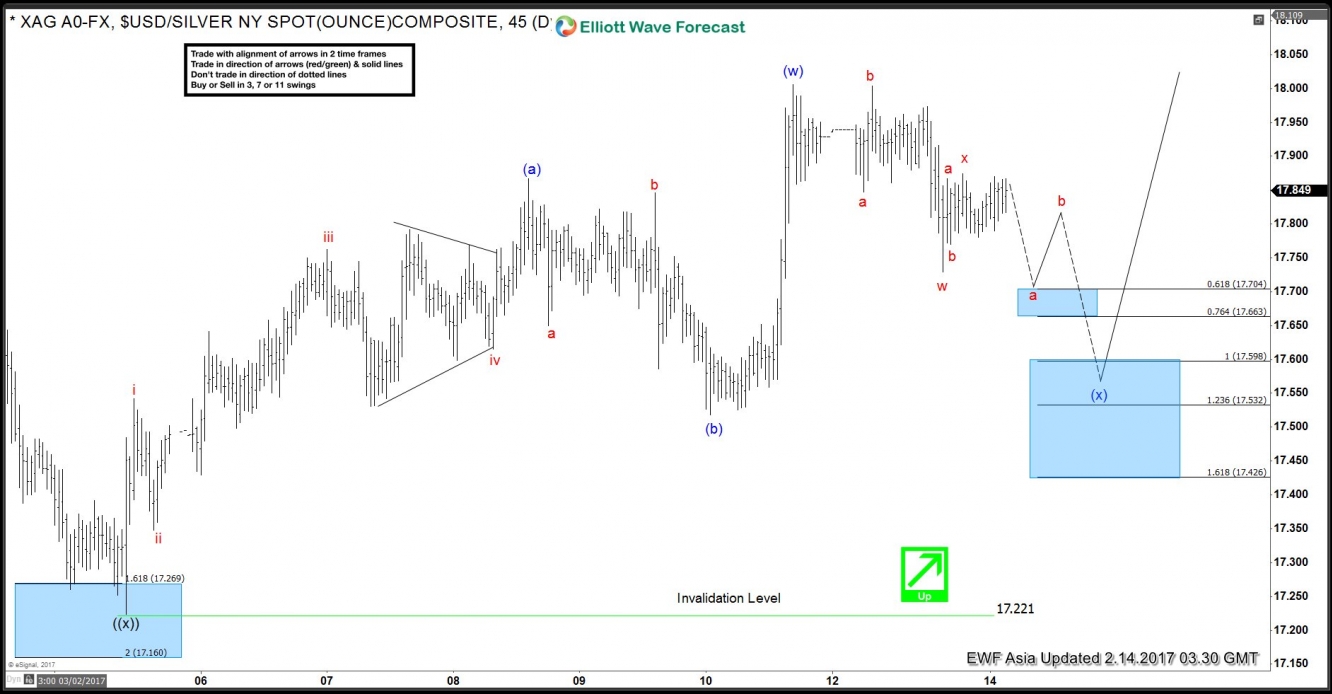

Preferred Elliott wave view in Silver suggest that the metal is showing the 7 swings bullish sequence from 12/20 lows, Also the cycle from 1/27 low is incomplete and favoring more upside extension towards 18.31-18.71 area to reach the extreme from 12/20 lows.

Silver short term the pullback in minute wave ((x)) ended in 3 swings at 17.22 low. Up from there cycle ended in 3 swings as zigzag structure (5,3,5) at 17.985 in minutte wave (w), where within that cycle minutte wave (a) ended at 17.84 and minute wave (b) at 17.51.

Below from 17.985 peak metal is correcting the cycle from 17.22 low in minutte wave (x) pullback as double correction, where it has ended the sub minutte wave w at 17.73 and sub minutte x at 17.85 peak. And should be looking lower initially towards 17.70-17.66 area to see a sub minutte bounce in wave b. Afterwards it is expected to trade lower towards 17.59-17.42 equal legs area from 17.985 peak within sub minutte wave y lower before metal resumes the upside or bounces in 3 swings at least to correct the cycle from 17.985 peak.

Silver 1 hour chart