The price of silver has been crushed during the last four years. Prices are ready to reverse. We will know soon enough after the High-Frequency-Traders have their way with prices for paper silver and gold on the CME.

But consider:

- Gary Savage has declared that “Gold is Now a Buy.”

- The US Dollar peaked in March and has been slipping lower since then.

- Gold peaked four years ago. Silver peaked four years and three months ago. Both are due for a rebound.

Is there anything specific regarding silver, or is it just “hope and change?” Yes!

- Daily charts (not shown): Silver hit its low about 2 weeks ago and has weakly rallied since then. Most oscillators show that silver prices are deeply oversold and that momentum has turned upward.

- Weekly charts (not shown): Silver prices have closed higher for the last two weeks, and like the daily charts, oscillators are oversold and turning higher.

Anything more? Yes! Long term cycles indicate that silver has finally made a major bottom. I have little faith in short term cycles because prices are so easily manipulated by HF-Traders, but longer cycles are more difficult to manipulate, and more meaningful. When longer cycles align with other confirming evidence, it is significant.

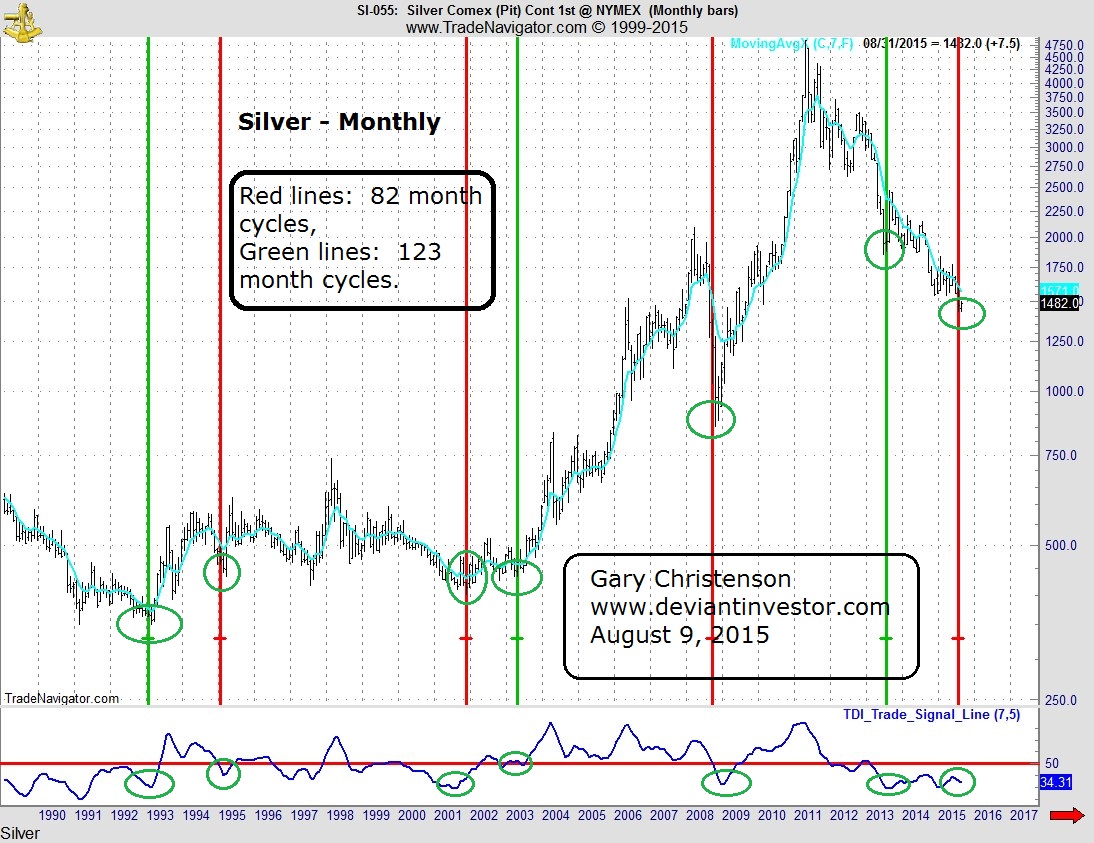

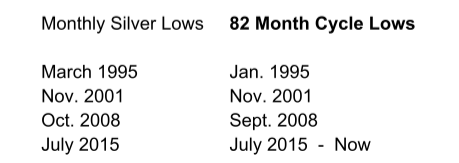

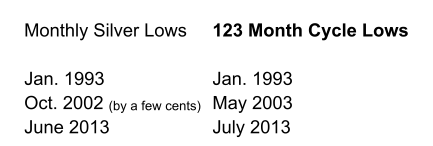

Note the following chart showing monthly silver prices back 25 years to 1990. All major lows in silver prices have been indicated by two long cycles – 82 months and 123 months (82 months times 1.5). The red vertical lines show the 82 month cycles and the green vertical lines show the 123 month cycles.

We could discuss whether the cycles are relevant or not, or if they should be 82 and 123 months, or less or more, but I see the following:

When two cycles can point to every major low since 1993, they have value.

The 82 month cycles point to a low in July or August of 2015 – NOW.

Daily, Weekly, and Monthly oscillators indicate over-sold conditions and that the silver (and gold) market is due to rally. These confirm a silver cycle low for July – August 2015.

At other 82 month cycle lows prices have rallied a little or a lot depending on other factors, so a cycle low is NOT a guarantee of substantially higher prices ahead.

But given the last seven years of QE, ZIRP, other monetary manipulations, substantially increasing investment demand for silver, and insane debt levels that inevitably will increase further, it looks like a major low has been reached in silver.

By the way, the next MAJOR silver lows, based on the 82 month and 123 month cycles are due about mid-2022 and late 2023.

What about cycle highs? I see a 94 month cycle in silver highs that might be significant. Note the silver highs in January 1980, 1987, 1995, 2003-04, and 2011. The next high cycle, based on this progression, is due approximately 2019.

Assume that:

- A major LOW in silver has occurred in July 2015 or will occur soon.

- A potential cycle HIGH in silver is due in approximately 4 years.

War cycles indicate a substantial increase in global conflicts for the next five years. (Larry Edelson and war cycles) Consumer price inflation, higher silver and gold prices, increasing debt, and increasing war cycles trend together.

In the long term, silver prices trend with US national debt, which we can all agree will continue to grow much larger.

Silver lows are due in 7 – 8 years, which allows considerable time for prices to spike higher in 2019 – 2020 before they drop into cycle lows in 2022-23.

There are many reasons for silver to rally substantially from here and possibly two for silver prices to stagnate or continue to fall – global deflation and recession/depressions via crashing economies. But, do you believe that central banks and governments will not fight deflation and recession with every “printing press” available? In that scenario, I think money supply and debt will accelerate higher along with silver prices.

CONCLUSIONS

Silver is at or very near an intermediate bottom and an 82-month cycle low.

Long term cycles indicate another high is due in about four years – plenty of time for silver to rally far higher.

Fiscal policy and monetary policy – spend and “print” – support much higher prices for silver.

Even global recession and global deflation are likely to force much more QE and “money printing” to bail out banks, the economy, and governments, and that will push silver prices higher.

Stack silver and trust that your governments and central banks will devalue their currencies, which they do so effectively.