Silver has been much weaker than gold for the past nine years. Is that trend about to change? A short-term change is possible.

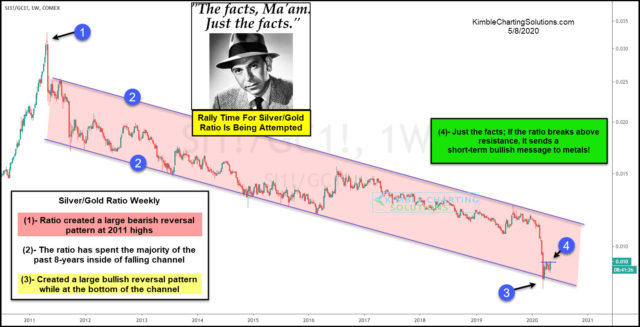

This chart compares the price of silver to gold over the past decade. At the 2011 highs, the ratio created a bearish reversal pattern at (1). Since creating that pattern, silver has been much weaker than gold.

Silver currently is 60% lower than its 2011 highs, while gold is around 8% lower.

The ratio has created a series of lower highs and lower lows inside the falling channel (2). While testing the bottom of the channel a few weeks ago, the ratio created a bullish reversal pattern at (3).

The trend remains down at this time and a couple of weeks of positive action has not changed the trend. If the ratio breaks out at (4), it suggests that silver could be stronger than gold for the short-term, which historically is bullish for both metals.