Traders flipped to net-long exposure on Silver 3 weeks ago. Whilst it’s currently facing selling pressure, we’re looking for key levels above $15 to hold and confirm a bullish flag pattern. Silver was pushed down to an 8-day low in light of improved risk appetite, yet we’re keeping a close eye on its bullish trend structure and suspect it could break to new highs in due course.

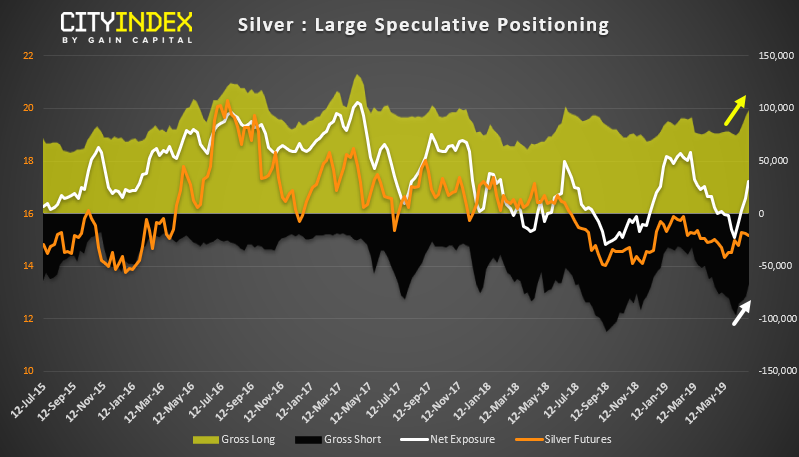

As noted in this week’s COT report, traders flipped to net-long exposure on Silver 3 weeks ago. At 30.5k contracts long, it’s the most bullish traders have been on the metal since mid-March, and the past four weeks has seen a steady increase of long positions and decrease of shorts.

However, prices are under pressure given the lift in sentiment around the G20 meeting which has forced Silver down to an 8-day low earlier in the session. Still, the trend structure remains bullish and we suspect bulls will look to build a base above $15, which is also around the 100-day average. Assuming downside is limited from here, we’d then want to see bullish momentum return before assuming a break to new highs.