Silver cracked the $14 level in yesterday’s session but managed to recover prior to the close. Some of the recovery was aided by the retreat of the US dollar away from the magical 100 level basis the USDX.

As the dollar backed off from 100, silver rose back from its lows.

Unless we get some sort of data or further signals out of the ECB or the Fed, traders may be reluctant to really take the dollar through that tough resistance level of 100. That might buy the beleaguered silver bulls a bit of a respite.

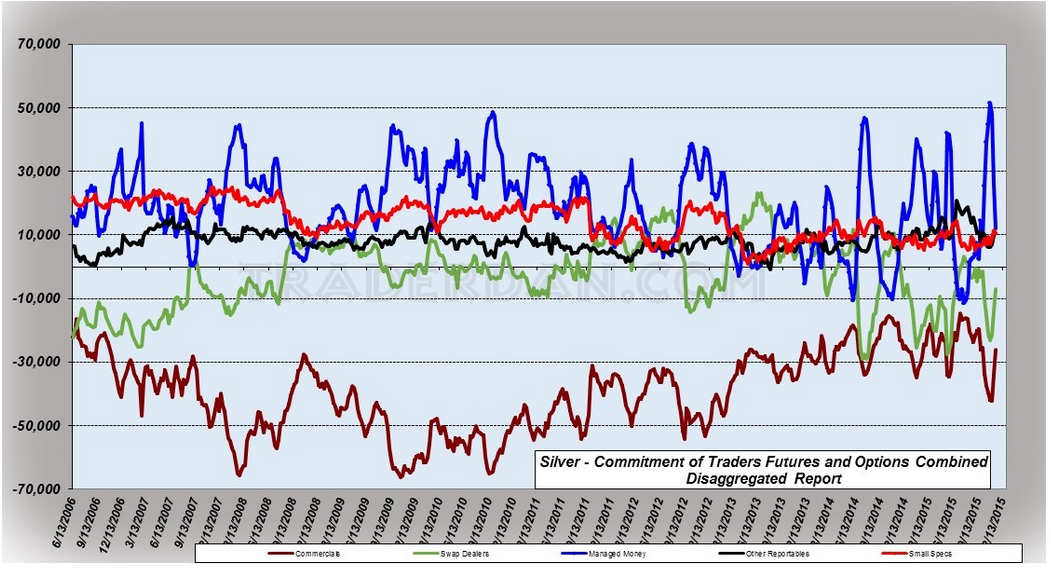

The problem that silver has unfortunately is that the speculative crowd, for some strange reason, remains bullish on the metal in spite of the fact that it has fallen 15% in price over the last few weeks.

In spite of this sharp fall, the specs REMAIN NET LONG, every single category, both large and small. Hedge funds are rapidly closing out those losing positions but they have been doing so from a record net long position, meaning that until we see some sort of stability in the metal, there is a lot more fuel for further selling.

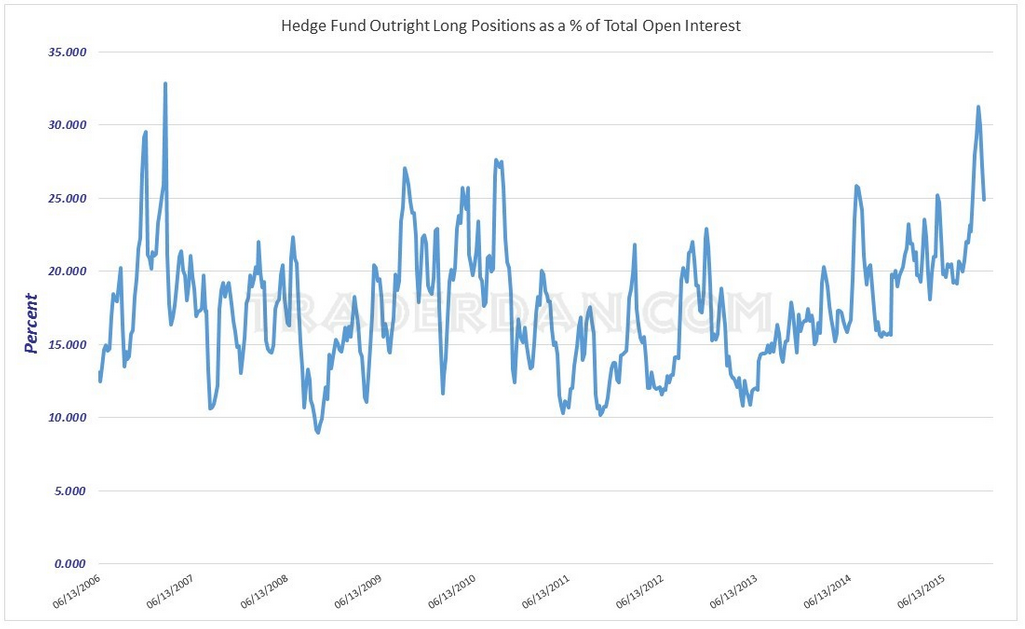

We know this by looking at the percentage of hedge fund long positions as a percentage of the total open interest.

As you can see, even after some strong long liquidation by the hedge fund category alone, this group of large traders remains inordinately exposed to the long side of the market.

If the Dollar Index manages a strong close into that resistance zone near 100 and especially if it shows no sign of backing down from that level once achieved, I fear a significant round of further long liquidation from the hedge funds will create a rather nasty mess of the silver market.

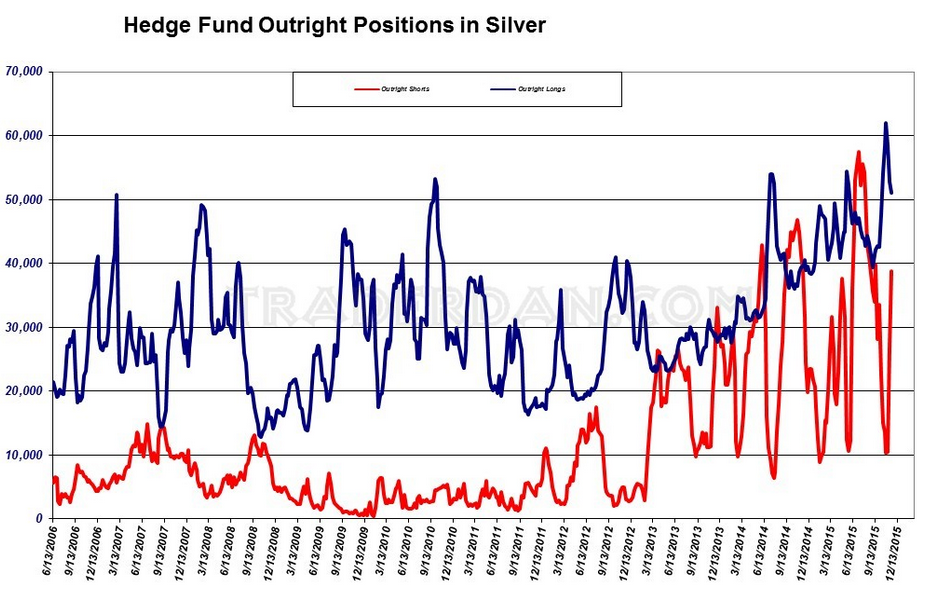

Here is another look:

They are certainly building up their once miniscule short side exposure to the market, but their long position remains quite sizable.

Back to the price chart however:

The market being oversold to this extent is perhaps the only bullish argument I can see for the metal at this time. That being said, it is hard for me to see a significant price recovery unless the dollar experiences some sort of sharp selloff.

Maybe the December payroll reading for November will be a dud and that will drop the dollar, but trying to anticipate what that number might, or might not, be is no different than flipping a coin.

The ADX line is solidly rising higher, approaching 30, the threshold we generally like to see for a trending market. This is why, in spite of the sharp fall in price over the last month, we cannot unequivocally state that silver is in a downtrend. It is still holding above the very bottom of the price range, near $14. However, if it does crash through that level and is unable to recover, the ADX should register a solid downtrend and would then be in place to take this indicator through the 30 level.

When one looks at the overall commodity complex as illustrated by the Dow Jones-UBS Commodity Index, you can see that yesterday’s session was the first session in 13 sessions in which a WHITE CANDLE was registered. That is how severe the selling has been across this asset class as a whole.

Traders seemed to use the retreat of the dollar away from that 100 level mentioned above to book profits on shorts not just in silver but in a wide number of other commodities as well. How long this short covering pop will last is uncertain.

Holiday-shortened trading weeks such as this Thanksgiving week are notorious for producing all manner of strange gyrations in markets, especially commodity futures markets as many large traders will close out positions or reduce them early and simply take the rest of the week off. With that sort of thing as a backdrop, oftentimes all it takes to produce some sharp moves is some smaller orders which normally would not be felt.

I am also reminded about what happened to crude oil last year during this same week. You might recall that OPEC had their meeting in Austria on Thanksgiving Day here when they announced NO PRODUCTION CUTS were going to be forthcoming. That was pretty much all she wrote for the oil markets as they have yet to come anywhere near to the price from which they fell when word spread across the newswires about the outcome of that OPEC meeting.

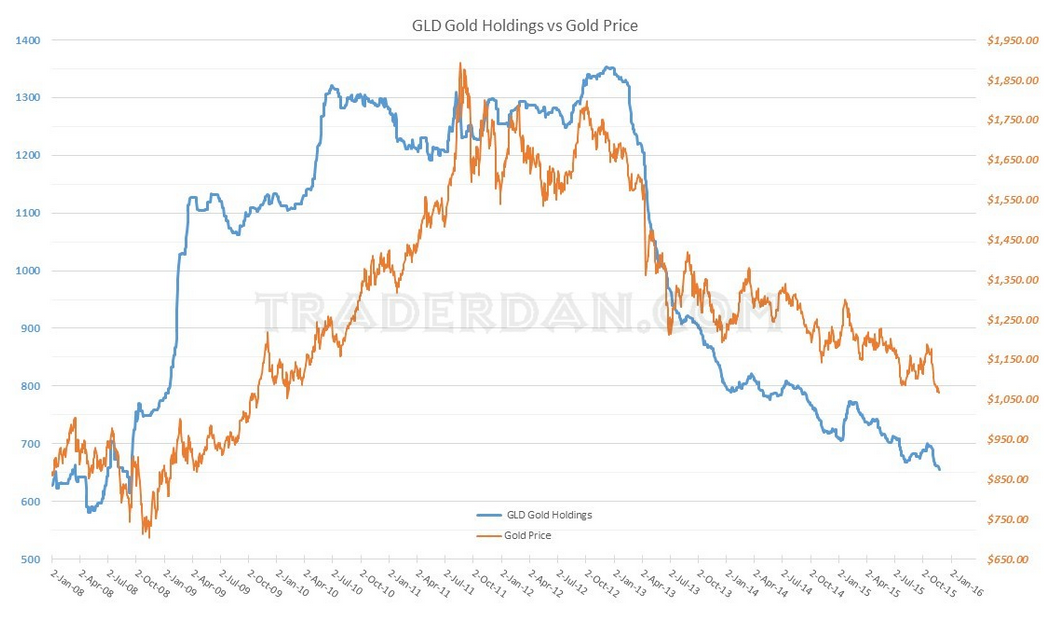

By the way,SPDR Gold Shares (N:GLD), the giant gold ETF shed yet another 5 TONS of gold yesterday. Reported holdings are now at 655 tons, remaining at levels last seen in September 2008. GLD has shed a total of 53.33 tons of gold since the beginning of this year.