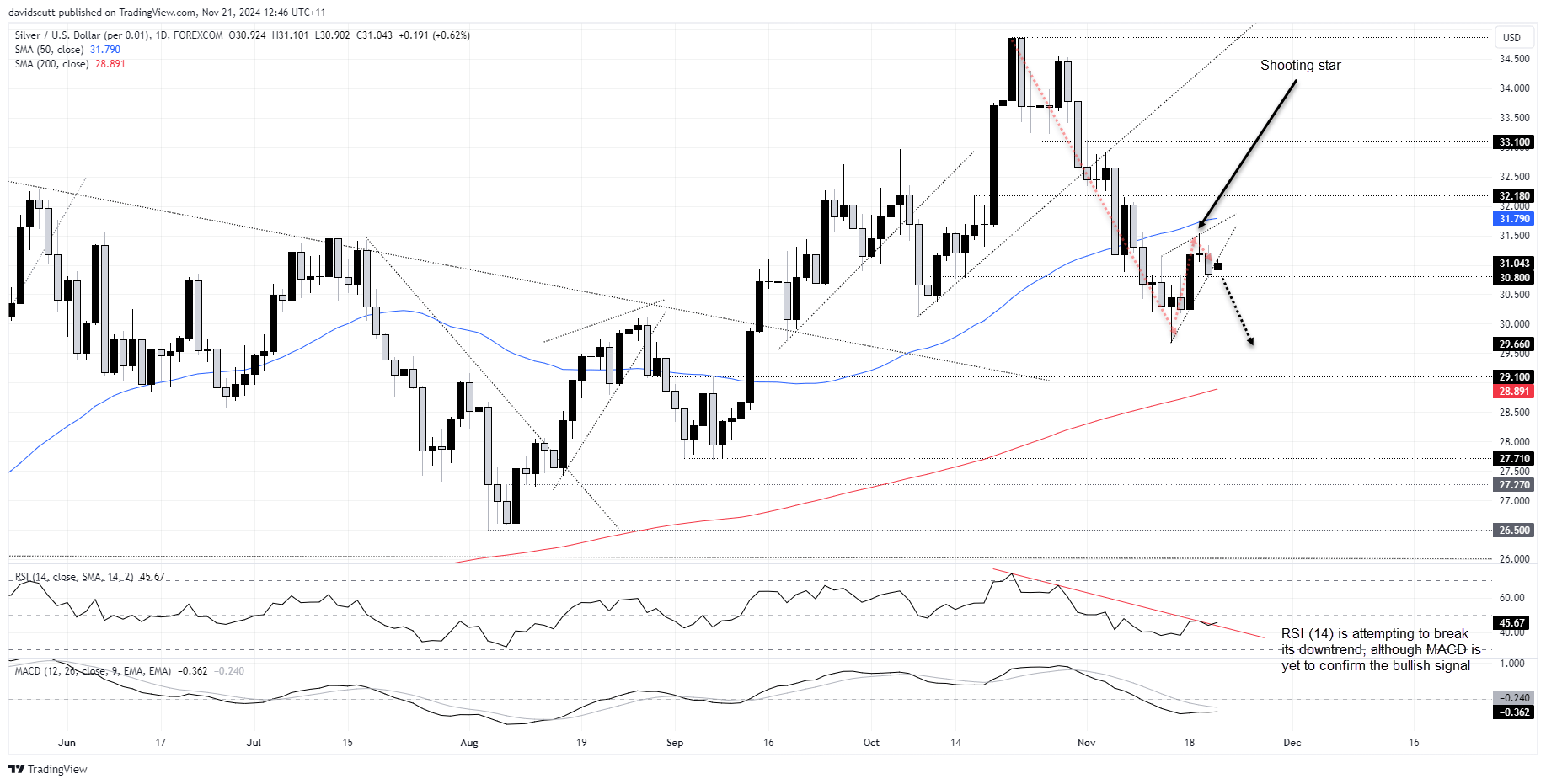

- Silver breaks pennant support; $30.80 key for further downside

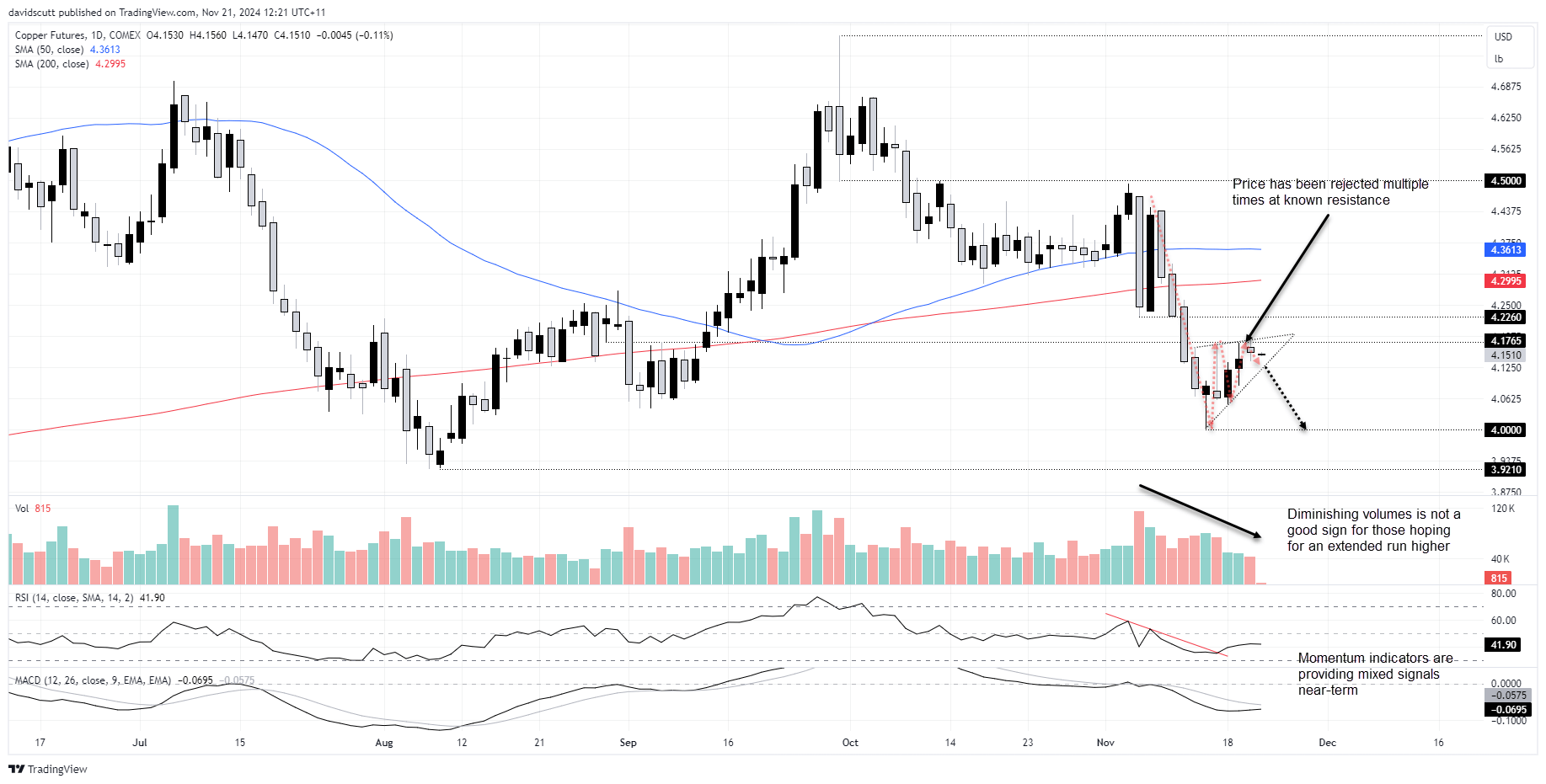

- Copper stalls near $4.176; bear flag warns of resumption of bear trend

- Mixed momentum signals; MACD lags RSI (14) on both metals

Overview

Silver and copper prices have stabilised this week after a prolonged bout of weakness. However, sitting in what looks to be bear pennant pattens, whether this period of tranquillity can last is debatable. Given the quiet macro calendar, we look at that price and momentum signals for clues on what may happen next.

Silver Slices Support; Bear Trend Resuming?

Source: Trading View

Silver may already be in the process of resuming its downtrend with the price breaking pennant support following a decent reversal on Wednesday. The move, coming despite big gains in gold, makes sense in the context of the shooting star candle that printed on Tuesday.

While some may be willing to short now in anticipation of a resumption of the bearish trend, I’d prefer to see whether the price can break and hold below $30.80 first. It’s acted as both support and resistance on multiple occasions in recent weeks, making it a near-term barrier in the way of downside.

If $30.80 were to give way, you could sell with a tight stop above targeting a return to $29.66, another level that has acted as support and resistance earlier in the year. The fact the price bounced so aggressively from it last week underlines its importance.

Momentum indicators are providing mixed messages near-term; RSI (14) is trying to break through the downtrend it’s been sitting in, although MACD has yet to confirm the signal

If the price were unable to break $30.80, the setup should be scrapped in favour of range trading or a possible push higher.

Copper’s Bounce Accompanied by Dwindling Volumes

Source: Trading View

Copper also looks to be trading in a bear flag, although it’s yet to break support. Like silver, momentum indicators are providing mixed messages with RSI (14) through its downtrend without being confirmed by MACD. However, volumes accompanying the bounce have been dwindling – not a great sign for those looking for a sustained push higher.

Overhead, the price has been rejected twice at $4.176 over the past two sessions, hinting we may be due some downside near-term. If pennant support were to be broken, you could sell with a tight stop above for protection. $4 would be an obvious trade target.

If the price were to break and hold above $4.176, the bearish bias would be nixed, opening the way for bullish setups.