I love the silver market. If you read my articles you can understand why, because when it comes to the technical side of things it loves to play along and has done so for some time.

In the current period silver has been going through a strong technical pattern of consolidation. This has been after a steep down trend over the previous months, where a lot of metal traders took full advantage of the situation. The reason for this down trend was the appreciation of the USD and the outlook remaining positive for the US economy – nothing keeps the speculators further away than a booming economy for a change.

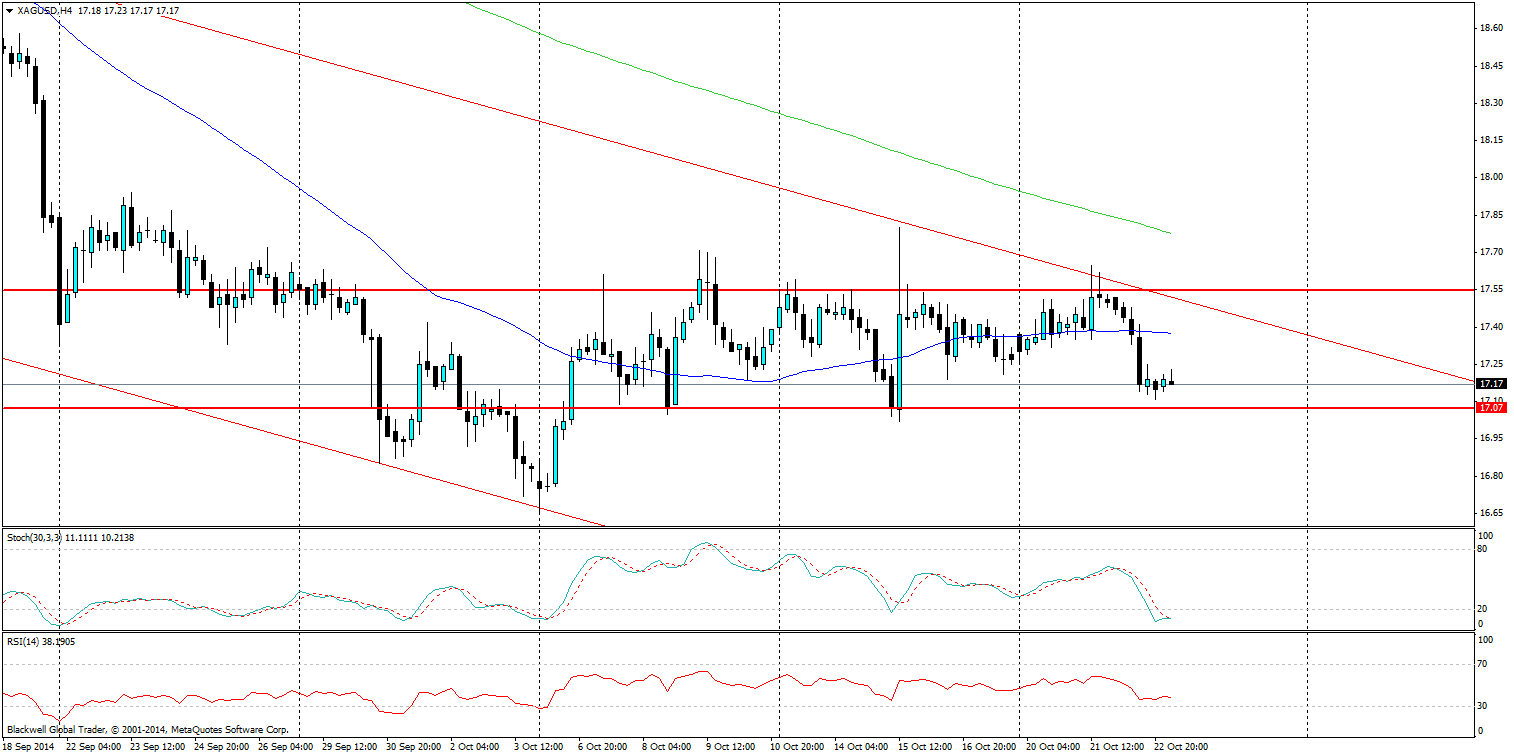

Source: Blackwell Trader (XAGUSD, H4)

With a ceiling at 17.55 and a floor at 17.07, the markets will be eyeing up the possibility of a fall below the 17.07 level, a solid bearish candle below this level could bring the bears back into the market to swipe down silver once more. This is not something that is unreasonable either when you think about it, despite some recent US woes the labour market and consumer sentiment is still very strong. The prospect of rates is ever more increasing as a result.

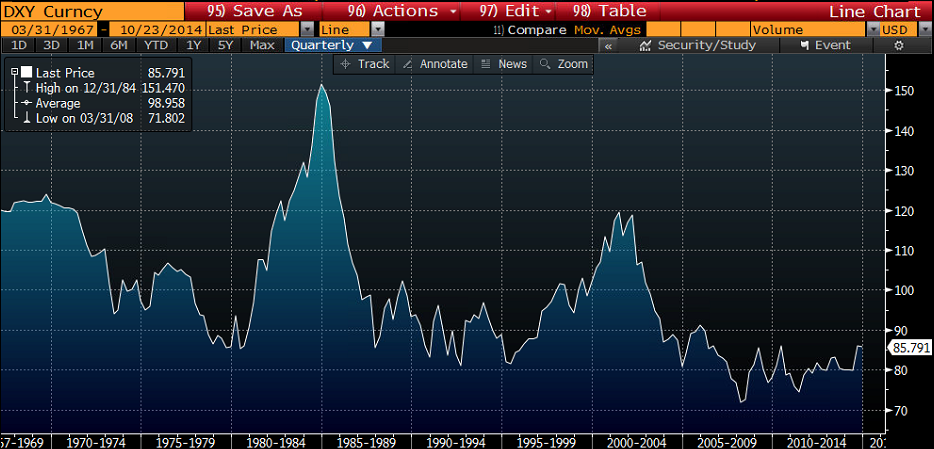

Source: Bloomberg (Dollar Index)

To put it in an even better perspective long term; we have seen the dollar index well below its average against other trade weighted indexes. This is unlikely to remain the same in the long term as other currencies look to devalue themselves in an effort to stimulate their economies. In the long term metals will likely fall against the US dollar as a result

Overall, silver in the long term looks likely it will drop further and it is just a matter of time. In regards to justification, I look fundamentally to the US dollar strengthening and demand for precious metals tapering off further. From a technical point of view we have seen silver consolidate a few times before a large drop, and this looks no different.