Silver has been down in the dumps recently as the outlook for US interest rates pointed to an imminent rate rise. The situation has evolved slightly, thanks to recent comments from an FOMC member, and the precious metal has come charging back up the charts.

Federal Reserve Bank of Atlanta President Dennis Lockhart yesterday gave his thoughts on the upcoming FOMC meeting and whether interest rates will rise. He has previously turned from dovish to hawkish, so the market was expecting more hawkishness from the man. He delivered to some extent, suggesting that the Fed was ‘close’ to raising interest rates (read: September). This gave the market little to get excited about as essentially he said the same thing last week and the picture is still not clear enough.

The real change, and what got the Silver bulls excited, were his comments on the pace of rate rises. He said that inflation will be important on setting the pace for rate hikes once they start to rise. He also said he sees the pace as gradual, meaning that there will be less than one hike per meeting.

Reading more into this and it’s easy to see why Silver has turned bullish. I believe we can expect a rate rise when the Fed meets on September 17th and the market has more or less priced this in. This will give the Fed some wiggle room if conditions deteriorate and it will take some heat out of the equity bubble.

But thereafter, the Fed will look to inflation to set the pace of rate rises. With inflation low thanks to commodity prices, it’s likely that this pace will be much slower than the market had been hoping for. It would be a hard sell for the Fed to raise rates at a quick pace if inflation is still hovering around the 0% area where it is currently.

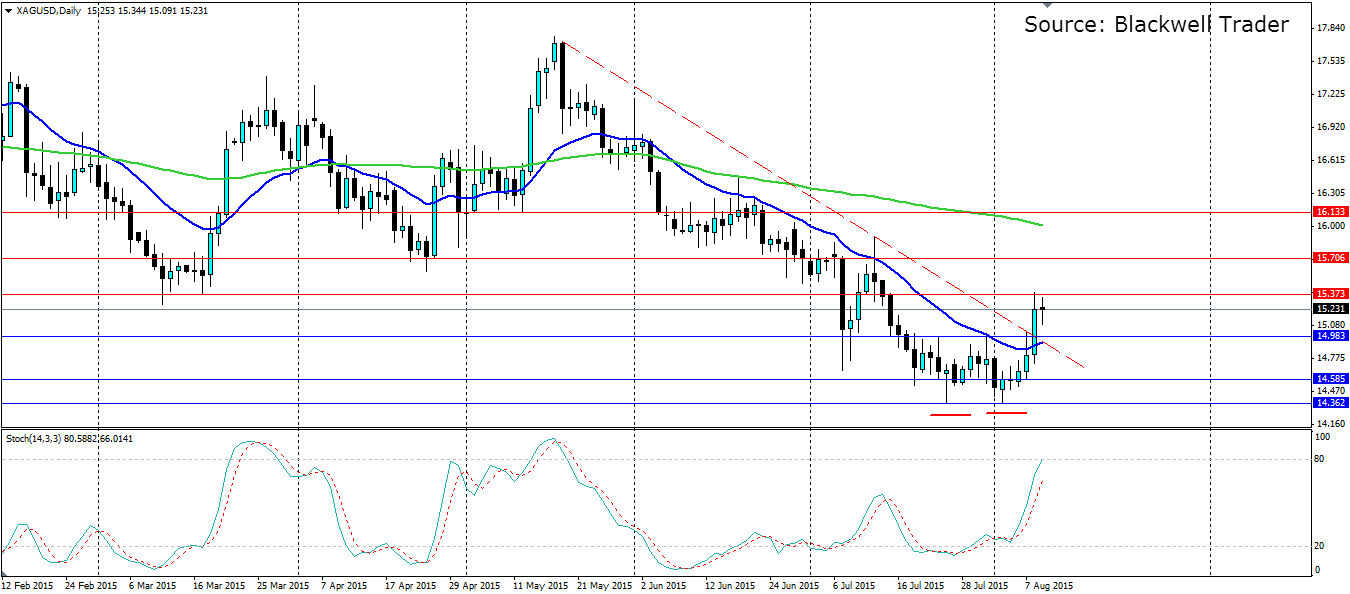

This is what stoked the Silver market. The prospect of fewer rate rises than expected over the next 12 months makes Silver a relatively more attractive investment, so it’s no surprise to see a 3.1% jump in the price. A double bottom on the daily chart looks to signal the start of a solid bullish push after a three month bearish trend. Look for support to be found at 14.983, 14.585 and 14.362 while resistance is found at 15.373, 15.706 and 16.133.

The fundamental outlook for Silver is a little rosier than it was a week ago, thanks to the expectation that interest rate rises may come at a slower pace than expected. It has given the silver bulls something to cheer about and could lead to a solid push higher.