When the U.S. market begins trading on Monday, the first day of June, it could be very interesting for the Silver price. Why? Well, the silver price closed right at an important technical level on the last trading day of May. More importantly, the silver price closed just a few cents shy from the highs for the month. This could be very bullish for traders, depending on where silver trades during the Asian market on Sunday night.

According to Stockcharts.com, the silver price increased more than $3.50 in May, up a healthy 23%. I wrote about the technical levels for the silver price in my newest video, WARNING: Economic & Market Depression, Precious Metals Bull Market. On Thursday, May 28th, the silver price closed at $17.97. The chart below is a “Monthly Chart,” so the candlesticks represent one month of trading.

I stated in the video, that once silver closed above the $18.50 level, on a monthly basis (at the end of the month), it would be a positive sign for silver. Then it could quickly jump up to the $21 level. You will notice that During 2013 and 2014, $18.50 was acting as a SUPPORT LEVEL, and since 2017, it was behaving as a RESISTANCE LEVEL.

Now, let’s look at the same chart on the close of Friday, the last trading day in May:

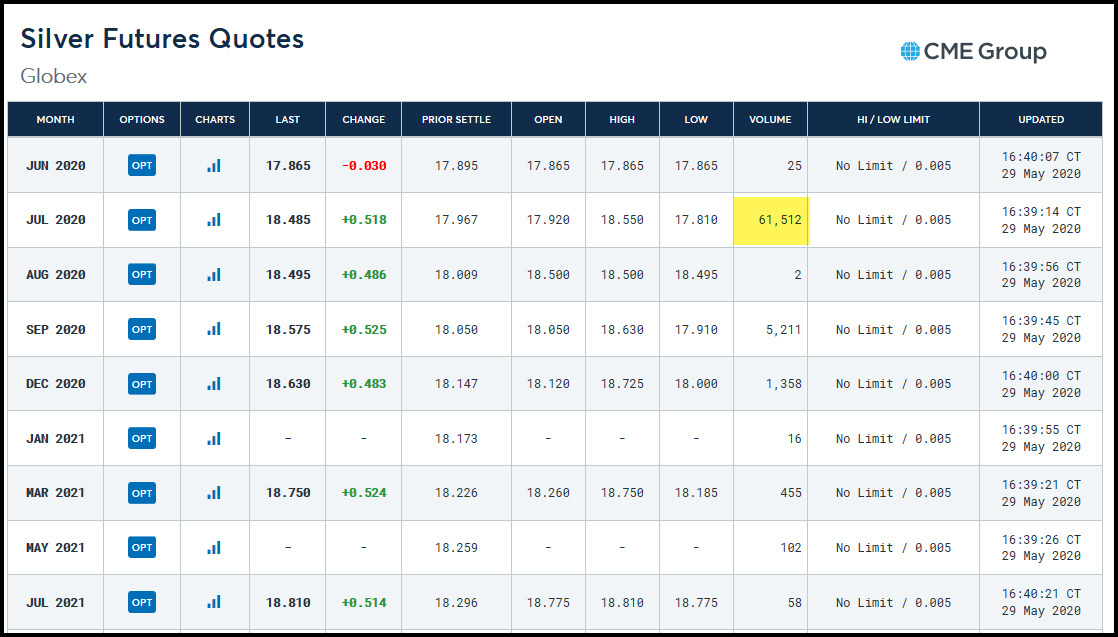

The silver price surged right up to the $18.50 level and closed the month just a few cents near the high. Some of you may be asking, “Why is this silver price shown on Stockcharts and Investing.com different from Kitco.com which closed on Friday at $17.85. Kitco.com is posting the most current silver futures contract of June, while other chart quoting services are going by the much more heavily traded July contract.

If we look at the SILVER CHART OF THE WEEK again, there are several important factors to consider:

Important Trading Factors to consider:

- The May candlestick closed just a few cents near its high of the month. This is very positive for traders. Typically, a close at the high or very near the high suggests the trend will continue.

- If silver starts trading above the $18.50 level on Monday (10-20+ cents higher), that could also be very positive for the price as the RESISTANCE LEVEL may become the SUPPORT LEVEL. We will have to see how trading resumes during the first week of June.

- If the silver price continues higher in the first few trading days in June, it may continue to the next technical level of $21

So, I am really looking forward to the early Asian trading Sunday night. Again, if silver GAPS up 10-20 cents and continues in the U.S. market, this could be very positive for the silver price. If silver opens higher but sells of down to $18.20-$18.30, it could be setting up for a short-term correction before resuming its upward trend.

REMEMBER: This is just focusing on technical analysis that most traders look at when placing their bets. If silver does jump above the $18.50 level, it will signal more traders to come in and join the upward trend. Even though paper trading controls the current price of silver, I believe in the future that price discovery will transition to “Physical demand.”