Silver has come under serious buying pressure overnight, much to the delight of silver bulls in the market. As the US dollar sell off hit full steam overnight as the markets tossed and turned over heavy volatility. This in turn led many to run in the markets to find some sort of safe havens and they moved sharply as a result.

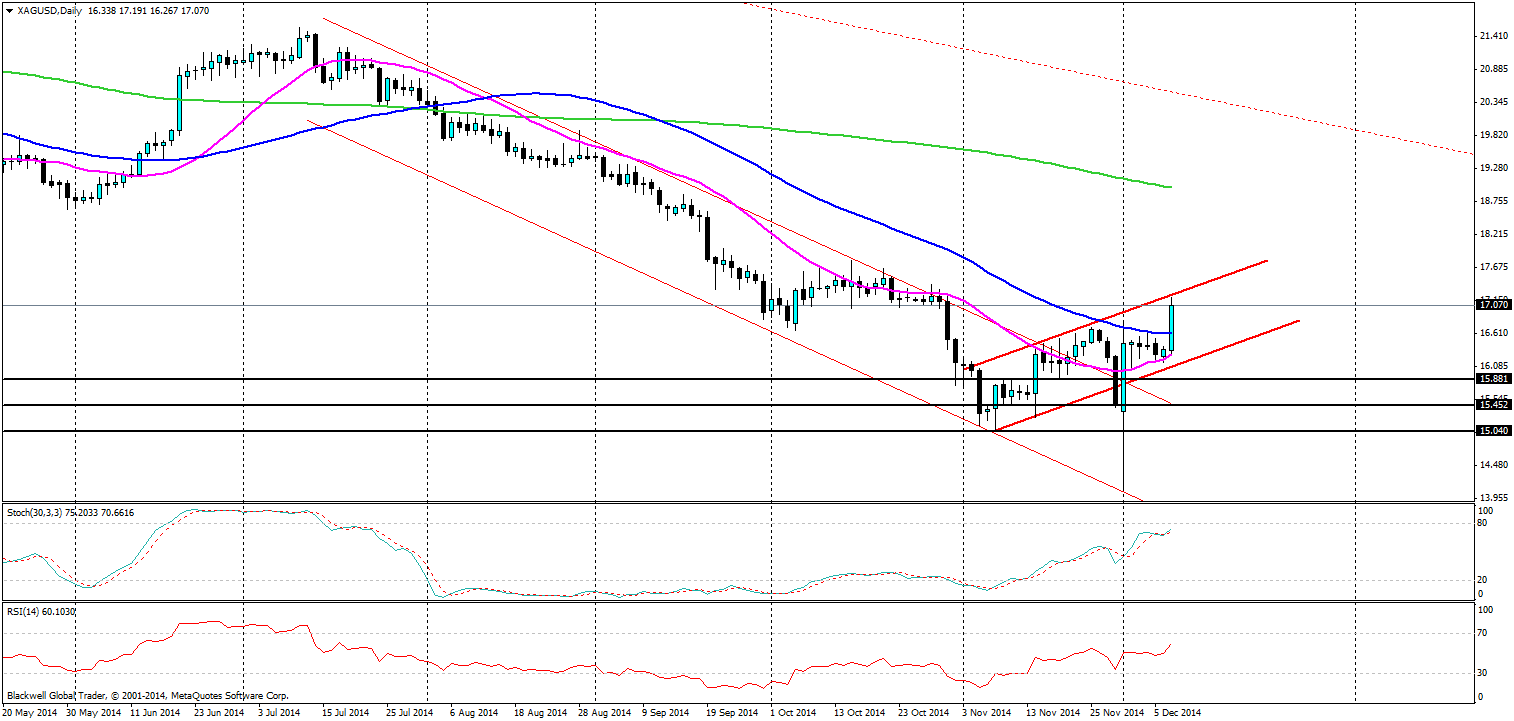

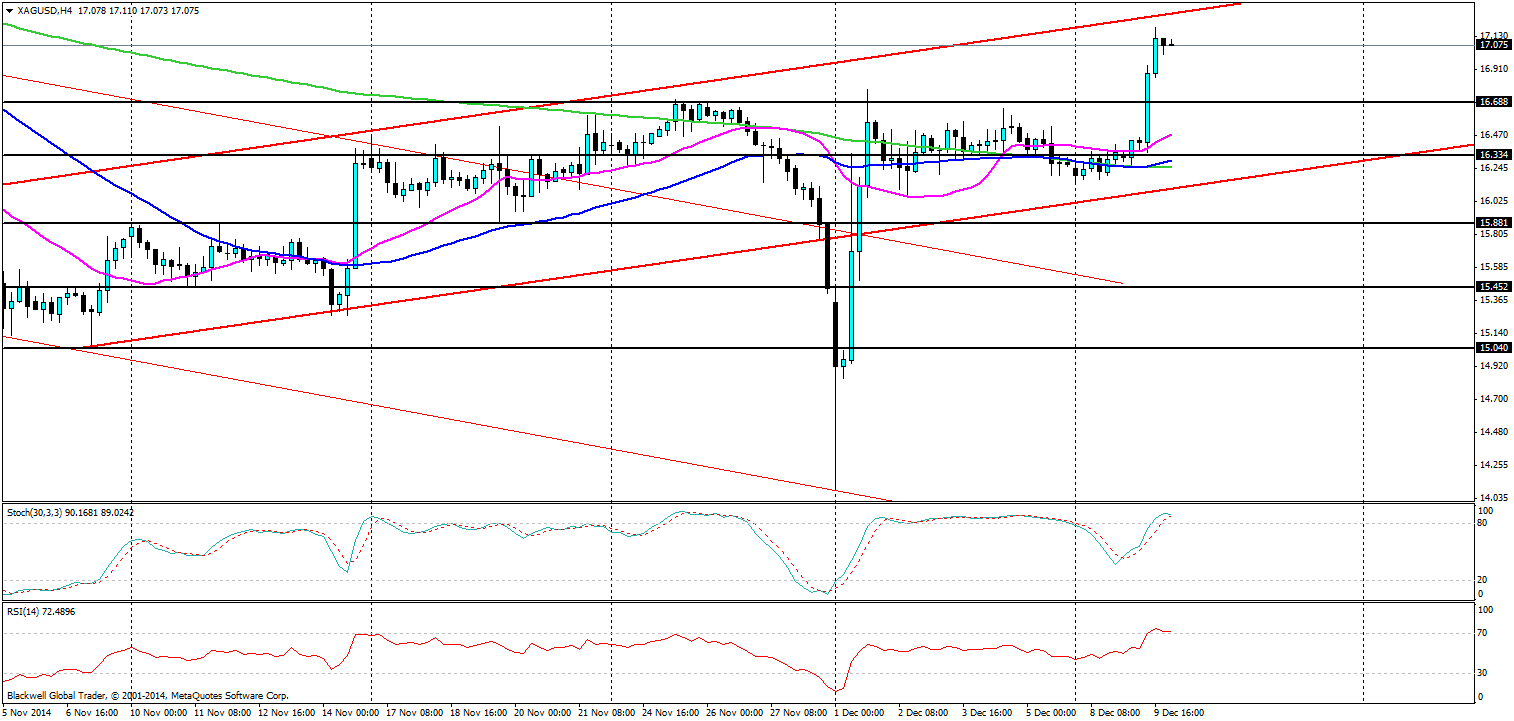

While the fundamentals are hit and miss at the moment, there is certainly cause to pay attention to the technical aspect of silver on the charts. At present we have a possible channel that has formed – if not a channel, then a bullish trend line at least. When we go to a smaller time frame the market movements become more apparent.

On the silver chart, we have seen large movements higher followed by trending markets, which play between key ranges. This set up looks likely to continue in the market at present. However, long term, it’s likely we will see strong plays on the charts in a bullish manner.

A quick glance back at the daily chart shows that the 20 day MA has shifted upwards and is starting to look bullish for a change. Markets ranging lower should look to use this as dynamic support and if we do have a breakdown before the bottom channel level I would target the levels at 16.688 and 16.334 where the markets will find liquidity and support.

Despite this trend upwards, I believe that silver is a good trade during prime metal trading hours, and we should see ranging between the given levels and channel with large movements during strong news events, so pay attention otherwise the markets may catch you out.