We saw divergence yesterday between stocks and precious metals – with the former struggling as a result of more euro fears, while the latter rallied higher; the gold and silver selling at the end of last week once again tempting bargain hunters into precious metals. The US dollar also gained as a result of “safe haven” bids – with the EUR/USD dropping to a low of $1.247 before recovering. The Dollar Index gained 0.29% to settle at 82.50. PIIGS debt again sold off following Spain’s formal request for a bank bailout, with strong bids for German Bunds, US Treasurys, and to a lesser extent UK Gilts.

Today is expiration day for Comex silver options, which might have had something to do with the weakness seen in silver at the end of last week. However, there were strong bids for the “poor man’s gold” yesterday afternoon which took the price up by around 75 cents in a matter of minutes. This has lifted silver away from its dangerzone around $26, and confirms the decent buying support that exists for silver below $27.

Trader Dan highlights the correlation between the Continuous Commodity Index (CCI) and the silver price. Silver’s industrial component has been acting as a drag on the price in recent months (given the generally weak business sentiment). Silver is also much more reactive to inflation expectations than gold. Given that inflation has been trending sideways to lower in major economies this year, again, it’s not so surprising that silver hasn’t regained the kind of upward momentum we saw during late 2010/early 2011, when the Fed’s QE2 programme was raising inflation expectations and pushing hot money into commodities.

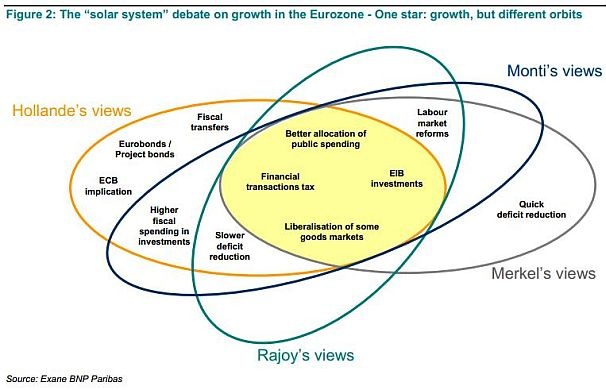

Changing tack slightly, and as part of the run-up the Thursday and Friday’s crucial European Council meeting, BNP Paribas has put together the ingenious chart below showing eurozone leaders’ policy preferences for tackling the continent’s debt crisis. The common ground is easily spotted.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Silver Buying Support Below $27

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.