The charts for Silver have been looking very bullish as of late, and this has been on the back of major uncertainty across the board for all markets.

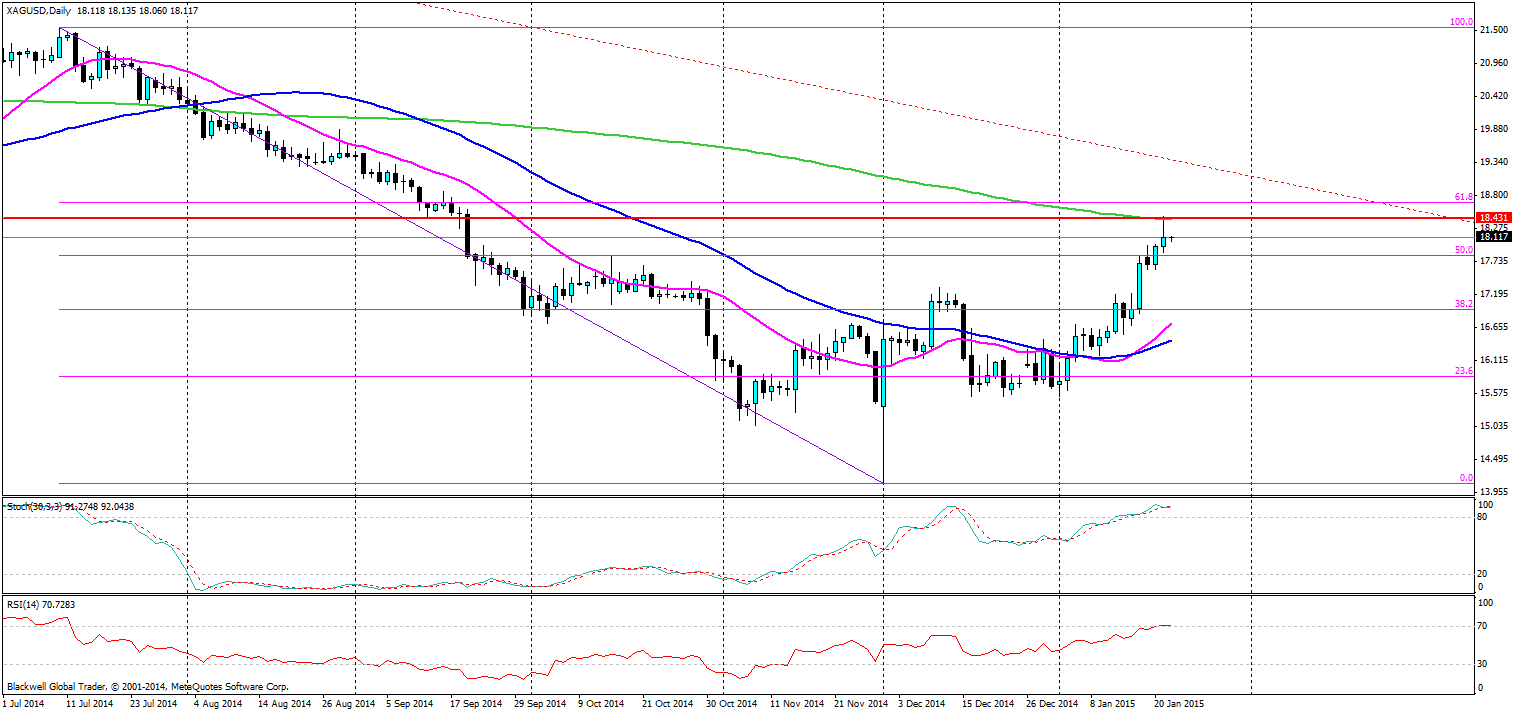

(Source: Blackwell Trader Silver, D1)

With the ECB decision today there are a few key levels to watch here for silver market players. The first one is the resistance level which also has the 200 day MA on it at 18.431. The market is currently viewing this as a strong level and tonight we may see another push on this level if there is still more uncertainty. Certainly the combination of the 200 day MA and the resistance level are leaving bulls cautious.

Additionally, we have heavy pressure on the indicators as both the Stoch and RSI are currently showing being overbought on the charts. That should be no surprise as it looks to be a trending market at present. However, this resistance level is looking tougher than expected and a pullback of it is possible as currently we are in a 5th leg up the charts.

If you’re looking to catch silver if it does pullback just be careful of volatility tonight as it can whip around quite nastily. I would look to catch it much lower with a sell stop just below the 50.0 fib level. If we see silver charge through the 200 day MA and 61.8 fib level I would expect to see the markets move aggressively into a more bullish phase.