- Silver breaks stubborn resistance at fifth attempt, hitting 2025 highs

- Momentum indicators support further upside

- Gold correlation strong and strengthening, offering additional trade filter

Summary

Silver (XAG/USD) has spiked to seven-week highs after bulls rolled over offers layered below $31 at the fifth time of asking. With no clear correlation to other asset classes beyond Gold (XAU/USD) over shorter timeframes, traders assessing the topside break may want to lean more on price and momentum signals than usual.

Silver Bulls Roll Over Resistance

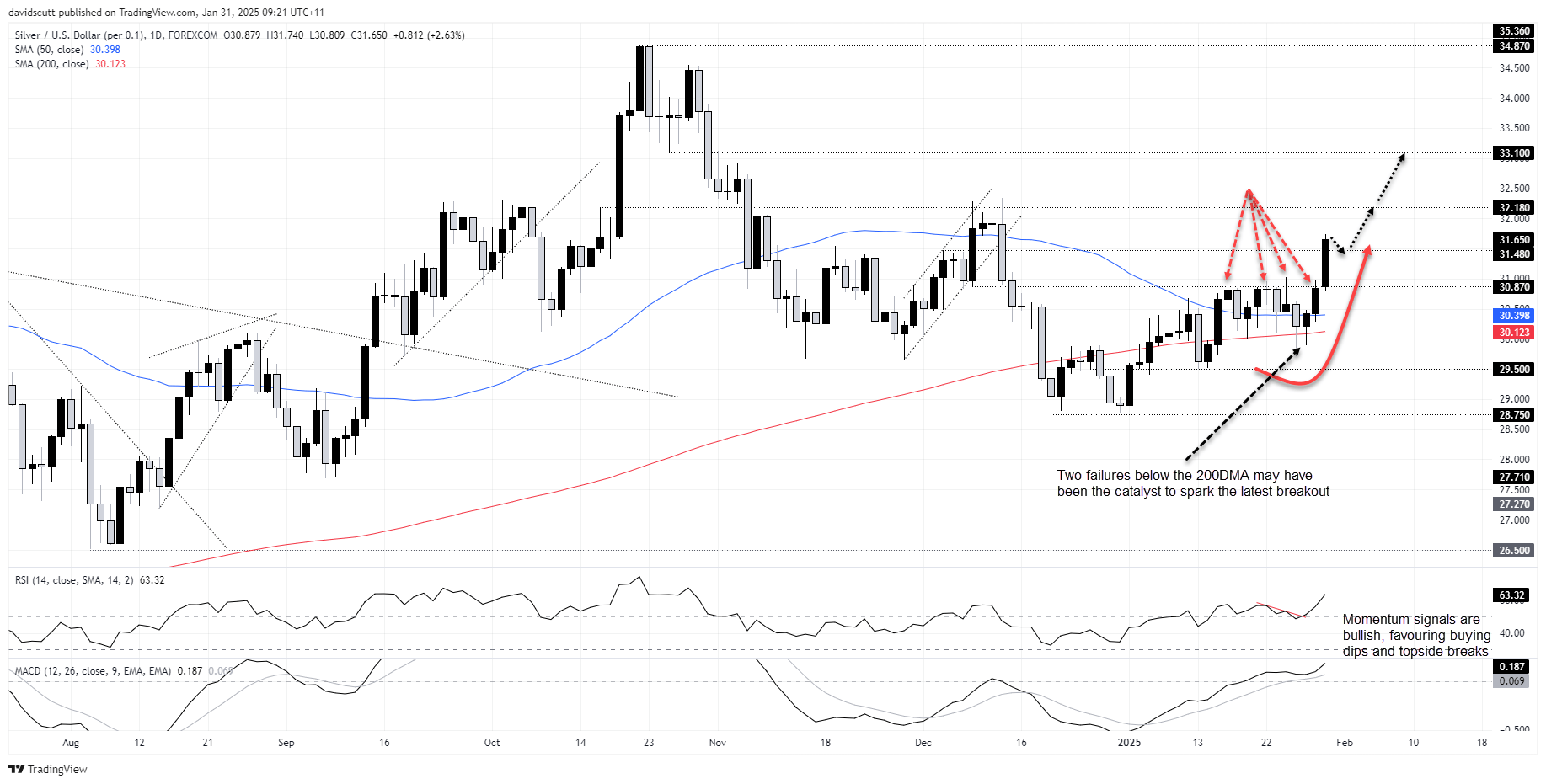

The break of resistance at $30.87 was convincing with silver not only clearing offers above but also minor resistance at $31.48. The failure to sustain two bearish thrusts below the key 200-day moving average earlier in the week likely helped set the stage for the move.

Momentum indicators reinforce the bullish bias with MACD trending higher and widening its gap from the signal line, while the minor downtrend in RSI (14) has been broken—both supporting the case for buying dips and bullish breaks.

Source: TradingView

If silver can hold $31.48 it could be used to build bullish setups around, allowing for longs to be established above with a stop beneath for protection. $32.18 looms as a nearby hurdle, acting as both support and resistance on multiple occasions between October and December. It's one potential target.

However, if the break can extend to take out the December swing high, it may encourage other traders to join the move, putting a test of $33.10 and the October 2024 swing high on the table.

If silver is unable to hold $31.48, it may warrant shifting the near-term bias from bullish to neutral, favouring range trading. If we were to see a reversal beneath $30.87, it would invalidate the bullish signal entirely.

Gold Sets Record as Tariffs Hit

Silver and gold have seen a relatively strong relationship over the past month, sitting with a correlation coefficient score of 0.81. Therefore, the technical picture for gold is relevant to those assessing silver setups.

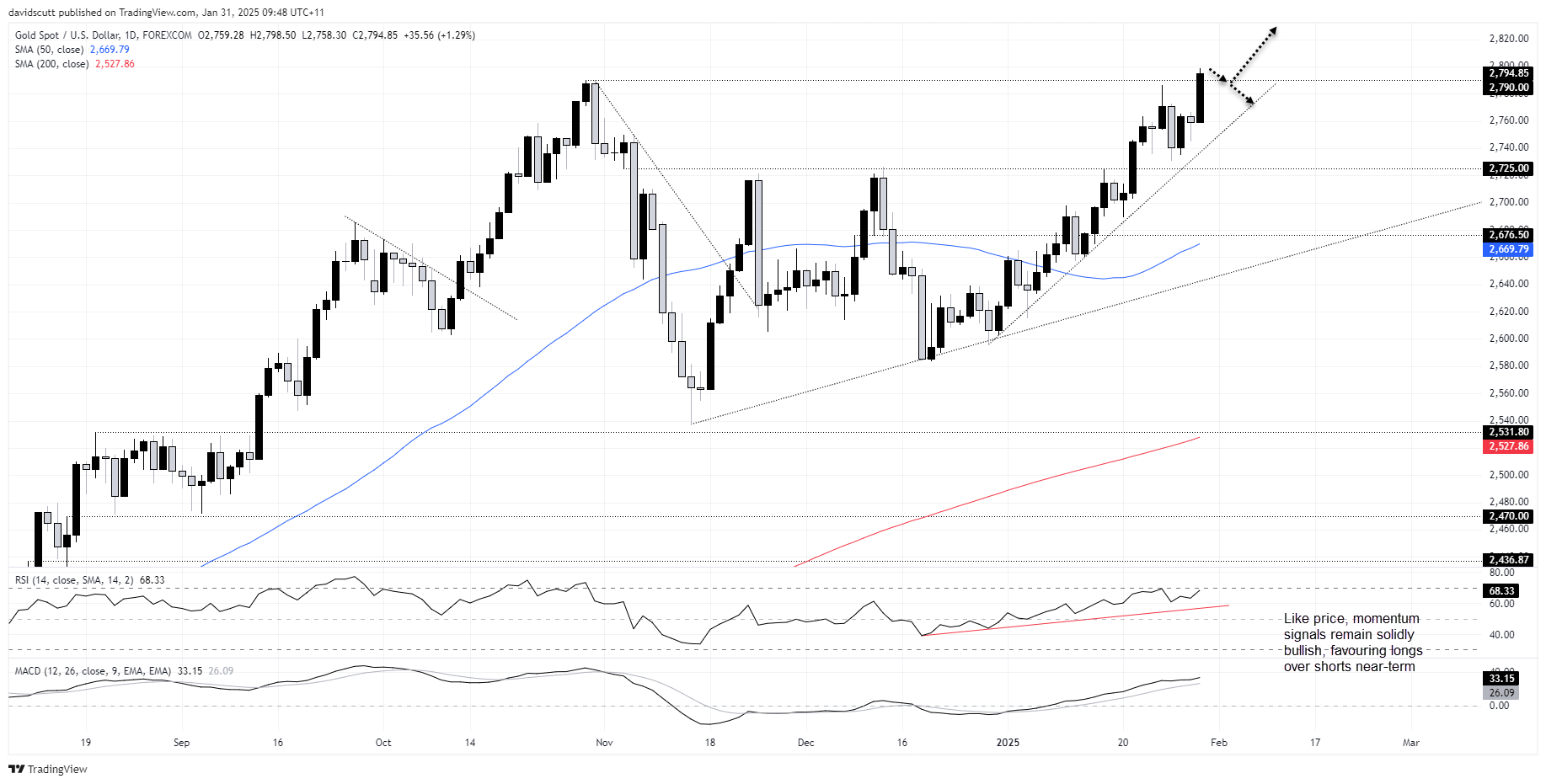

There is no doubt about the message being sent by bullion: bullish.

Source: TradingView

It took out the record high of $2790 with ease on Thursday, extending the bullish run from December 30 to 7.7%. The break came before news broke the Trump Administration will introduce 25% tariffs on Mexican and Canadian imports from Saturday. Uncertainty as to what comes next adds to the bullish backdrop despite generating upside risks for the US dollar and bond yields—two traditional headwinds for precious metals.

MACD and RSI (14) are generating bullish signals on momentum, although the latter is nearing overbought territory which argues against chasing the price higher given the risk of potential pullback.

Those contemplating bullish setups should pay attention to near-term price action in and around the former highs. If the break sticks, longs could be established above with a stop below for protection. $2800 screens as an obvious near-term target. Above, rather than extension forecasts, the preference would be to wait for a topping signal before exiting the trade, such as an evening star, shooting star, or bearish engulfing candle.

A reversal beneath the former high may warrant a neutral bias, with the bearish price signal offset by the proximity of uptrend support running from December 30.