The silver bulls have capitalised on the weaker US dollar as some doubt creeps into the market about whether a rate rise will happen in September or not. The silver bulls are rejoicing and will keep charging for as long as that doubt remains.

The devaluation of the yuan this week by the PBOC has had a big effect on the commodity markets, and silver has been taking full advantage. The devaluation is likely to flow on to the US in the form of deflationary pressure, which is something the Fed will not be pleased with. This could have serious implications for the Fed’s desire to normalise interest rates. Certainly the market believes that the probability of a rate rise in September is now below 40%.

Earlier this week, Atlanta’s FOMC member Dennis Lockhart said that inflation will be important on setting the pace for rate hikes once they start to rise. He also said he sees the pace as gradual, meaning that there will be less than one hike per meeting. With a devalued yuan and persistently weak commodity prices, US inflation is at a real risk of going nowhere. Then it will be impossible for the Fed to justify further rate rises.

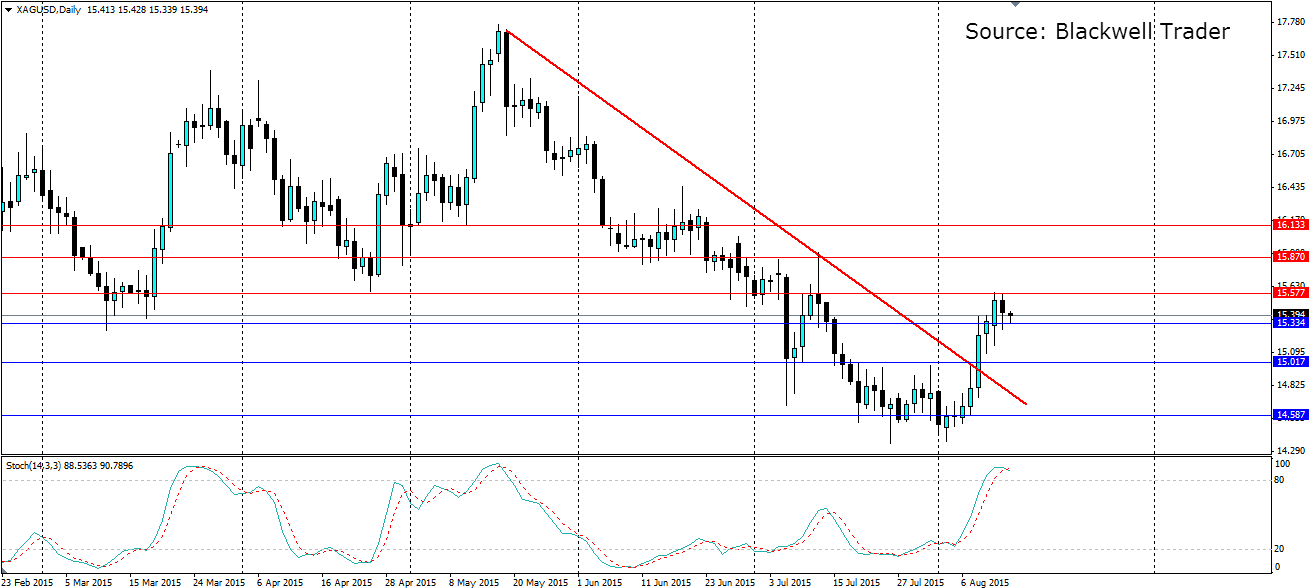

Silver has been on the charge since the double bottom formed at the beginning of this month. The breakout of the bearish trend was confirmation of this, and it is now trading between the resistance at $15.577 an ounce and the support at $15.334. We may see a pull back as traders look to take profits off the table, and the Stochastic Oscillator hints at this with it sitting up in oversold territory. Once this pushes back into neutral territory, the bulls are likely to regroup and charge once again.

Further support below the current 15.334 is found at 15.017 and 14.587, while resistance is found at the aforementioned 15.577 handle, with further resistance at 15.870 and 16.133.