The silver bulls have been patiently waiting, but now have been given their chance to charge, and charge they did. Silver was up over 3.5% on the weak US economic news, and has now broken out of the bearish trend it was consolidating under. The bulls are likely to regroup for a prolonged charge that could see silver trend much higher.

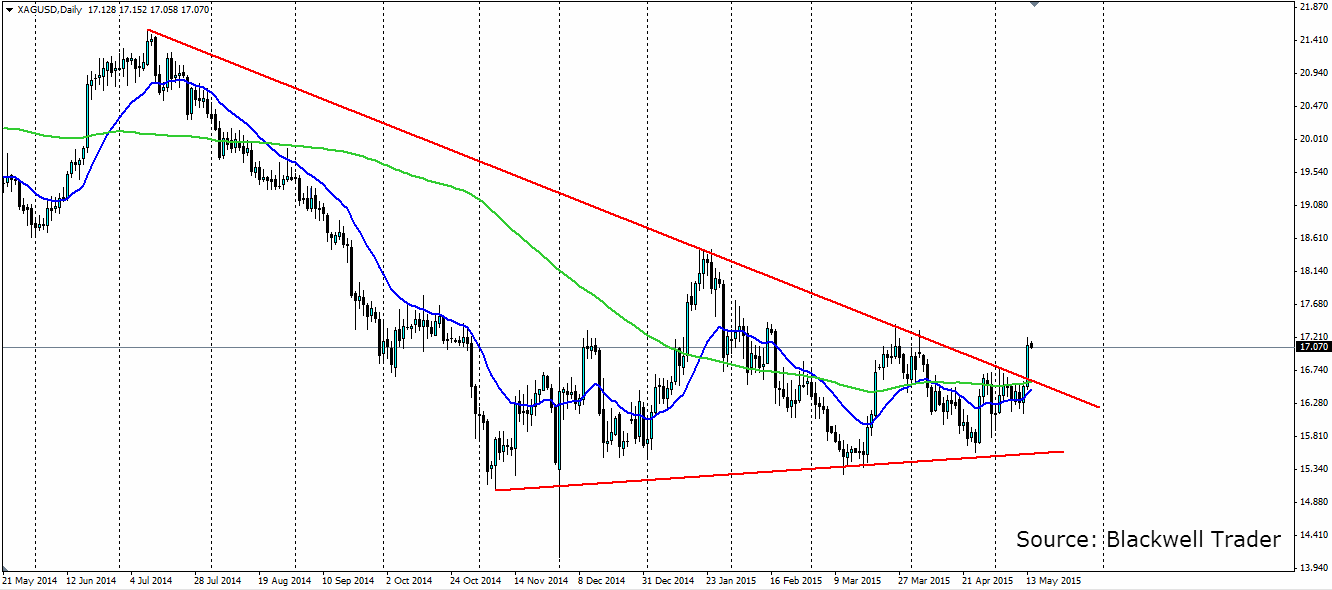

The consolidation has been a year in the making, with the swing highs in July last year marking the beginning of the bearish trend. Since then, silver has found support at the $15 an ounce level with periodic tests on both the bearish trend line and the support line. The highs have been getting lower and the lows higher in a sign that a breakout was more likely, the more it squeezes.

The overall trend has been bearish thanks to the market’s expectations that the US Federal Reserve will be raising interest rates as early as June this year. That was on the basis of the positive economic news over the last half of 2014 and early 2015. The bulls only had scraps to feed on, but they were just biding their time.

The economic indicators have been turning against the US recently, especially in the consumer sector and GDP. This makes an interest rate rise in June very unlikely and even a rise in September is in doubt, hence the bullish pressure on silver. This is the scenario the bulls were waiting for and their queue to charge.

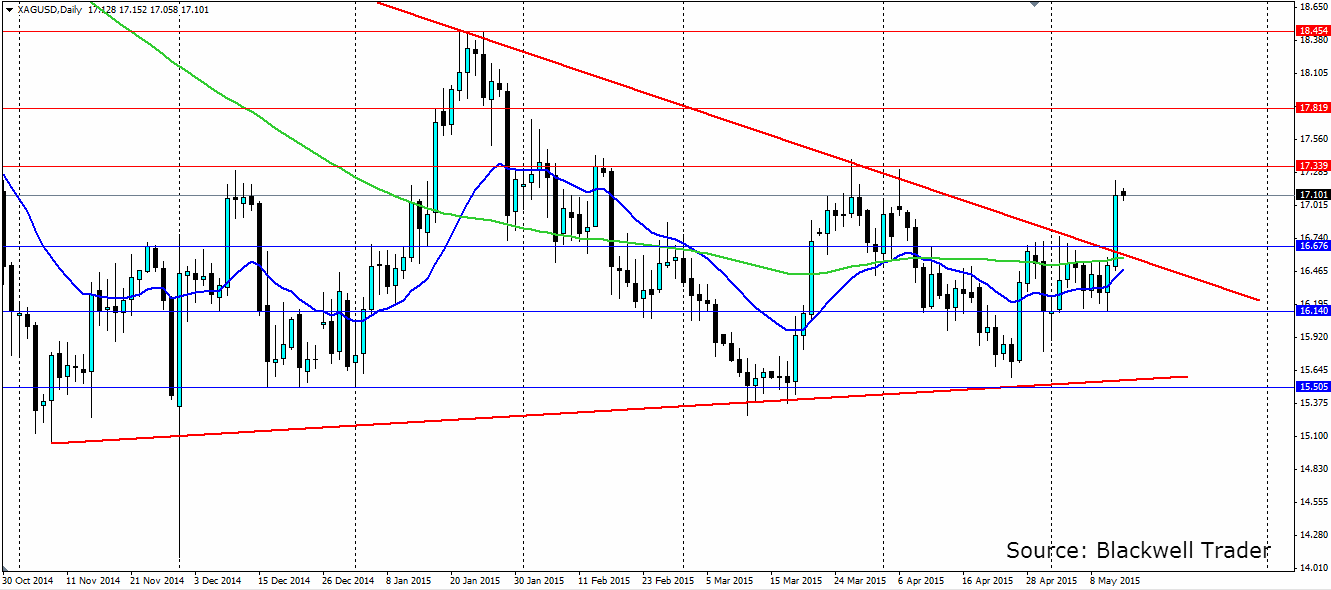

From here we could see the bears try and win back some ground and push the metal back towards the trend line. Silver has stopped short of the resistance at 17.339 an ounce and may retrace back towards the support at 16.676. If this holds, and it is highly likely to given the strength of the breakout, watch for an extended push higher that will regain some of the losses over the last 10 months.

Support will be found at 16.676 as stated above, with the previous bearish trend line now likely to act as support just below the 16.676 level. Further down, support is found at 16.140 and 15.505. Resistance is found at the previous swing high at 17.339, with further resistance at 17.819 and the high for the year, at 18.454, being the ultimate target.