The Silver market is looking extremely bullish as tensions from the middle east cross over into commodity markets. Recent reports out of the Middle East have painted a dark picture of a group that is bent on destruction and stoking religious tensions.

The ISIL is looking incredibly dangerous in Iraq, as they continue a campaign of terror against the current government. Many onlookers believe that with the fall of Mosgul and the acquiring of heavy weaponry from the soldiers that abandoned their posts, that the ISIL is now a force that has the potential to attack other major targets in Iraq creating more unrest.

Either way the attacks are likely to put the spotlight back on the Middle East and the tensions that are very much apparent, as governments fund terrorist groups and support waring factions.

The only winner in any sort of conflict seems to be speculative safe havens when it comes to financial markets.

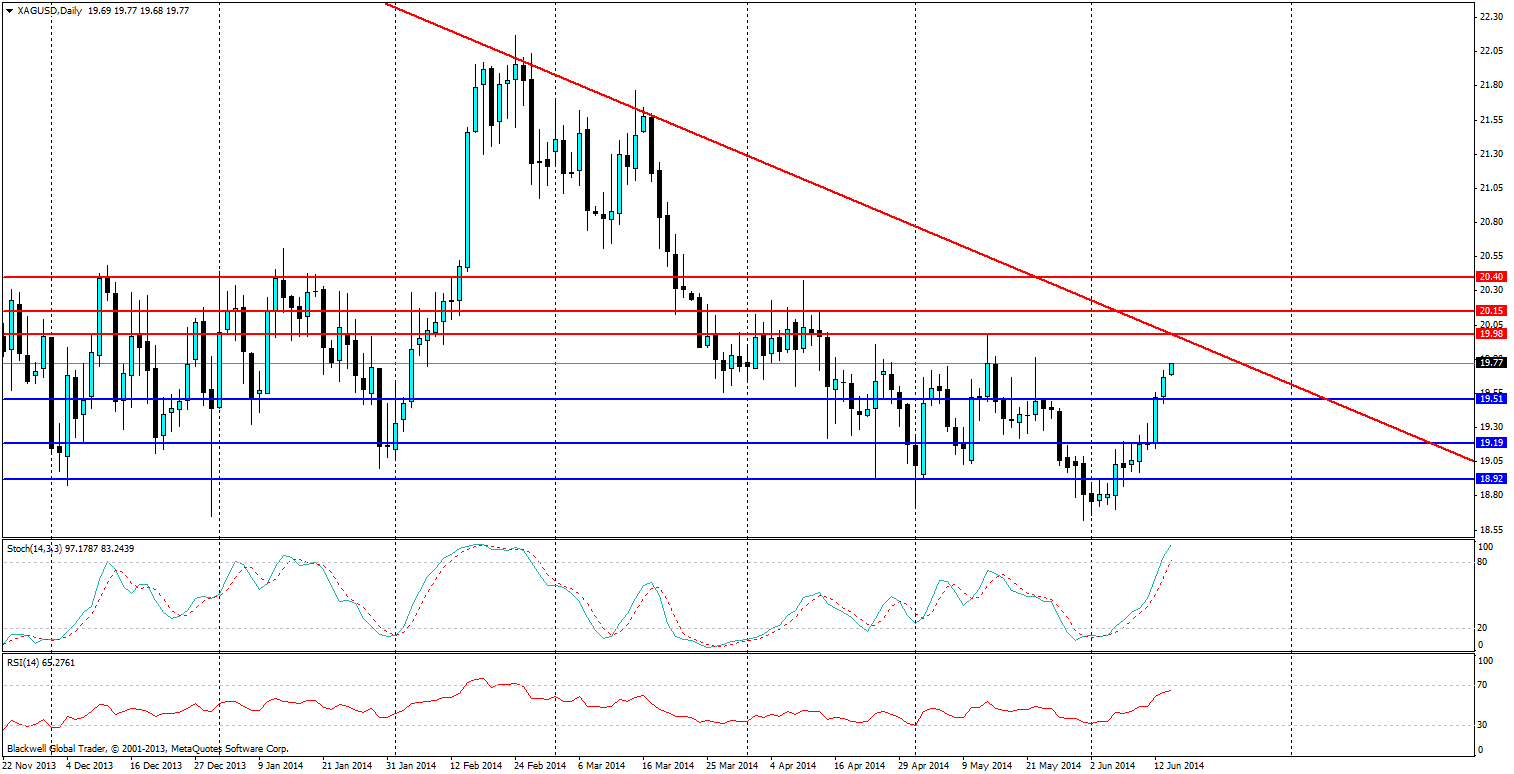

Silver has been looking very bearish for some time, closely following gold in some respects – which has smashed through its bearish trend line as of last week. Silver now looks to be likely to do the same, as it approaches its trend line. Current market resistance levels are likely to be found at 19.98 or more realistically at 20.00 – a psychological level, as well as a key resistance point – but, markets are likely to find more momentum if things escalate further in the middle east – something which seems likely.

Further resistance levels are fairly tight at 20.15 and 20.40; any pushes above these levels would be extremely significant and would lead to serious buying pressure. However, I believe its more prudent to use these levels as a form of take profit, or key level to watch. Markets are not a fan of aggressive short term bull markets, and sellers like to jump in as well.

Support levels can be found at 19.51, 19.19 and 18.92, I would not expect these to be tested anytime soon though, as markets are still very much bullish but any push lower should be watched especially if the trend line does hold.

If tensions do suddenly ease, on the back of aggressive military action, then it’s likely we will see a massive sell-off back to pre crisis levels. Silver has been facing a long term downward trend and minor blips have been unsustained long term.

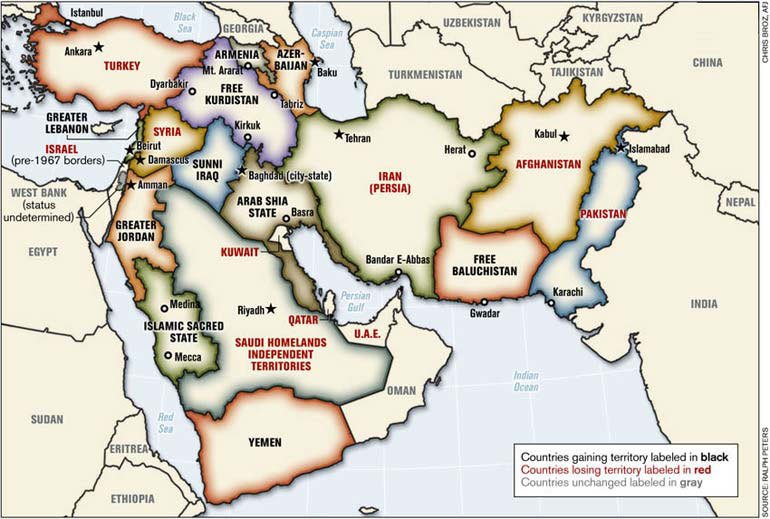

Source: Centre of research on globalization

Either way, I believe there is certainly bullish opportunity in the short term, especially up to the trend line. Additionally, I have included an interesting map which I think paints how dynamic the middle east is, especially in terms of redrawing itself. The current borders are senseless, and from a colonial era where empires carved up continents. Nowadays they are a poor representation of the reality, and cultural and religious changes will sweep across the middle east in the long term. Speculative commodities such as silver will benefit every time, as well as other commodities as these changes happen.