-

Silver may finally break its multi-year consolidation, potentially catching up with gold's recent all-time highs and possibly targeting $50 in the long term.

-

Despite underperforming compared to gold and Bitcoin, silver could see a turnaround this year amid China's economic recovery and a renewed industrial demand.

-

Silver's technical analysis indicates a potential breakout from its 3.5-year consolidation and short-term traders should closely monitor daily price action for potential movements toward $30 or even $50.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

After gold hit repeated all-time highs last week, silver may finally come out of its multi-year consolidation and start catching up with the yellow metal this week. A move towards $30 is not too optimistic.

But there is no major reason why the grey metal cannot go on to achieve its own record high this year.

After all, many other assets have done it like gold, Bitcoin, and many stock indices. Could we see silver at a record $50 at some point this year?

Why has silver underperformed gold?

We all know what has helped to propel gold to record highs.

Years of high inflation and devaluation of fiat currencies have increased the appetite for gold (and Bitcoin), which many see as the ultimate store of value and an effective hedge against inflation. But this hasn’t yet underpinned silver.

I think it all boils down to silver’s dual uses as a precious metal and an industrial material. This has worked against it, given raised concerns about weaker demand from China for industrial metals.

But with signs China is turning things around, and with the government setting an aggressive 5% growth target, we may well see stronger appetite for industrial commodities like copper and silver this year.

This could be the year for silver, after its multi-year under-performance and lack of any major movements since the height of the pandemic in 2020.

Silver technical analysis and trade ideas

Silver has been in a rather lengthy consolidation between around $19 to $30 ever since the height of COVID-19 in 2020.

The 3.5-year consolidation means the eventual breakout could be significant, potentially paving the way for the grey metal to head towards its 2011 all-time high of just under $50.

But it remains to be seen whether and when that breakout will take place as gold’s previous runs to nominal all-time highs in recent years didn’t trigger a corresponding move for silver.

Still, it pays to be prepared. Looking at the monthly candles of silver, a breakout could happen soon as the price gets squeezed between two converging trend lines.

February’s high of around $23.50 is now key support in this time frame. The bulls will not want to see a move back below this level in light of this month’s current +7% rally.

The resistance trend line of the consolidation pattern comes in around $25.00 give or take a few dollars. Above this level, we have a horizontal level of resistance circa $26.00, which has proven a tough nut to break in recent years.

So, $25.00 and then $26.00 are the next immediate levels of resistance that the bulls will need to break to trigger a move higher on the larger time frames.

Should we see a move above these levels then at the very least I would expect silver to probe its multi-year resistance around $30.00 next.

Meanwhile, if support gives way and silver breaks the bullish trend instead then in that case the bulls will have to wait for a fresh buy signal before having another crack at it.

In the near term, it is important not to lose track of short-term price action as the road towards $30 (or even $50) could well be a bumpy one.

So, don’t forget to keep a close eye on your lower-time frames, such as the daily or lower if you are an active trader.

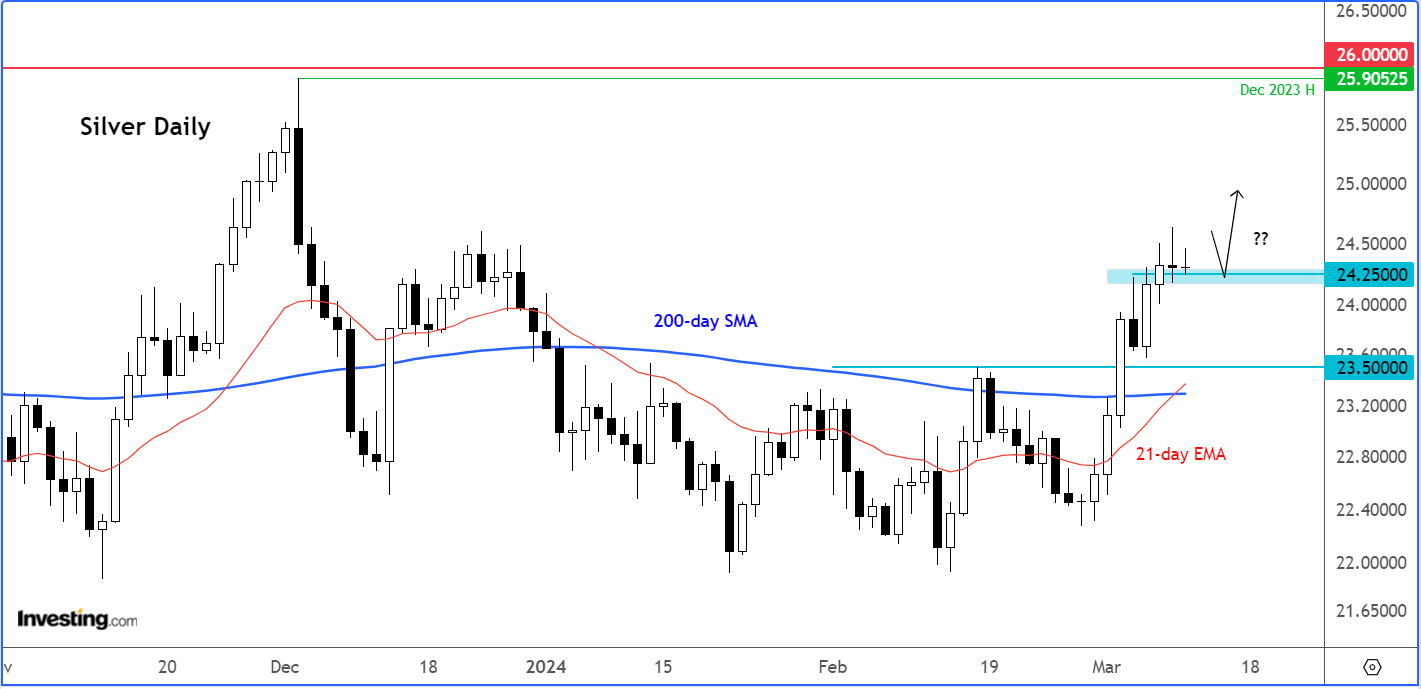

On the daily time frame, one can observe that silver has already broken above $23.50, which is a bullish signal. Now, the 21-day exponential moving average is starting to rise above the 200-day simple average, which is another bullish sign.

Last week, silver formed some resistance around the $24.20/5 area, but by mid-week, it broke above this level and held there. Moving forward, this $24.20/5 level is now going to very important in terms of support.

For as long as it holds now then the short-term path of least resistance will remain aligned with the longer-term view: to the upside. A move to probe liquidity above December’s high of $25.90 could well be underway on this time frame.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

Don't forget your free gift! Use coupon codes OAPRO1 and OAPRO2 at checkout to claim an extra 10% off on the Pro yearly and bi-yearly plans.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.