Silver markets have been looking very hard to read in the short term as of late, but the long term trends are still a contributing factor for a lot of traders and hedge funds out there.

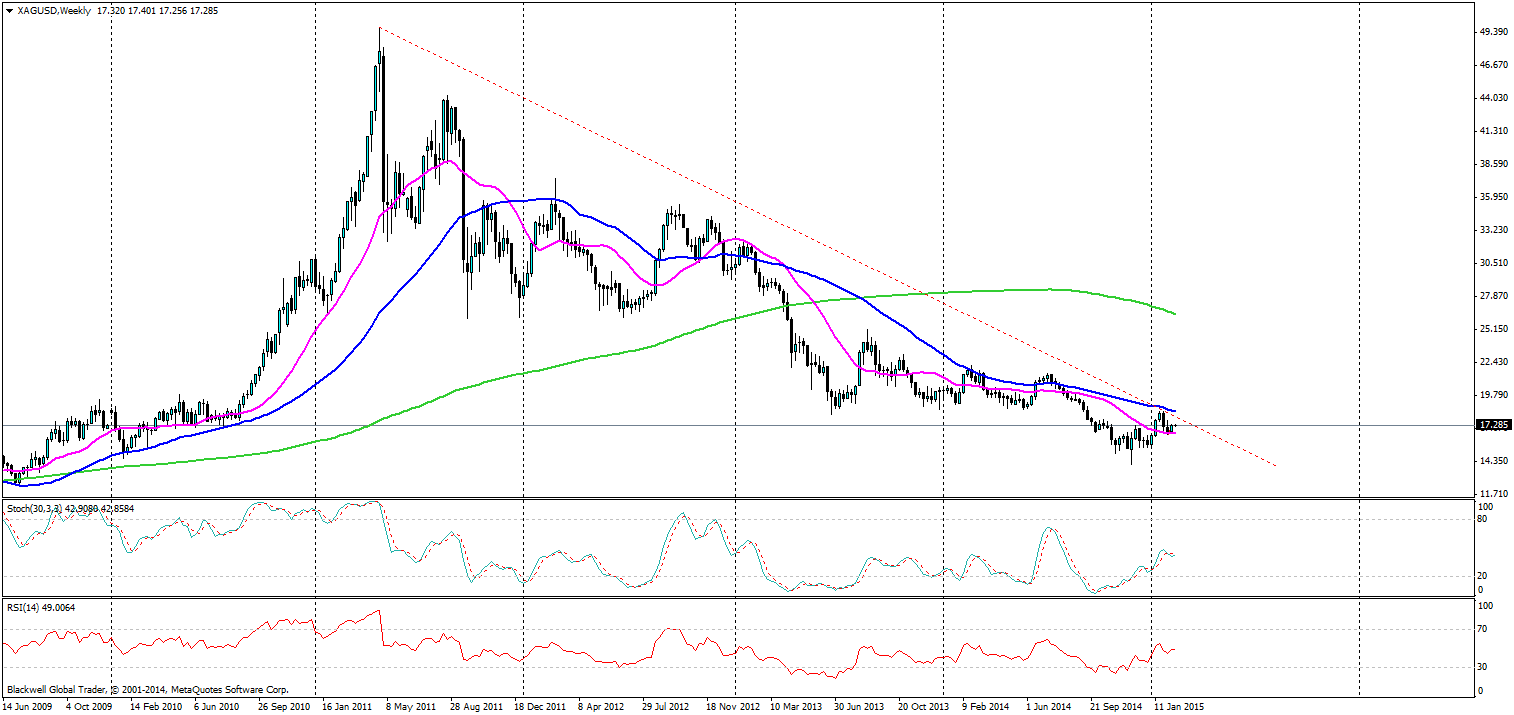

(Source: Blackwell Trader (XAG/USD, W1)

Long term, it’s all down hill and that trend has continued that way since 2009, though for now it has somewhat tapered off and we have seen a bit of a silver revival when it comes to movements. What is key to the market though is the long term trend, because this will help to lessen movements upwards

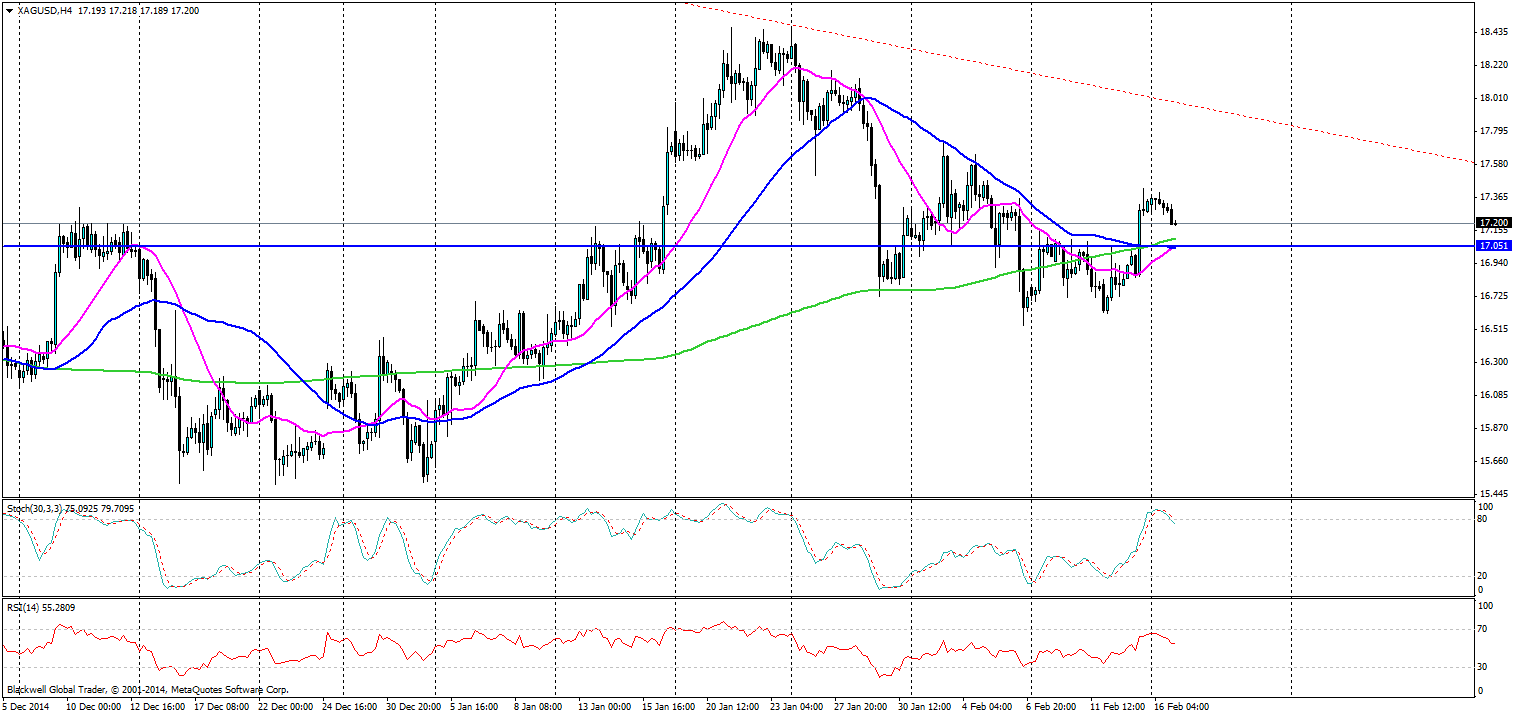

(Source: Blackwell Trader XAG/USD)

Currently on the H4 we are seeing some interesting moves. After a move upwards silver has hit oversold levels and the market has pulled back as a result. The market is now looking for another move lower and it’s likely to find strong support at 17.051 on the charts. After this it wouldn’t surprise me to see consolidation before the bears or bulls rush back in on speculation over Greece, which is sure to drive plenty of it as a greek exit may become a reality if everyone refuses to blink; a reality scenario now days.

Either way if you’re a silver bear now is the time to strike and then wait on news fresh out of Europe as that could lead to a big jump in the speculation of precious metals. Short term is bearish but medium term is certainly mixed at this stage.