Source: Blackwell Trader

Anyone watching the silver charts would still have quite a bearish bias as of late, and rightfully so given the current market climate. But there has been a lot of action on the H1 chart and some interesting developments since then.

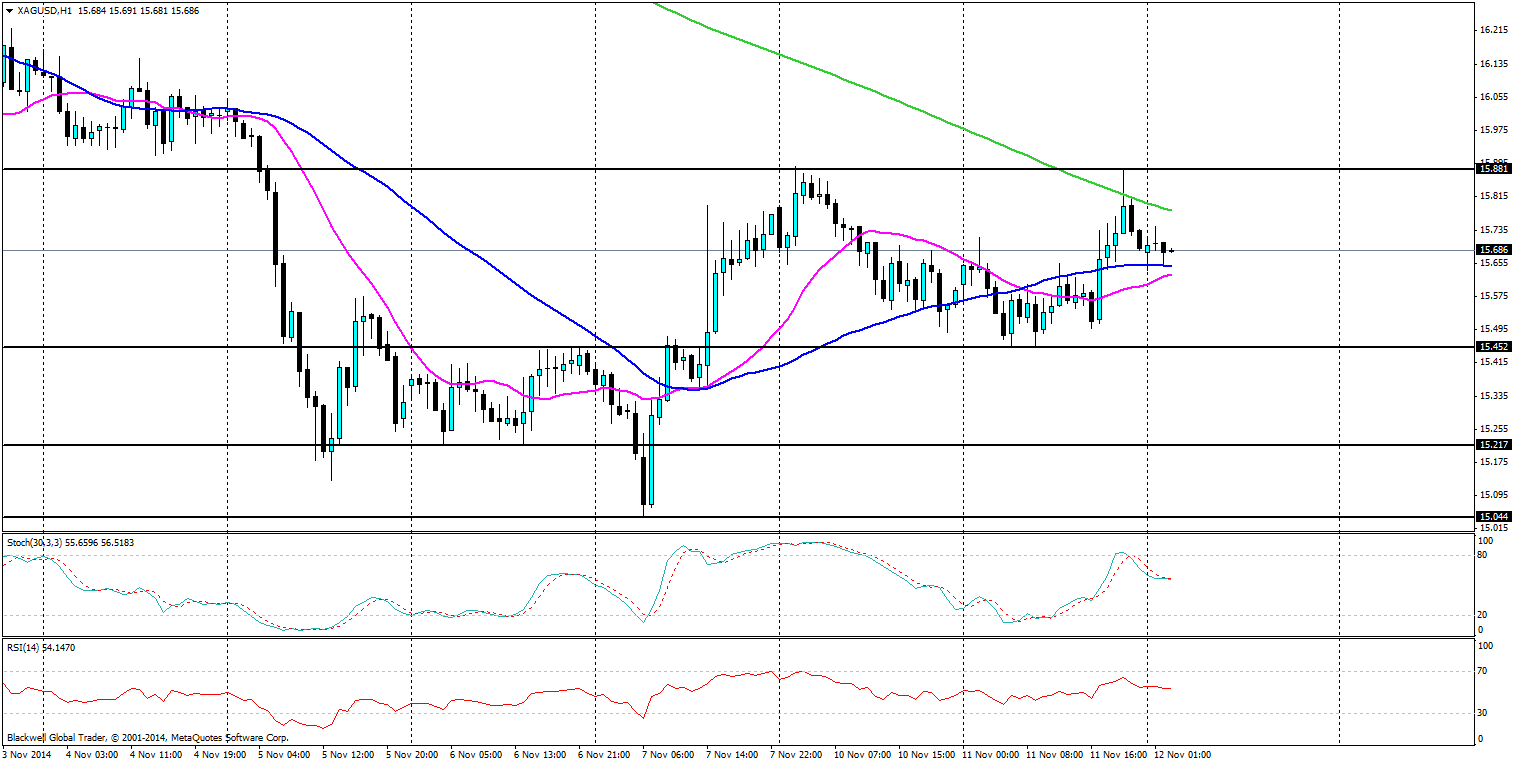

After briefly touching 15.044 (very close to that 15.000 level) the market shot back up sharply and looked for a chance to breath. This was followed by a solid impulsive trend upward, which in turn found sharp resistance at 15.881. The market briefly held around here before the trend kicked in and started to work its way back down.

Despite this being a consolidation period we have seen a sharp warning sign for silver in the market, as the second touch on resistance was met by a very sharp pullback, which signals the bears are looking to make a point that further lows are on the horizon for silver markets. Additionally, this saw the 200 day moving average used as dynamic resistance by the market.

Markets looking to go lower seem to be the trend in commodities and currently the market is looking for further momentum to go below the 20 day moving average as it currently acts as basic support in the market. The next level lower is 15.452 which has so far seen two strong touches and a third is very much on the cards in the coming hours.

Below this would signal a push to 15.217 and 15.044 which is a very bearish target and may take some fundamental shift to push it that low. Markets will also be looking to see if any of these levels can hold up to pressure, and any push off and up higher will see a return to consolidation before levels get pushed further.