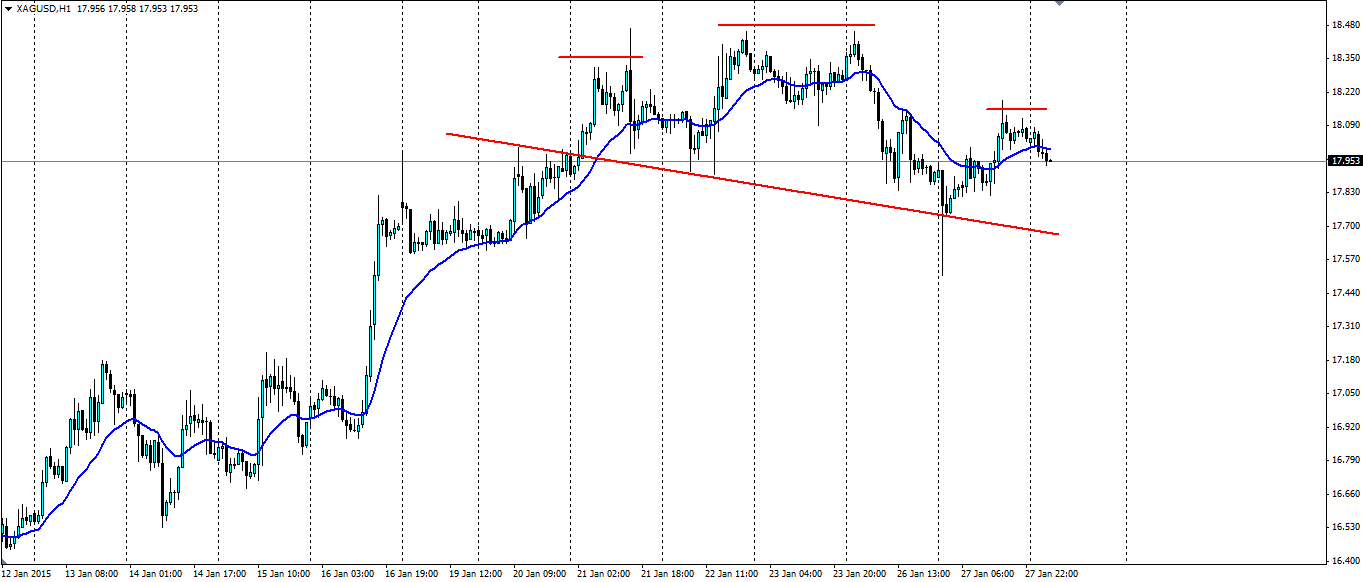

Silver looks to have begun forming a head and shoulders pattern that could see a movement back towards the $17 an ounce mark. The formation of a bearish channel could also add to the bearish sentiment.

Silver could be rather volatile in the markets over the next 24 hours as the US Federal Open Markets Committee meet to discuss interest rates. The fall in inflation has led many in the market to expect the Fed to be more dovish than usual, however, this has already been priced in with the market pushing both gold and silver up to 4 month highs.

The head and shoulders pattern outlined on the chart above is roughly 63 cents wide. The rule of thumb is for the target to equal the width of the pattern which would put the target very close to the $17 an ounce mark.

The formation of a bearish channel adds weight to the head and shoulders set up. There have been a couple of breaches of the channel but that attests to the volatility we see in the silver market.

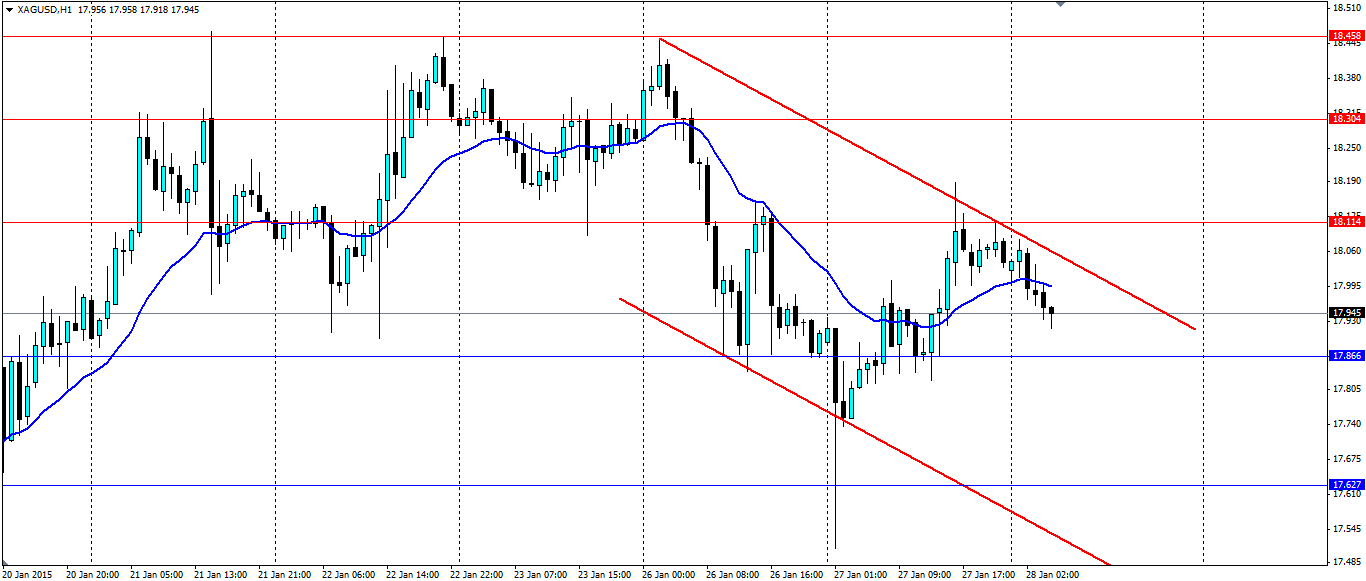

If we see the channel hold, look for the price to target support levels at 17.866, 17.627, 17.182 and of course the support at the psychological 17.000 mark where the head and shoulders target is. Resistance is likely to be found at 18.114, 18.304 and the tops at 18.458.

The silver market is looking to turn bearish with two technical setups both pointing that way. Watch out for increased volatility with the FOMC statement later today.