Silver Back For Round 2

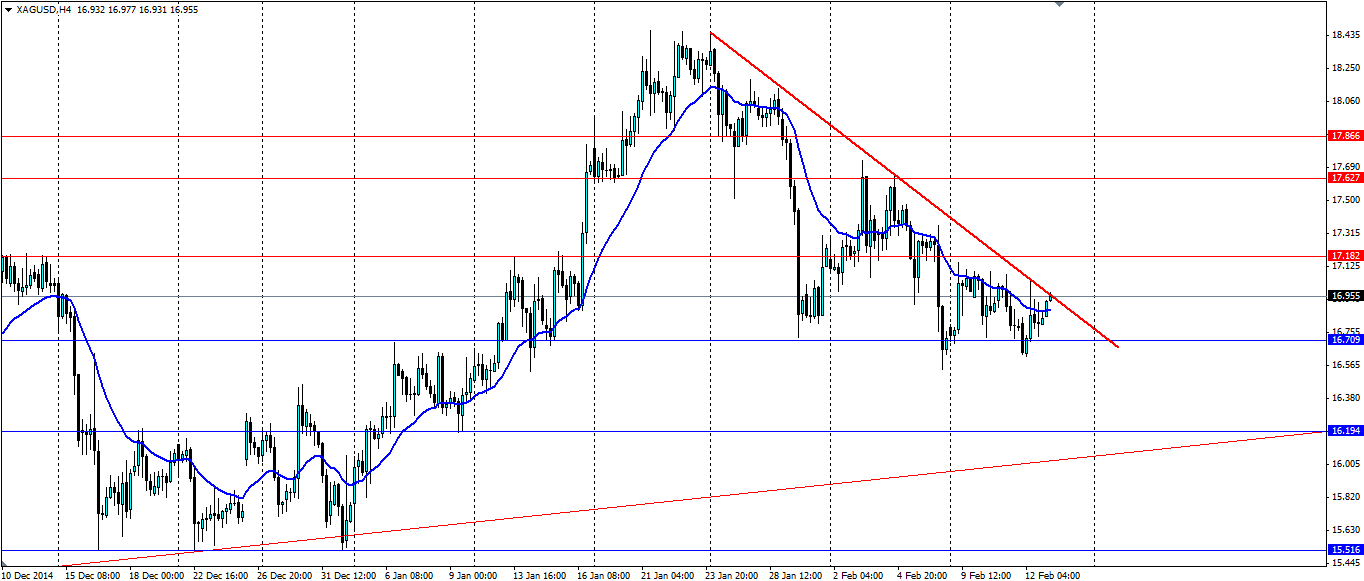

Earlier in the week I wrote about the bearish trend that silver has been playing off. We saw a strong rejection and now silver is back up to the trend line for another round.

(Source: Blackwell Trader)

After I wrote about silver, it rejected quite nicely off the trend line for a $0.45 movement and hopefully some of you took those pips. With the recent turmoil in the markets, particularly Greece and Japan, silver has pushed back up to the trend line for another go. Both gold and silver have been in demand thanks to the uncertainty on whether the EU and Greece will reach an amicable agreement. If not Greece could exit the EU which will create an enormous amount of volatility in the euro.

The Bank of Japan caused a bit of a stir last night when a leaked report suggesting that further stimulus would be counterproductive. This caused a large strengthening in the yen and other safe haven commodities including silver. Weaker US data certainly provided support for silver, but the fact remains that the US economy is solid and the Feds are determined to raise interest rates by mid-year.

From the technical side of things, the bearish trend line that has formed over the last two weeks is looking quite solid after a number of tests. With the price sitting just under the trend line, and just under the resistance at the magical $17.000 mark, we could very well see another rejection.

The current squeeze in the price between the short term bearish trend line and the support at 16.709 is likely to lead to a breakout. If the momentum holds, it will be carried lower where it will run headlong into the older trend line with a slight bullish bias. This will again lead to a squeeze and would be a good place for anyone short on silver to take profits off the table.

(Source: Blackwell Trader)

If we see an upside breakout from the current position, the price will look for resistance at 17.182, 17.627 and 17.866. A bearish breakout will occur once the support at 16.709 has broken with further support at 16.194 and 15.516 and of course the older trend line mentioned above will act as dynamic support.