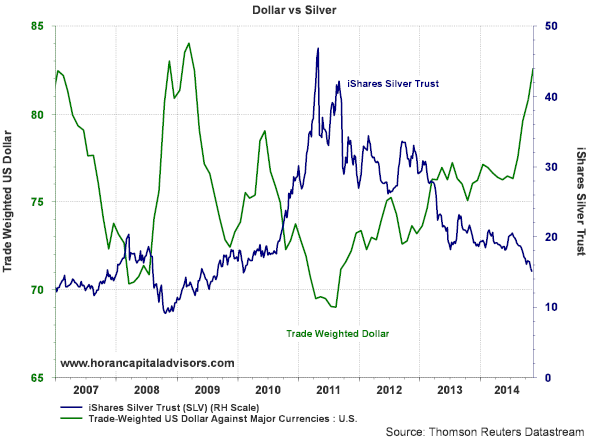

Given the decline in Silver prices, it is not surprising we are beginning to field questions from investors about the potential opportunity in silver and commodities in general. One of the easiest ways investors are able to invest in silver is via the exchange traded fund, iShares Silver Trust (ARCA:SLV). As the below chart shows, this index has been on a fairly steady decline since peaking in early 2011.

|

| From The Blog of HORAN Capital Advisors |

As timing would have it, today's Wall Street Journal contains an article on small investors loading up on silver. The WSJ article contains commentary from some strategists who believe the silver ETF could fall to $8 before finding support. Investors should keep in mind silver traded below $5 in early 2003. Lastly, the below chart looks at a weekly time frame going back to early 2011. The red dotted line shows the ETF continues to trade under long term resistance.

|

| From The Blog of HORAN Capital Advisors |

Many forecasters believe the US Dollar could trade with parity to the Euro before we see an end to US Dollar strength. If this were to occur, commodity related investments would continue to face downward price pressures. We commented on the relationship to dollar strength and commodity prices in an article last year, Interest Rate Policy To Impact The Dollar And Commodity Related Industries.

Disclosure: No positive in SLV