This week, two investment firms came out expressing their disbelief that silver has any more upside, so investors may start getting nervous and begin asking the same question. Back on February 11, 2014 I wrote an article titled “Coffee to Outperform Precious Metals” and within the article I stated that Coffee looked to reach $1.75 per pound – yesterday it reached $1.78. I had recommended buying the Coffee ETF (JO) at $23.28 and selling it at 32.99 for a 47% profit in 21 days. What I did not mention in that article was the interesting similarities between the charts of Coffee and Silver.

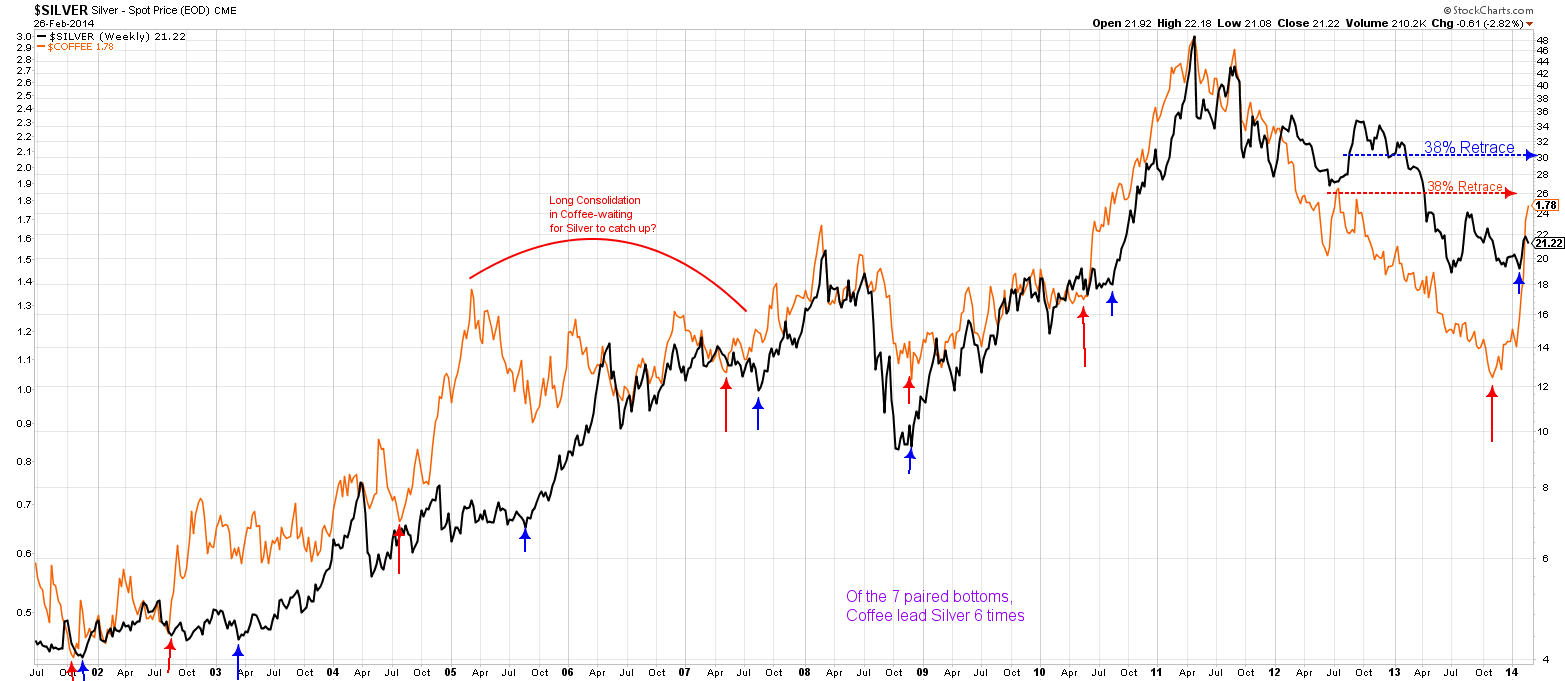

Often, you can get what is called an ‘analog’, which simply means a representation of data that is similar when compared to data of a different origin. Coffee and Silver are the two sets of data of different origin that are being compared in the chart below, from year 2001~2014, with coffee represented by the orange line and silver by the black line. The coffee price scale is on the left side of the chart and silver on the right.

What's most interesting, is that of the 7 paired bottoms (coffee=red arrow:silver=blue arrow), coffee bottomed before silver 6 times during significant moves, which silver subsequently followed. You will no doubt notice that the most recent move in coffee has been one of the most significant advances during the last 13 years. This begs the question, is silver next?

The coffee price has almost reached its 38% Fibonacci retracement of the entire 2 year decline. For silver to achieve the same level, it would have to go to just over $30 per ounce. Although I have never been a big fan of analogs, given that so many commodities are rallying strongly, there is little reason for silver or gold to be excluded.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Silver's Coffee Analog

Published 02/27/2014, 02:39 AM

Updated 07/09/2023, 06:32 AM

Silver's Coffee Analog

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.