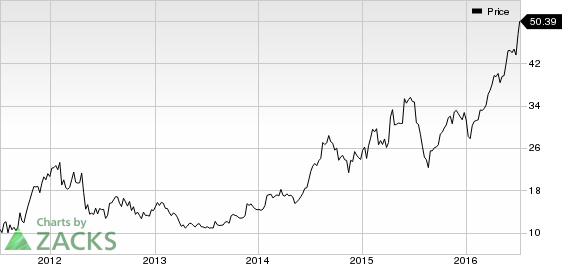

A sneak peek into second-quarter 2016 results of fabless semiconductor company Silicon Motion Technology Corp. (NASDAQ:SIMO) drove shares by 5.1% during the trading session on Jul 7. The company also announced a considerable hike in its top-line guidance two weeks ahead of its quarterly release, pacifying skeptic investors to some degree.

In the preliminary second-quarter results, Silicon Motion affirmed that revenues will now grow in the range of 23% to 25% sequentially from the previous 5% to 10% range. Also, non-GAAP gross margin is forecasted to be in the upper half of the original guidance of 47% to 49%.

Reasons Behind the Hike

We believe that the company’s bullish revenue guidance has been backed by surging demand for SSD controllers from NAND flash partners and increasing use of SSD controllers in embedded applications. Also, increasing use of these controllers in storage OEM partners as well as module makers is boosting demand.

Also, the company’s acquisition of China's leading enterprise grade PCIe SSD and storage array vendor, Shannon Systems has been a major catalyst. Shannon has already gained over 100 customers ranging from the leading Internet and e-commerce companies to utilities, telcos and other state-owned enterprises including government agencies.

Large volume shipments of customized enterprise grade PCI SSD solution to a leading Chinese ecommerce company provided a major boost to the enterprise and industrial SSD solutions during the first quarter of 2016. Solid enterprise and industrial SSD solutions during the second quarter of 2016 sales can also act as a major revenue driver.

In addition to this, rebound of eMMC controller sales is adding to the company’s strength. Factors including shipment of USS2.0 controllers to selected premium flagship smartphones and tablets and multiple USS2.0 program wins with NAND flash partner are responsible for this uptick.

To Conclude

As a matter of fact, the company’s embedded storage products, including eMMC, SSD controllers as well as enterprise and industrial SSD solutions, grew 35% sequentially during the first quarter of 2016 and accounted for 80% of total sales. We believe conducive market trends are set to send this value higher and is largely responsible for the company’s sales growth optimism.

Silicon Motion carries a Zacks Rank #3 (Hold). Better-ranked stocks in the sector include Amkor Technology, Inc. (NASDAQ:AMKR) , CEVA Inc. (NASDAQ:CEVA) and FormFactor Inc. (NASDAQ:FORM) . All the three stocks carry a Zacks Rank #2 (Buy).

FORMFACTOR INC (FORM): Free Stock Analysis Report

SILICON MOTION (SIMO): Free Stock Analysis Report

AMKOR TECH INC (AMKR): Free Stock Analysis Report

CEVA INC (CEVA): Free Stock Analysis Report

Original post