Sign, sign, everywhere a sign

Blockin' out the scenery, breakin' my mind

Do this, don't do that, can't you read the sign?

-- Five Man Electrical Band

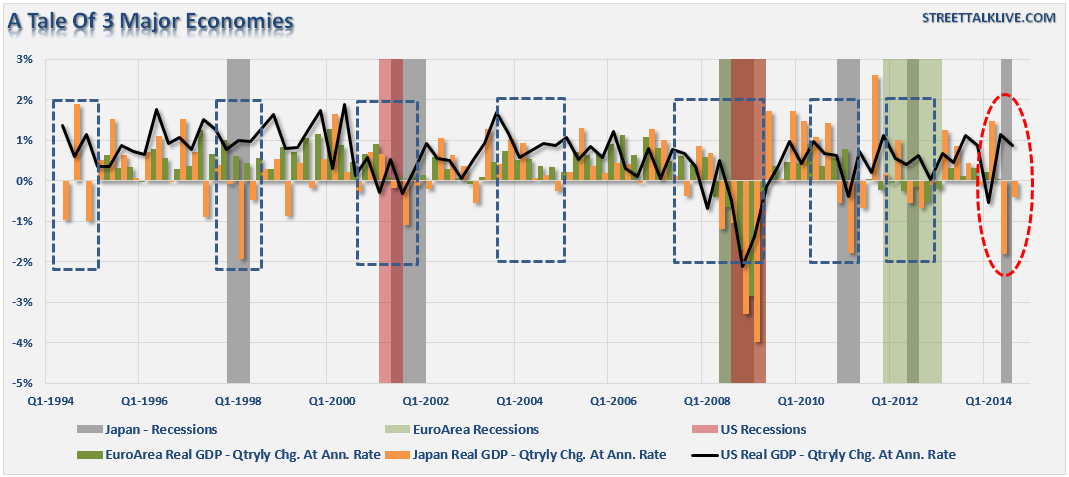

For months now I have been discussing that despite the "hopes" that this time is different, there is little chance that the U.S. can remain an island of economic prosperity in the sea of global deflation. To wit:

"While none of this analysis suggests that a domestic recession is imminent, it does suggest that the hopes that the U.S. can "decouple" from the rest of the world's deflationary drags are likely misplaced. As shown in the chart below, the U.S. economy has historically been unable to achieve accelerating rates of economic growth when both the Euro Area and Japanese economies have been weak."

"The implications to investors are important. The current growth in domestic profits is one of the last remaining footholds of market "bulls." With valuations now expensive, interest rates near zero and yield spreads flattening, the risks to the markets have risen substantially. While this doesn't seem to be the case as markets push up against all-time highs; it is worth remembering that we saw much the same in early 2000 and 2007. This time is likely no different, only the timing and catalyst will be."

The following series of charts all suggest that current hopes of surging economic growth in the U.S., over the next several quarters, will likely be met with disappointment. I have added brief comments, but primarily you should judge for yourself.

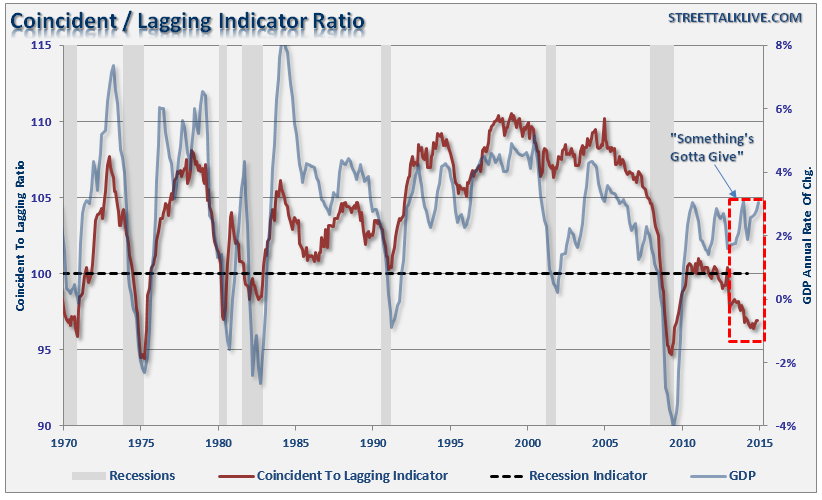

LEI Coincident To Lagging Ratio

The coincident-to-lagging ratio is like a "book-to-bill" ratio for the economy. It is hard to suggest that the economy is "firing" on all cylinders when this ratio is languishing at levels normally indicative of a recessionary economy.

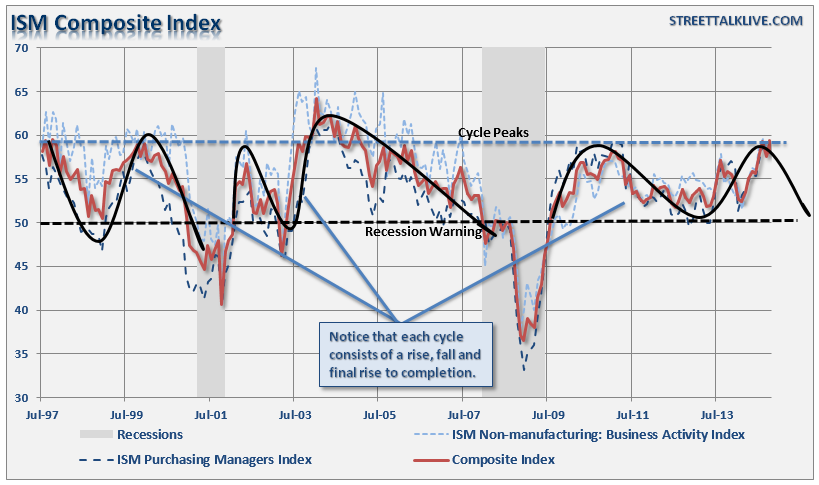

ISM Composite

While the ISM composite survey is near the top end of its range, there are clear signs that the ratio will likely subside in the months ahead. I have mapped the normal cycles of the index in the past. It is important to remember that the ISM survey is a "sentiment" survey that tends to lag actual inputs like new orders and backlogs.

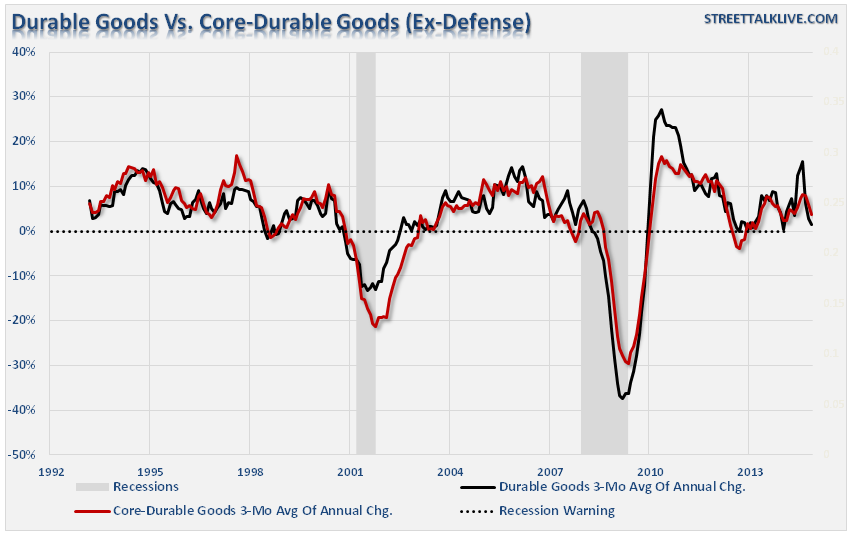

Durable Goods

Speaking of orders, durable goods (ex-aircraft) are showing considerable signs of weakness domestically. The demand for goods has weakened significantly over the last couple of months in particular despite the hopes that falling oil and gasoline prices would buoy spending. (I wrote several articles dispelling this myth see here and here.)

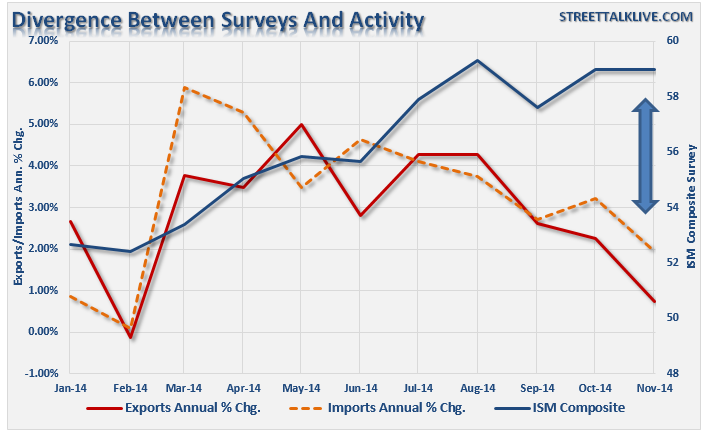

Imports vs. Exports

The surging dollar and weak consumer demand are also being reflected in import and export activity.

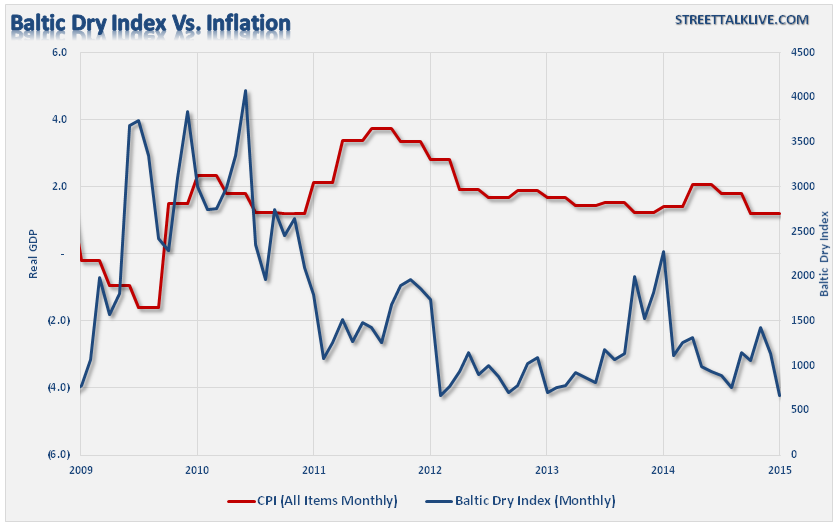

Shipping

The rising weakness in demand for goods and products can be clearly seen in the decline in the shipping index.

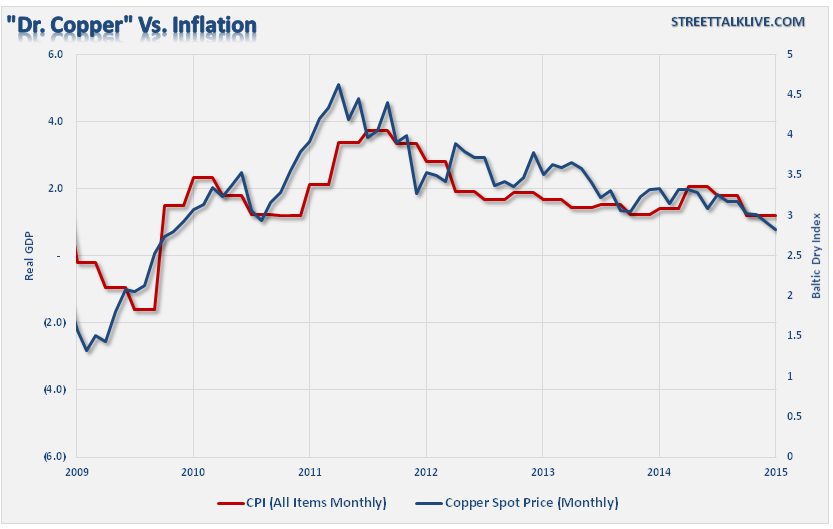

Copper, a component used in virtually every facet of manufacturing, production and consumption also suggests that economic demand is weakening.

National Activity vs. Economy

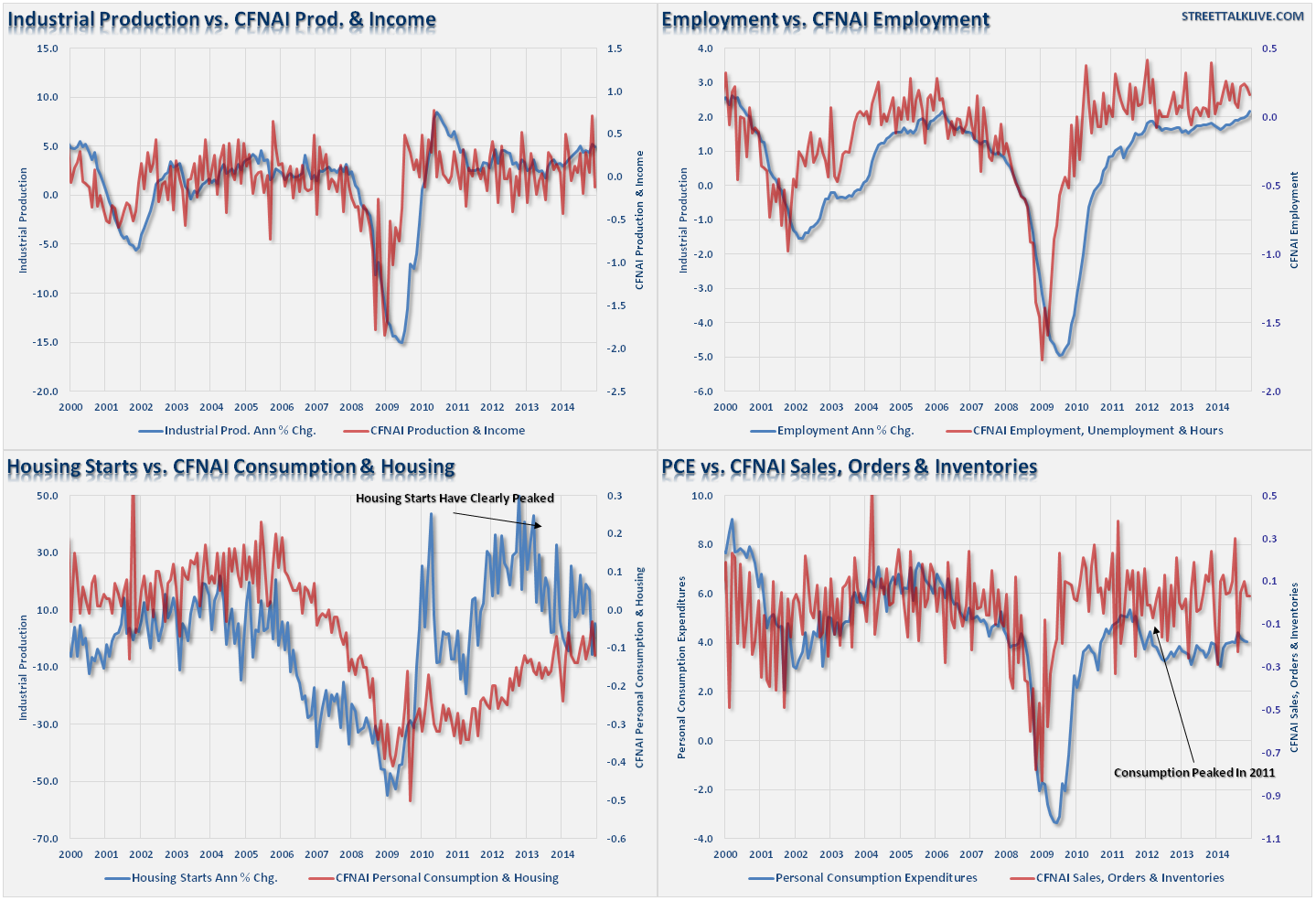

We can see this more clearly by looking at the major components of the Chicago Fed National Activity Index (CFNAI) as compared to the relative economic indicators.

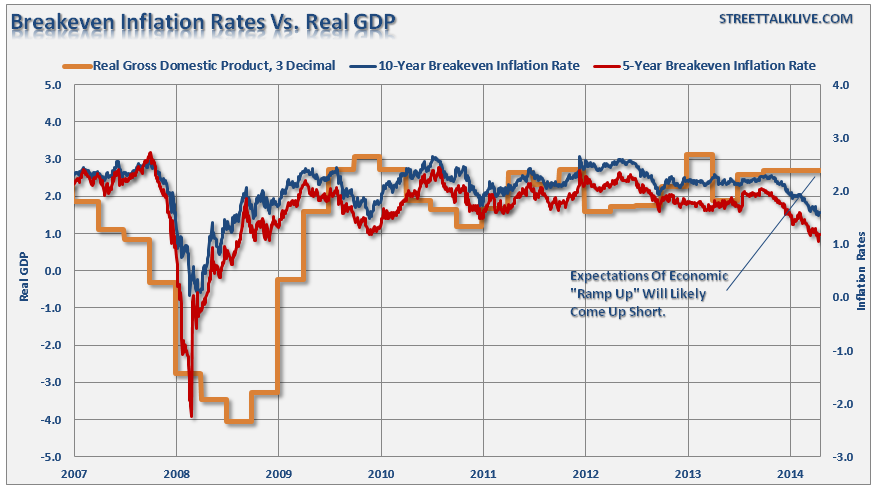

Inflation

The 5- and 10-year breakeven inflation rates continue to suggest that underlying economic strength is much weaker than headline statistics suggests.

These charts all clearly suggest that the real economy is likely weaker than currently believed. In addition, current data would likely already be printing lower growth rates had it not been for revisions a couple of years ago that added more questionably measured components such as "intellectual property."

However, while I am not suggesting that a recession is imminent, I am suggesting that the risk to investors has risen markedly over the last few months. The rising financial instability in the Eurozone, particularly following the Greek elections, combined with the global deflationary tide, puts currently extended financial markets in jeopardy.

There is little question that the markets will eventually suffer a rather nasty mean reversion. However, bull markets don't end simply due to old age, it requires a catalyst. The problem remains that throughout history the "catalyst" that finally triggers a market reversion and coinciding economic recession are rarely identified in advance.

This is why I point to the signs. The signs are everywhere that the market is currently a "bug in search of a windshield." It will eventually find one, and as the old saying goes, the last thing that goes through the mind of the bug is its.