Last Thursday on September 26, the Bureau of Economic Analysis (BEA) released several very significant upward revisions to real Gross Domestic Product (GDP), real Gross Domestic Income (GDI), personal income, and personal saving.

Collectively, they blew away the hard landing scenario. They didn't leave much, if any, room for the soft landing scenario either. They suggest that productivity growth will be revised higher and unit labor cost inflation will be revised lower—a no-landing scenario.

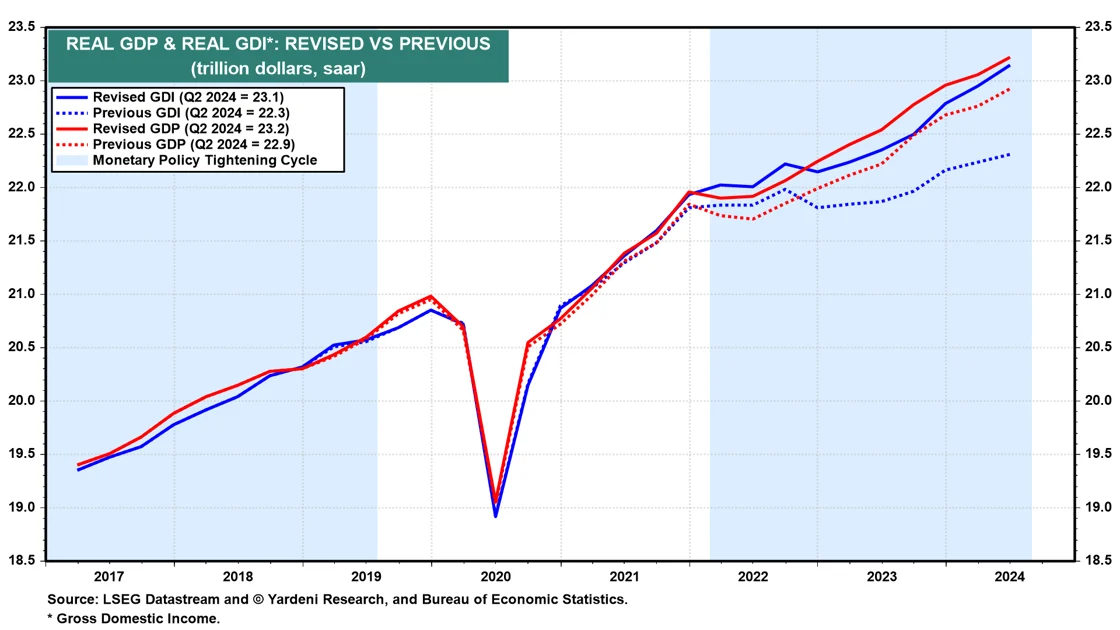

These revisions show that real GDP has been rising every quarter but one since the pandemic lockdown recession during H1-2020 (chart). The technical recession during H1-2022 has been revised away. Q2's level of real GDP was raised by 1.3% to a record high. More importantly, the level of real GDI was revised up by 3.6%.

The significant tightening of monetary policy from March 2022 through August 2024 did not cause a recession. There has been no landing and certainly no hard landing.

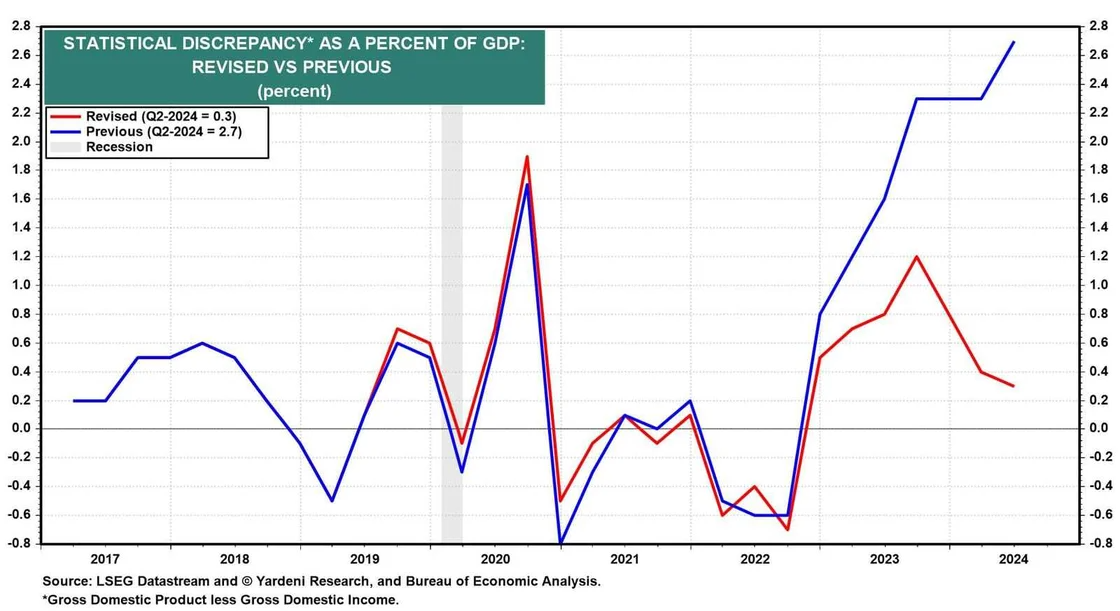

The statistical discrepancy between nominal GDP and GDI was revised down to just 0.3% from an unusually wide 2.7% during Q2-2024 (chart). Several economists warned that GDP was likely to be revised down to reduce the discrepancy.

They were wrong. GDI was revised up along with personal income.

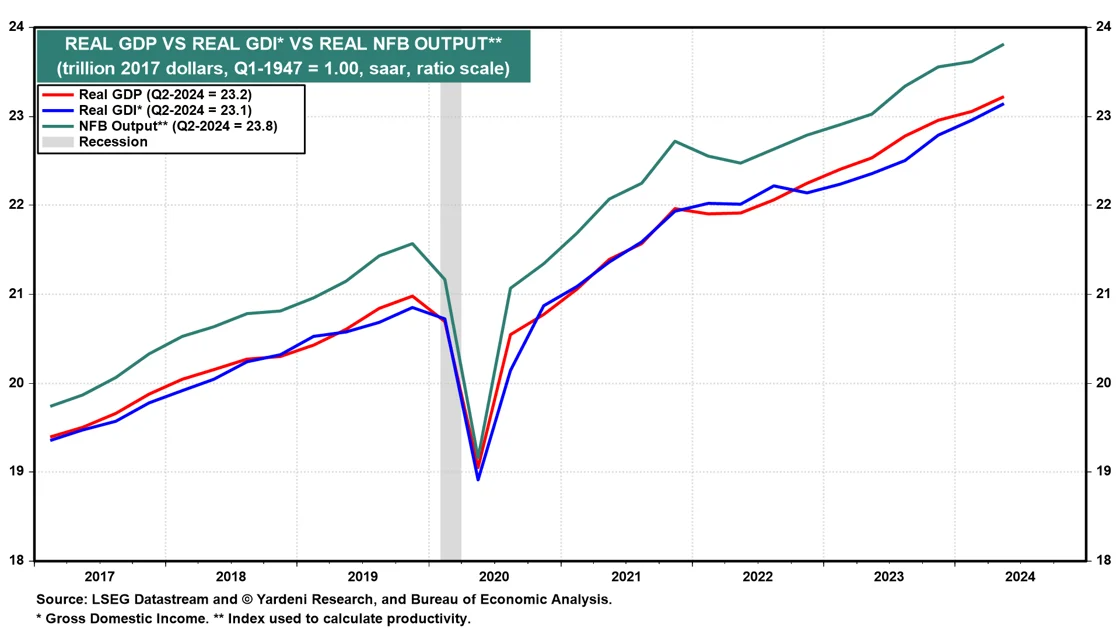

This is a big deal for our productivity-led Roaring 2020s outlook. The upward revision in real GDP will likely be followed by a similar revision in real nonfarm business output, which is used to calculate productivity (chart).

So the strong 2.7% y/y increase in productivity during Q2-2024 is likely to be revised higher.

Higher productivity growth should also lower the 0.3% y/y increase in unit labor costs (ULC) during Q2-2024. ULC is the ratio of productivity to hourly compensation.

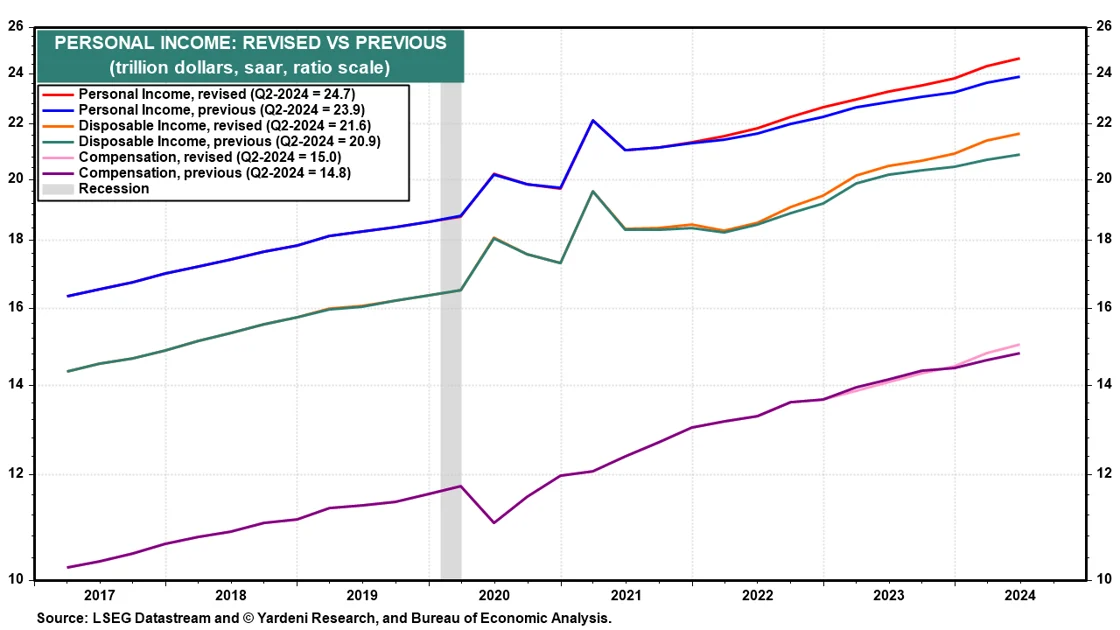

Labor compensation was revised slightly higher over the past two quarters but less than the likely increase in revised productivity (chart). So ULC inflation, which is the underlying inflation rate determined in the labor market, might have declined during Q2.

The big 3.3% upward revision in personal income during Q2 was mostly attributable to nonlabor income (i.e., interest, dividends, rents, proprietor's income, and government transfer payments) rather than wages, salaries, and benefits.

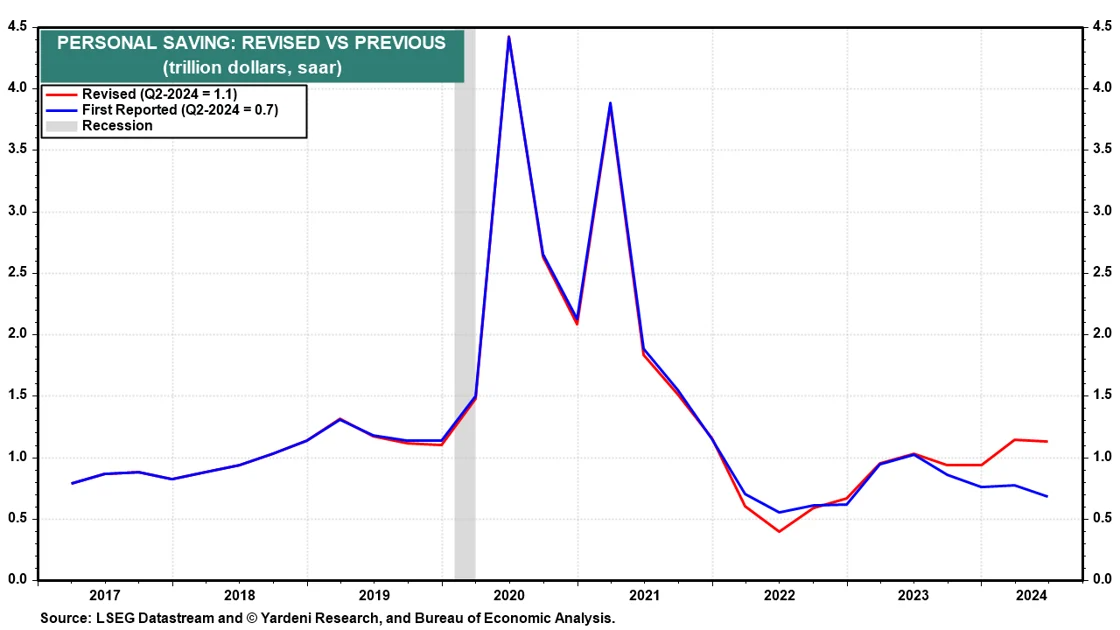

As a result, personal savings totaled $1.1 trillion (saar) during Q2 instead of $0.7 trillion (chart).

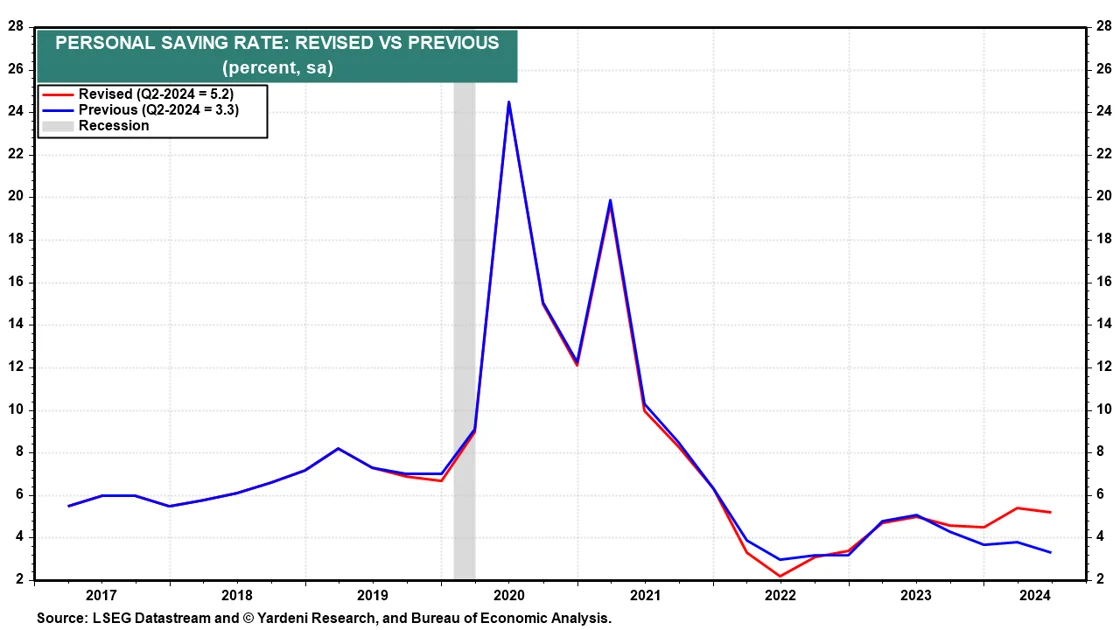

The personal saving rate was revised from 3.3% to 5.2% (chart). Last Wednesday, September 30, Fed Chair Jerome Powell said at the National Association of Business Economics annual meeting that the revisions reduced the downside risk to the economy. The higher personal saving rate also reduced the downside risk of consumers’ retrenching. He acknowledged that productivity growth might be stronger.

Powell and many commentators were worried that the Bureau of Labor Statistics' recent downward revision of 818,000 in payroll employment over the past 12 months through March meant that the economy is on a much weaker footing.

The latest BEA revisions put a fork in that theory since the upward revision in real GDP combined with a downward revision in labor input means productivity growth is stronger.

All this confirms our thesis that the US is in the midst of the Roaring 2020s, propelled by technology-driven productivity growth.