Major U.S. stock indexes and ETFs continue in a sideways channel as important economic reports are coming up in the week ahead.

On My Wall Street Radar

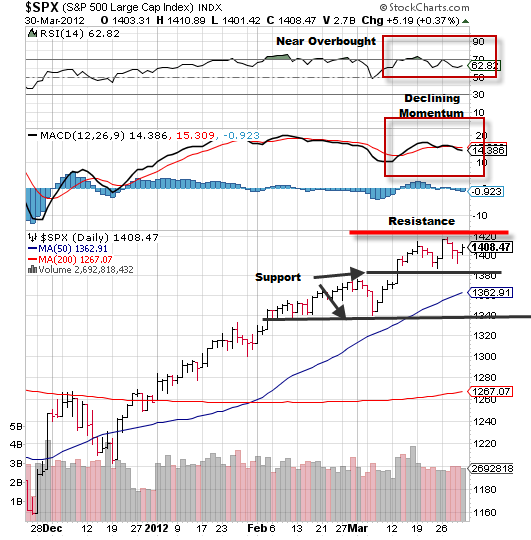

In the chart above of the S&P 500 (NYSEARCA:SPY) we can see how RSI remains near overbought levels in the top panel while daily MACD, representing short term momentum, has crossed the “0″ line and is now on a “sell” signal.

Major resistance has been established at the 1420 level, dating back to 2008 while support is represented by the black lines at 1380 and 1340.

A look at the index itself shows that this sideways channel has been ongoing for about three weeks now, leaving investors in a sort of no man’s land as we wait for a break one way or other.The longer this channel continues, the more powerful the break is likely to be in whatever direction it may take.

Looking ahead, we have important economic reports this week and seasonality soon to come into play with the “sell in May and go away” concept rapidly approaching, along with continued reports of declining earnings growth.

Coupling technical, seasonal and fundamental factors together, headwinds for U.S. stock indexes continue to increase.

The Economic View From 35,000 Feet

Last week’s economic reports and developments saw Europe staying on the back burner (regardless of the riots and strike in Spain) and the University of Michigan Consumer Confidence index rose.Personal spending was also up, beating estimates and new unemployment claims continued to decline.

On the negative side of the ledger, pending home sales declined, home prices hit nine year lows, durable goods orders were down, and various Federal Reserve reports from districts including Dallas, Richmond and Kansas City indicated slowing economic activity. Overseas, Shanghai Composite continued its decline, now down 7.6% from the beginning of March as China continues to slow and German retail sales continued to fall for the fourth month out of the last five.

For the quarter, U.S. stocks posted astounding gains as the Dow posted its best first quarter in history, and the S&P 500 was up more than ever for any first quarter since 1998.Quarterly gains seen in Q1 2012 would normally be outstanding yearly gains with the Dow up 8%, the Nasdaq 100 up 20% and the S&P 500 up 12%.

FactSet.com reports that this increase in the index has come while earnings estimates for the quarter have declined by 3%.This quarter the index has moved in the opposite direction of earnings for the second consecutive quarter and this is only the fourth time in the last 10 years that the percentage change in the index and earnings have moved in opposite directions by more than 3%.

This week brings significant economic reports with Monday bringing March ISM, Tuesday the FOMC meeting minutes, Wednesday ADP Employment and ISM Services, weekly jobs reports on Thursday and the heavyweights on Friday with March Non Farm Payrolls and Unemployment.

Bottom line: After an almost historic first quarter that defied both gravity and earnings expectations, markets now look to economic reports and the Federal Reserve for clues to further direction.

Disclaimer:Wall Street Sector Selector actively trades a wide range of exchange traded funds (ETFs) and positions can change at any time.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Sideways Channel Continues

Published 04/02/2012, 03:09 AM

Updated 05/14/2017, 06:45 AM

Sideways Channel Continues

Major indexes and ETFs continue in sideways channel, waiting for a breakout

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.